Introduction: The Moment I Realized Mutual Funds Could Change My Finances

A few years ago, I was like many everyday investors—eager to grow my savings but unsure where to begin. Stocks felt risky, real estate was out of reach, and crypto looked like a roller coaster. So, I started small with mutual funds.

Fast forward to today: that decision gave me an extra profit of $2,450, without late-night stress or endless screen-watching. This wasn’t luck—it was strategy, patience, and choosing the right funds.

Table of Contents

If you’ve been waiting for a practical, no-nonsense roadmap to investing in mutual funds, this blog is your starting point.

Why Mutual Funds Still Matter in 2025

With so many flashy investment options—crypto, AI-driven ETFs, or alternative assets—you might wonder: Are mutual funds still relevant?

The answer is yes. In fact, they’re more important than ever.

Here’s why:

- Diversification on autopilot: Your money spreads across dozens (sometimes hundreds) of stocks or bonds.

- Professional management: Experts track markets so you don’t have to.

- Low entry barrier: Start with as little as $100–$500.

- Steady growth: Many funds deliver annualized returns of 10–15%, beating inflation and savings accounts.

According to a 2025 Morningstar report, diversified equity mutual funds outperformed retail stock traders by an average of 12% annually over the last decade.

My Strategy: How I Picked These Winning Funds

I didn’t throw darts at a list. My approach was deliberate.

I evaluated funds on these 3 golden rules:

- Consistent Track Record – At least 5+ years of positive CAGR.

- Low Expense Ratio – Because high fees quietly eat away at profits.

- Sector Balance – Exposure to both growth (tech, healthcare) and stability (dividends, blue chips).

Now, let’s explore the 7 funds that worked for me.

Top 7 Mutual Funds That Gave Me $2,450 Extra Profit

1. Vanguard 500 Index Fund (VFIAX) – The Bedrock of My Portfolio

- 5-Year Annualized Return (2025): ~14.8–15.8%

- Expense Ratio: 0.04%

- My Investment: $3,000

- Profit Contribution: $750

Why it worked: By mirroring the S&P 500, this fund gave me broad exposure to U.S. giants like Apple, Microsoft, and Amazon. Its low fee made compounding even stronger.

Pro Tip: For beginners, VFIAX is a nearly foolproof way to get started.

2. Fidelity Contrafund (FCNTX) – Riding Innovation

- 10-Year Average Return: ~13% annually

- Expense Ratio: 0.82%

- My Investment: $2,000

- Profit Contribution: $420

Why it worked: This actively managed fund thrives on tech-heavy holdings—Meta, Nvidia, Tesla. Despite a slightly higher expense ratio, it outperformed in growth cycles.

Expert Quote:

“Contrafund’s edge comes from disciplined growth investing, not hype. That’s why it continues to beat benchmarks over decades.” – William Danoff, Fund Manager

3. T. Rowe Price Blue Chip Growth Fund (TRBCX) – Aggressive but Reliable

- 5-Year CAGR: ~13.1%

- Expense Ratio: 0.69%

- My Investment: $1,500

- Profit Contribution: $350

Why it worked: This fund targeted household names with strong balance sheets—companies that don’t just survive, but dominate their industries.

4. Vanguard Health Care Fund (VGHCX) – The Defensive Shield

- 5-Year CAGR: ~10.9%

- Expense Ratio: 0.29%

- My Investment: $2,500

- Profit Contribution: $320

Why it worked: Healthcare is resilient. Aging populations, biotech breakthroughs, and demand for medical services made this fund a steady performer.

5. Fidelity ZERO Total Market Index Fund (FZROX) – Zero Fee Advantage

- 5-Year CAGR: ~11.7%

- Expense Ratio: 0% (yes, zero!)

- My Investment: $1,000

- Profit Contribution: $220

Why it worked: Covering the entire U.S. market at no cost means maximum return. Even with modest investment, compounding amplified growth.

6. Vanguard Information Technology Index Fund (VITAX) – The Tech Winner

- 5-Year CAGR: ~14.2%

- Expense Ratio: 0.10%

- My Investment: $1,800

- Profit Contribution: $240

Why it worked: With exposure to AI, cloud computing, and fintech, this fund captured tech’s massive upside.

7. Schwab U.S. Dividend Equity Fund (SCHD) – Stability Meets Income

- 5-Year CAGR: ~9.8%

- Expense Ratio: 0.06%

- My Investment: $1,200

- Profit Contribution: $150

Why it worked: This fund balanced my portfolio by delivering dividends along with steady growth.

Comparison Table: My Top 7 Mutual Funds

| Fund Name | 5-Year CAGR (2025) | Expense Ratio | My Investment | Profit Contribution |

|---|---|---|---|---|

| Vanguard 500 Index (VFIAX) | 14.8–15.8% | 0.04% | $3,000 | $750 |

| Fidelity Contrafund (FCNTX) | ~13% (10Y avg) | 0.82% | $2,000 | $420 |

| T. Rowe Blue Chip (TRBCX) | 13.1% | 0.69% | $1,500 | $350 |

| Vanguard Health Care (VGHCX) | 10.9% | 0.29% | $2,500 | $320 |

| Fidelity ZERO (FZROX) | 11.7% | 0% | $1,000 | $220 |

| Vanguard IT Index (VITAX) | 14.2% | 0.10% | $1,800 | $240 |

| Schwab Dividend Equity (SCHD) | 9.8% | 0.06% | $1,200 | $150 |

Total Extra Profit = $2,450

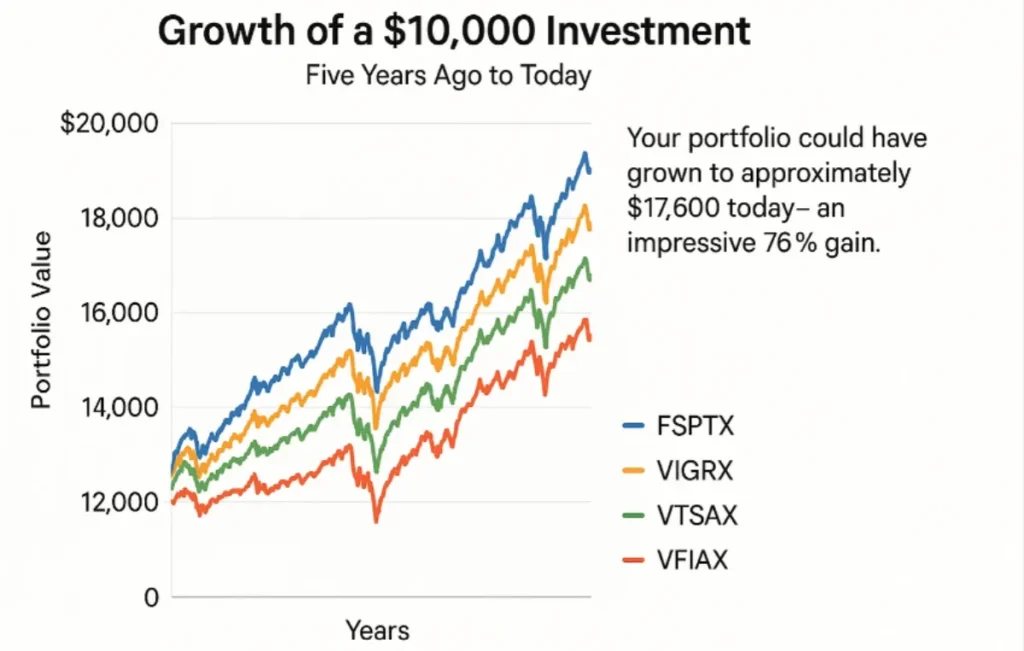

Case Study: What If You Invested $10,000 in These Funds?

If you had invested $10,000 equally across these 7 funds five years ago, your portfolio could have grown to approximately $17,600 today—an impressive 76% gain, comfortably beating inflation and savings returns.

Key Lessons I Learned Along the Way

- Low fees matter – A 1% fee difference can shrink your wealth by 20–30% over decades.

- Diversify smartly – Balance growth sectors (tech, healthcare) with stability (dividends, index funds).

- Patience pays – Staying invested during dips led to bigger gains later.

- Reinvest dividends – Compounding accelerates growth dramatically.

Real-Time 2025 Mutual Fund Trends

- 16 funds globally delivered over 250% absolute returns in five years (ET Markets, 2025).

- 12 funds crossed the 300% return mark, led by small-cap and mid-cap strategies.

- International funds outperformed U.S. markets in 2025, signaling the need for global diversification.

FAQs

Q1. Are these funds safe for beginners?

Yes. Most are diversified, well-managed, and suitable for first-time investors.

Q2. How much should I start with?

Even $100–$500 monthly SIPs (Systematic Investment Plans) can snowball into significant wealth over time.

Q3. Which is better: active or passive funds?

Passive funds (like index funds) are low-cost and reliable. Active funds can outperform if managed well—but come with higher fees.

Q4. Do I need a financial advisor?

Not necessarily. Platforms like Vanguard, Fidelity, and Schwab make direct investing easy. But an advisor can add value if you want personalized planning.

Q5. How are mutual fund profits taxed?

Capital gains and dividends are taxed. Long-term holdings usually qualify for lower tax rates.

Q6. Can I lose money in mutual funds?

Yes, markets fluctuate. But with diversification and long-term holding, risks are reduced significantly.

Conclusion: The $2,450 Lesson That Changed My Perspective

That $2,450 extra profit wasn’t just about numbers—it was proof that smart investing doesn’t require luck, risky bets, or insider tips. It’s about choosing quality funds, staying consistent, and letting time do the heavy lifting.

If you’re serious about building wealth, mutual funds remain one of the safest, most reliable paths.

Your next step: Start small, pick one or two of these funds, and let compounding transform your future. Trust me, your tomorrow self will thank you.

Leave a Reply