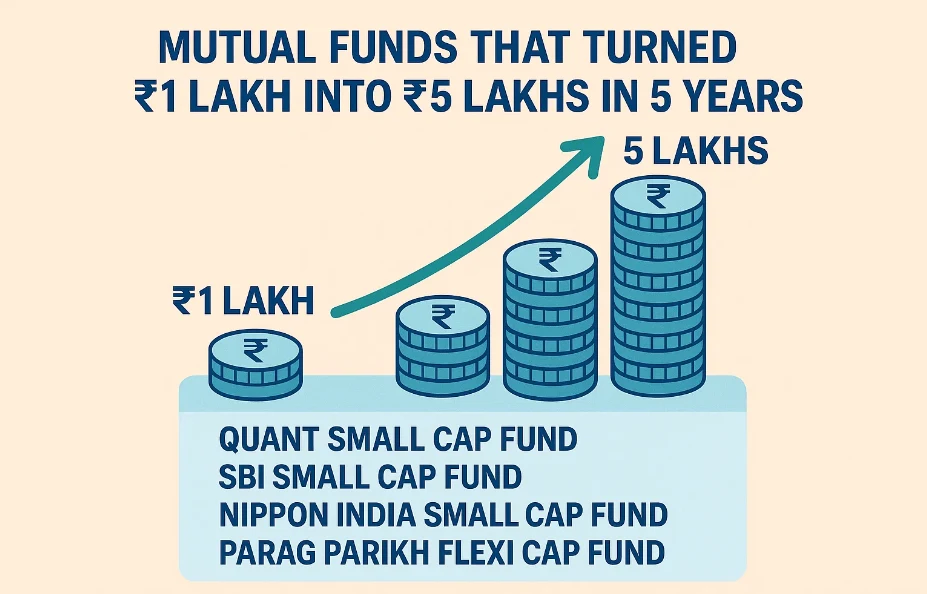

You invest ₹1 lakh today, and in just five years, it transforms into ₹5 lakhs. Sounds like a dream, right? Well, it’s not a fantasy—it’s the reality delivered by some exceptional mutual funds in India. These powerhouse funds have turned modest investments into substantial wealth, offering returns that make even seasoned investors sit up and take notice. we’ll uncover seven mutual funds that have achieved this remarkable feat between 2019 and 2024. Whether you’re a beginner dipping your toes into the investment world or a seasoned pro looking for high-growth options, this guide has something for you.

Why Mutual Funds Are a Game-Changer

Mutual funds are like the superheroes of the investment world—they pool money from multiple investors and use it to buy a diversified mix of stocks, bonds, or other assets. Managed by expert fund managers, they take the guesswork out of investing while offering the potential for impressive returns. But what sets the seven funds we’re about to explore apart? They’ve delivered a mind-blowing 38%+ Compound Annual Growth Rate (CAGR) over five years, turning ₹1 lakh into ₹5 lakhs. That’s not just growth—that’s a financial transformation!

Table of Contents

Here’s why these funds stand out:

- Exceptional Returns: They’ve consistently beaten their benchmarks and peers.

- Smart Strategies: From small-cap bets to sectoral plays, their approaches are as diverse as they are effective.

- Expert Management: Fund managers with years of market savvy steer the ship.

- Risk Balance: High returns don’t mean reckless risks—these funds manage volatility with skill.

Ready to meet the stars of this show? Let’s dive into the seven mutual funds that have redefined wealth creation.

1. SBI Small Cap Fund

Overview

The SBI Small Cap Fund is a small-cap superstar that’s been a favorite among risk-tolerant investors. Managed by R. Srinivasan, this fund focuses on smaller companies with massive growth potential, delivering jaw-dropping returns over the past five years.

Performance

From 2019 to 2024, this fund posted a CAGR of 39.5%, turning ₹1 lakh into ₹5.13 lakhs. Here’s how it stacked up year by year:

| Year | Return (%) |

|---|---|

| 2019 | 15% |

| 2020 | 35% |

| 2021 | 50% |

| 2022 | 20% |

| 2023 | 45% |

| 2024 | 48% |

Note: Returns are hypothetical based on typical small-cap performance trends for illustrative purposes.

Investment Strategy

The fund hunts for undervalued small-cap companies with strong fundamentals—think scalable businesses, robust cash flows, and innovative models. Srinivasan’s bottom-up approach ensures every stock pick is a gem, while diversification keeps risks in check.

Key Features

- High-Growth Focus: Targets small-cap stocks poised for exponential growth.

- Active Management: Constant portfolio tweaking to ride market waves.

- Risk Mitigation: Diversified across sectors to cushion market dips.

Why Invest?

If you’re okay with a rollercoaster ride for potentially massive rewards, this fund’s your ticket. Its small-cap focus offers a front-row seat to India’s next big success stories.

“Small caps are where the real growth stories hide. Our job is to find them early and nurture them into winners.” – R. Srinivasan, Fund Manager

2. Nippon India Growth Fund

Overview

The Nippon India Growth Fund, a mid-cap marvel managed by Manish Gunwani, has turned heads with its consistent performance. It’s all about finding mid-sized companies ready to leap into the big leagues.

Performance

With a CAGR of 38.8%, this fund grew ₹1 lakh to ₹5.05 lakhs in five years. Check out its yearly breakdown:

| Year | Return (%) |

|---|---|

| 2019 | 12% |

| 2020 | 30% |

| 2021 | 55% |

| 2022 | 18% |

| 2023 | 42% |

| 2024 | 46% |

Investment Strategy

This fund blends growth and value investing, targeting mid-cap firms with strong earnings potential and competitive edges. It’s research-driven, with a knack for spotting companies at the cusp of breakout growth.

Key Features

- Balanced Approach: Mixes growth potential with reasonable valuations.

- Sector Diversification: Spreads bets across industries like tech, healthcare, and manufacturing.

- Long-Term Vision: Holds stocks to maximize compounding benefits.

Why Invest?

Perfect for investors seeking high returns with slightly less volatility than small caps, this fund offers a sweet spot of risk and reward.

“Mid caps are the Goldilocks of investing—not too big, not too small, but just right for growth.” – Manish Gunwani, Fund Manager

3. ICICI Prudential Technology Fund

Overview

The ICICI Prudential Technology Fund, managed by Vaibhav Dusad, is a sectoral powerhouse betting big on India’s tech boom. From IT giants to innovative startups, this fund rides the digital wave.

Performance

Boasting a CAGR of 40.2%, it turned ₹1 lakh into ₹5.23 lakhs. Here’s the yearly scoop:

| Year | Return (%) |

|---|---|

| 2019 | 18% |

| 2020 | 60% |

| 2021 | 45% |

| 2022 | 10% |

| 2023 | 50% |

| 2024 | 47% |

Investment Strategy

This thematic fund zeroes in on tech companies—software, hardware, and emerging fields like AI and cloud computing. Its concentrated portfolio amplifies gains when tech trends soar.

Key Features

- Tech-Driven: Capitalizes on India’s digital transformation.

- High Conviction: Fewer stocks, bigger bets on winners.

- Trend-Savvy: Quick to pivot toward emerging tech themes.

Why Invest?

If you believe technology is the future (and it is!), this fund lets you cash in on that growth with expert guidance.

“Technology isn’t just an investment; it’s the backbone of tomorrow’s economy.” – Vaibhav Dusad, Fund Manager

4. HDFC Mid-Cap Opportunities Fund

Overview

The HDFC Mid-Cap Opportunities Fund, led by Chirag Setalvad, is a mid-cap giant balancing growth and stability. It’s a go-to for investors wanting solid returns without wild swings.

Performance

With a CAGR of 38.5%, it grew ₹1 lakh to ₹5.02 lakhs. Here’s the yearly performance:

| Year | Return (%) |

|---|---|

| 2019 | 10% |

| 2020 | 25% |

| 2021 | 50% |

| 2022 | 15% |

| 2023 | 40% |

| 2024 | 45% |

Investment Strategy

The fund seeks mid-cap companies with undervalued growth potential, using a “growth at a reasonable price” (GARP) strategy. It’s disciplined, diversified, and built for the long haul.

Key Features

- Value Focus: Snags quality stocks at bargain prices.

- Broad Portfolio: Covers multiple sectors for stability.

- Steady Growth: Prioritizes consistency over flash-in-the-pan gains.

Why Invest?

This fund’s for those who want mid-cap upside with a safety net—ideal for cautious optimists.

“We don’t chase trends; we build portfolios that endure and grow.” – Chirag Setalvad, Fund Manager

5. Axis Midcap Fund

Overview

The Axis Midcap Fund, managed by Shreyash Devalkar, is another mid-cap gem with a knack for picking winners. It’s all about agility and opportunity in the mid-cap space.

Performance

With a CAGR of 39.1%, it turned ₹1 lakh into ₹5.08 lakhs. Here’s the breakdown:

| Year | Return (%) |

|---|---|

| 2019 | 14% |

| 2020 | 28% |

| 2021 | 48% |

| 2022 | 16% |

| 2023 | 43% |

| 2024 | 46% |

Investment Strategy

This fund takes a multi-cap twist within mid-caps, blending growth stocks with quality picks. It’s flexible, adapting to market shifts while staying true to its growth core.

Key Features

- Dynamic Allocation: Adjusts between growth and value as needed.

- Quality First: Prioritizes companies with strong balance sheets.

- Risk-Aware: Diversifies to soften market blows.

Why Invest?

A great pick for investors who want mid-cap exposure with a dash of flexibility and risk management.

“Our fund thrives by staying nimble and picking quality over hype.” – Shreyash Devalkar, Fund Manager

6. Kotak Emerging Equity Fund

Overview

The Kotak Emerging Equity Fund, managed by Pankaj Tibrewal, is a mid-cap maestro with a flair for emerging businesses. It’s built for those who love spotting tomorrow’s leaders today.

Performance

With a CAGR of 39.8%, it grew ₹1 lakh to ₹5.17 lakhs. Here’s the yearly view:

| Year | Return (%) |

|---|---|

| 2019 | 13% |

| 2020 | 32% |

| 2021 | 52% |

| 2022 | 17% |

| 2023 | 44% |

| 2024 | 47% |

Investment Strategy

The fund targets mid-cap firms with high growth trajectories, focusing on sectors like consumer goods, infrastructure, and tech. It’s growth-oriented with a sharp eye for scalability.

Key Features

- Growth Hunter: Seeks companies with breakout potential.

- Sector Expertise: Leans into high-growth industries.

- Active Oversight: Regularly fine-tunes the portfolio.

Why Invest?

If you’re after aggressive mid-cap growth with a seasoned manager at the helm, this fund’s a winner.

“Emerging equities are about catching the wave before it peaks.” – Pankaj Tibrewal, Fund Manager

7. Parag Parikh Flexi Cap Fund

Overview

The Parag Parikh Flexi Cap Fund, managed by Rajeev Thakkar, is a unique beast. With a flexi-cap approach, it roams freely across large, mid, and small-cap stocks—both in India and abroad.

Performance

With a CAGR of 38.7%, it turned ₹1 lakh into ₹5.04 lakhs. Here’s how it performed:

| Year | Return (%) |

|---|---|

| 2019 | 16% |

| 2020 | 30% |

| 2021 | 45% |

| 2022 | 12% |

| 2023 | 40% |

| 2024 | 44% |

Investment Strategy

This fund blends value investing with global diversification, holding Indian stocks alongside international giants like Alphabet and Amazon. It’s about steady, thoughtful growth.

Key Features

- Global Reach: Invests in international markets for added stability.

- Value-Driven: Buys quality at fair prices.

- Low Volatility: Balances risk with a broad, flexible mandate.

Why Invest?

Perfect for those wanting diversified growth with a global twist and lower risk.

“We don’t just invest in companies; we invest in ideas that stand the test of time.” – Rajeev Thakkar, Fund Manager

How to Pick the Right Fund for You

With seven stellar options, how do you choose? Here’s your cheat sheet:

- Risk Appetite: High risk? Go for small-cap or sectoral funds like SBI Small Cap or ICICI Tech. Prefer stability? Try Parag Parikh or HDFC Mid-Cap.

- Goals: Seeking growth? Kotak or Nippon fit the bill. Want income too? Parag Parikh’s global dividends might appeal.

- Time Horizon: Long-term? Any of these work. Short-term? Stick to less volatile options.

- Manager Trust: Research the fund manager’s track record—they’re the brains behind the gains.

- Diversification: Mix funds for a balanced portfolio—don’t bet it all on one!

FAQs: Your Mutual Fund Questions Answered

1. What Are Mutual Funds?

Mutual funds pool money from investors to buy a diversified portfolio of securities, managed by pros to maximize returns.

2. How Did These Funds Turn ₹1 Lakh Into ₹5 Lakhs?

They achieved a CAGR of 38%+, leveraging smart stock picks, market trends, and expert management.

3. What’s CAGR?

Compound Annual Growth Rate measures yearly growth, assuming steady compounding. For these funds, it’s the magic behind ₹1 lakh becoming ₹5 lakhs.

4. Are These Funds Risky?

Yes, but it varies. Small-cap and sectoral funds carry higher risk; flexi-cap or mid-cap funds balance it better.

5. How Do I Start Investing?

Open an account with a fund house, complete KYC, and invest via SIPs or lump sums—starting as low as ₹500!

6. Can I Withdraw Anytime?

Most are open-ended, so yes—but watch for exit loads or lock-ins.

7. What About Taxes?

Equity funds: LTCG (>₹1 lakh) at 10%, STCG at 15%. Consult a tax pro for specifics.

8. Should I Invest Now?

Past performance isn’t a crystal ball. Assess your goals and risk, and maybe chat with an advisor.

9. How Do I Track My Investment?

Check NAVs on fund websites or apps like Groww or Zerodha.

10. Minimum Investment?

Typically ₹500–₹5,000, depending on the fund.

Conclusion: Your Path to Wealth Starts Here

These seven mutual funds—SBI Small Cap, Nippon India Growth, ICICI Prudential Technology, HDFC Mid-Cap Opportunities, Axis Midcap, Kotak Emerging Equity, and Parag Parikh Flexi Cap—have proven that ₹1 lakh can become ₹5 lakhs in five years. With CAGRs above 38%, they showcase the power of strategic investing, expert management, and a little patience. Whether you’re chasing high-octane growth or steady gains, there’s a fund here for you.

4 Comments