Investing can feel like a rollercoaster—exciting yet daunting, with twists and turns that keep even seasoned investors on edge. What if there were a way to smooth out the ride, build wealth steadily, and sleep soundly at night knowing your financial future is on solid ground? Enter index fund portfolio laddering, a structured strategy that blends discipline, simplicity, and the power of time to help you grow your wealth over the long haul.

What Is Index Fund Portfolio Laddering?

Before we unpack the laddering strategy, let’s set the stage with some basics.

Understanding Index Funds

An index fund is a type of mutual fund or exchange-traded fund (ETF) designed to mirror the performance of a specific market index, like the S&P 500, which tracks 500 of the largest U.S. companies. Think of it as a basket that holds a tiny slice of every company in that index. Why are index funds so popular? They’re:

- Low-cost: Minimal management fees since they’re passively managed.

- Diversified: Exposure to hundreds or thousands of companies in one fund.

- Simple: No need to pick individual stocks—just ride the market’s wave.

The Laddering Concept

Traditionally, laddering is a strategy used with bonds or certificates of deposit (CDs). You buy bonds with staggered maturity dates—say, 1 year, 3 years, 5 years—so you have money coming due at regular intervals. It’s a way to balance income, liquidity, and interest rate risk. But here’s the twist: index funds don’t have maturity dates. So how do we ladder them?

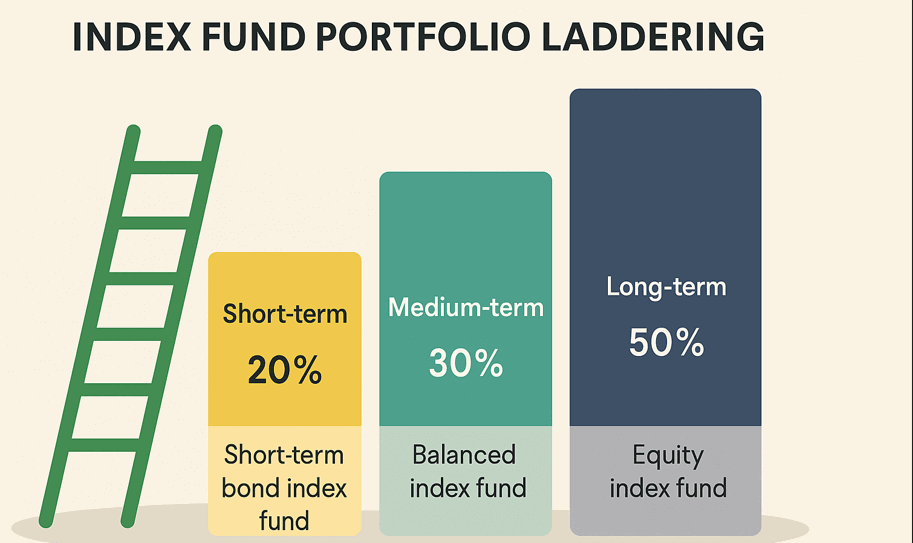

Index Fund Portfolio Laddering Defined

In the context of index funds, portfolio laddering is a systematic investment strategy where you invest a fixed amount into index funds at regular intervals—monthly, quarterly, or annually. Each investment becomes a “rung” on your ladder, made at different points in the market cycle. Over time, this builds a portfolio with a range of entry points, reducing the risk of dumping all your money in at a market peak and harnessing the magic of compounding for long-term growth.

Picture this: Instead of guessing the “perfect” time to invest, you spread your bets across time, letting the market’s ups and downs work in your favor. It’s disciplined, it’s strategic, and it’s surprisingly easy to implement.

Why Index Fund Portfolio Laddering Works: The Benefits

So, why should you consider this approach? Let’s break down the perks that make laddering a standout strategy for building wealth.

1. Mitigates Market Timing Risk

Timing the market is like trying to catch lightning in a bottle—nearly impossible. Invest all your money at a peak, and a crash could wipe out gains. Laddering sidesteps this by spreading your investments over time. Some rungs of your ladder might catch a high, others a low, but over the long term, it evens out.

2. Encourages Disciplined Investing

Consistency is the secret sauce of wealth-building, and laddering forces you to stick to a plan. By committing to invest regularly—say, $500 every month—you avoid the emotional rollercoaster of reacting to market headlines. It’s investing on autopilot, and it works.

3. Harnesses Dollar-Cost Averaging

Laddering naturally incorporates dollar-cost averaging (DCA), a proven technique where you invest a fixed amount regardless of market conditions. When prices are low, you buy more shares; when they’re high, you buy fewer. Over time, this lowers your average cost per share, boosting your returns.

4. Unlocks the Power of Compounding

Albert Einstein reportedly called compound interest the “eighth wonder of the world,” and for good reason. With laddering, your early investments have more time to grow, while later ones keep adding fuel to the fire. The result? A snowball effect that can turn modest contributions into a hefty nest egg.

5. Reduces Stress

No more agonizing over “Is now the right time?” Laddering takes the guesswork out of investing, giving you peace of mind and a clear path forward.

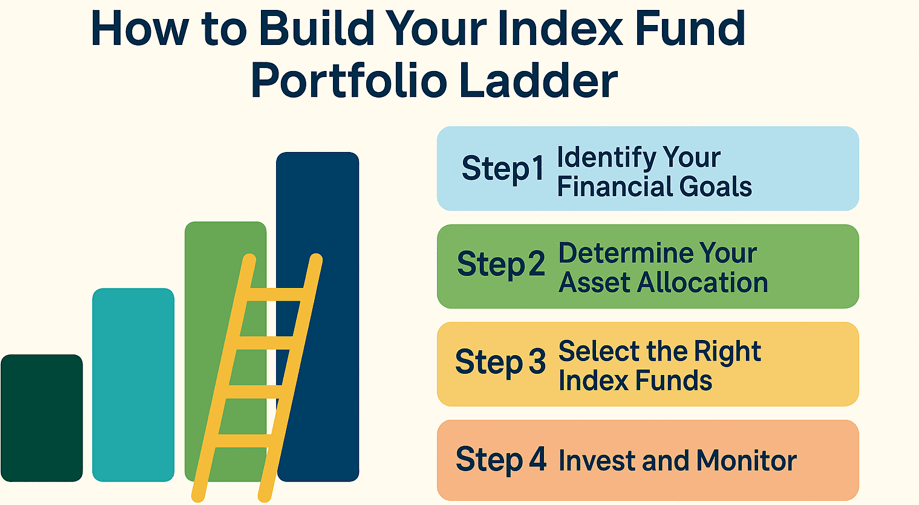

How to Build Your Index Fund Portfolio Ladder

Ready to start? Here’s a step-by-step guide to create your own index fund ladder. It’s simpler than you might think!

Step 1: Choose Your Index Funds

Your ladder’s foundation is the funds you pick. Aim for diversification and alignment with your goals. A classic starting point is the three-fund portfolio:

- Total Stock Market Index Fund: Tracks the entire U.S. stock market (e.g., Vanguard VTI).

- International Stock Index Fund: Covers global markets outside the U.S. (e.g., Vanguard VXUS).

- Bond Index Fund: Adds stability (e.g., Vanguard BND).

Pick low-cost funds with expense ratios below 0.1% to keep more of your money working for you.

Step 2: Set Your Investment Interval and Amount

Decide how often and how much you’ll invest. Examples:

- Monthly: $500 every 1st of the month.

- Annually: $6,000 every January.

The key is consistency—choose an amount you can sustain without stretching your budget.

Step 3: Automate Your Investments

Set it and forget it! Use your brokerage’s automatic investment feature to transfer funds into your chosen index funds on schedule. This eliminates the temptation to skip a month when the market dips.

Step 4: Monitor and Rebalance

Index funds are low-maintenance, but don’t ignore them entirely. Check your portfolio annually to ensure it matches your target allocation (e.g., 70% stocks, 30% bonds). If stocks surge and skew your mix, sell some and buy bonds to rebalance.

Step 5: Stay the Course

Markets will fluctuate—sometimes wildly. Resist the urge to tinker. Laddering thrives on time and consistency, so keep adding rungs to your ladder.

Real-World Examples: Laddering in Action

Let’s bring this to life with some examples.

Example 1: The Annual Ladder

Imagine you invest $1,000 every January into an S&P 500 index fund for 10 years. Here’s how it might play out:

| Year | Investment | Market Condition | Shares Bought (Hypothetical Price) |

|---|---|---|---|

| 1 | $1,000 | Bull Market | 10 shares @ $100 |

| 2 | $1,000 | Correction | 12.5 shares @ $80 |

| 3 | $1,000 | Bear Market | 16.7 shares @ $60 |

| 4 | $1,000 | Recovery | 11.1 shares @ $90 |

| 5 | $1,000 | Bull Market | 9.1 shares @ $110 |

After 5 years, you’ve invested $5,000 and own 59.5 shares. If the price rises to $150 by Year 10, your portfolio is worth $8,925—a 78% return, despite market swings. The ladder smoothed out volatility and let DCA work its magic.

Example 2: Lump-Sum vs. Laddering

Now, compare laddering to a $5,000 lump-sum investment in Year 1:

- Lump-Sum: 50 shares @ $100. At $150/share in Year 10 = $7,500.

- Laddering: 59.5 shares = $8,925.

In this case, laddering wins by buying more shares during dips. Of course, in a straight-up bull market, lump-sum might outperform—but predicting that is a gamble few win.

Potential Drawbacks: What to Watch For

No strategy is perfect. Here are some challenges to consider:

1. Market Risk Remains

Index funds track the market, so if stocks or bonds tank, your portfolio feels it. Laddering reduces timing risk, not market risk.

2. Opportunity Cost in Rising Markets

If the market climbs steadily, investing all at once early on could yield more. Laddering sacrifices some upside for safety—a trade-off worth weighing.

3. Fees Add Up

Even with low-cost index funds, frequent investments might rack up transaction fees (if your broker charges them). Stick to no-fee platforms like Fidelity or Vanguard.

4. Requires Patience

Laddering isn’t a get-rich-quick scheme. It’s a slow burn, best for those with a 10+ year horizon.

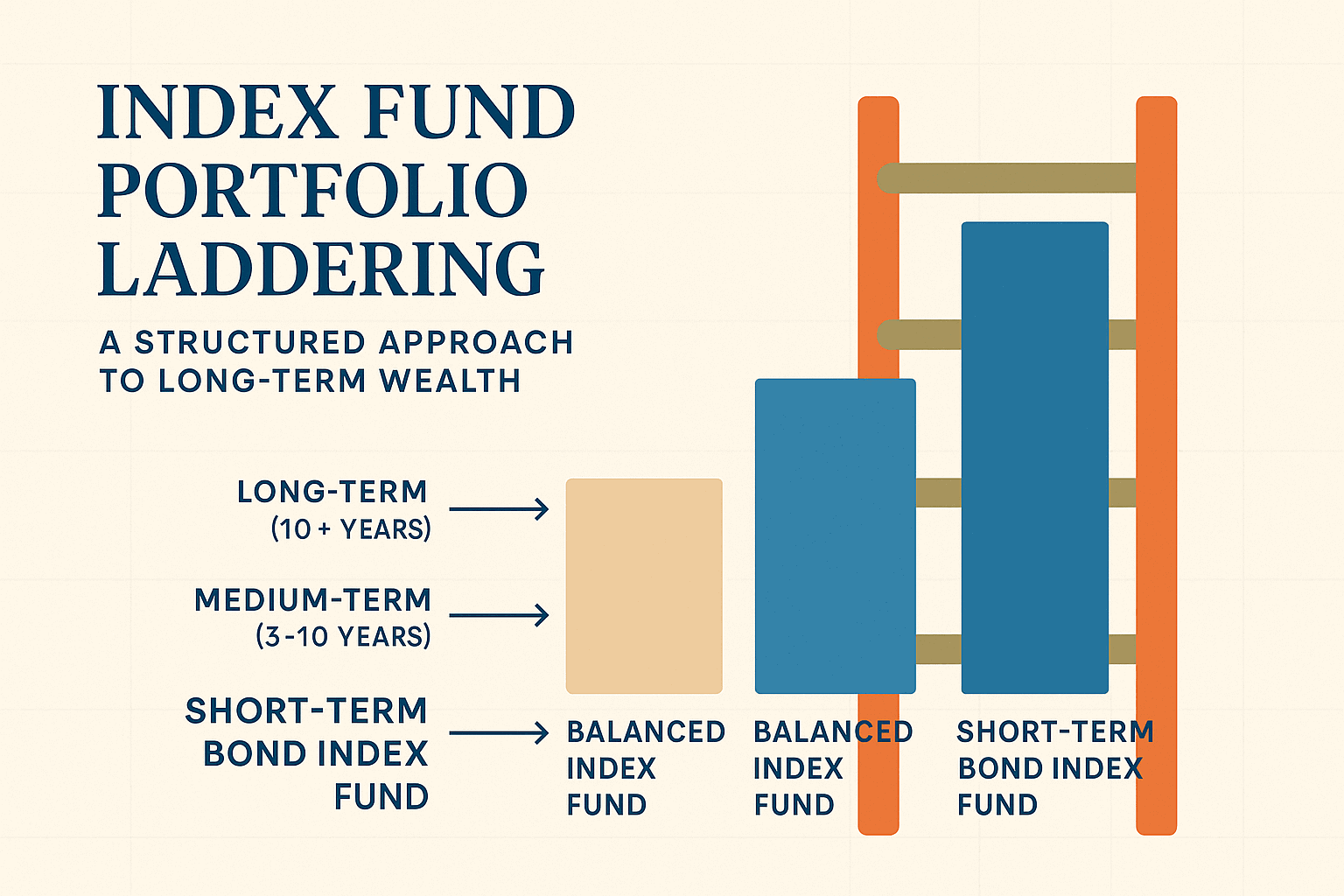

Advanced Laddering Strategies

Once you’ve mastered the basics, try these tweaks:

1. Diversify Across Asset Classes

Instead of one fund, ladder across multiple:

- Year 1: $1,000 in a U.S. stock index fund.

- Year 2: $1,000 in an international stock fund.

- Year 3: $1,000 in a bond fund.

Repeat the cycle for broader exposure.

2. Adjust for Life Stages

Tailor your ladder as goals shift:

- Young Investor: Heavy on stock index funds for growth.

- Nearing Retirement: Shift new rungs to bond funds for stability.

3. Reinvest Dividends

Many index funds pay dividends. Reinvest them into your ladder to turbocharge compounding.

Conclusion: Start Building Your Ladder Today

Index fund portfolio laddering isn’t flashy, but it’s effective. It’s a blueprint for long-term wealth that combines the simplicity of index funds with the discipline of regular investing. By spreading your investments over time, you dodge the pitfalls of market timing, harness dollar-cost averaging, and let compounding do the heavy lifting.

Ready to take control of your financial future? Start small—$100 a month, a single fund—and watch your ladder grow. The market will have its ups and downs, but with each rung you add, you’re one step closer to your goals.

FAQs

1. What’s the difference between laddering and dollar-cost averaging?

Laddering is a structured form of DCA, focusing on building a portfolio with regular investments over time. DCA is the broader concept of investing fixed amounts consistently.

2. Can I use laddering for short-term goals?

Yes, but choose less volatile funds (e.g., bond index funds) and shorten your intervals (e.g., monthly).

3. How many funds should I ladder?

Start with 1-3 for simplicity—stocks, international, bonds—then expand as you grow comfortable.

4. Is this strategy beginner-friendly?

Absolutely! It’s low-maintenance and perfect for hands-off investors.

Inspirational Quote

“The best time to plant a tree was 20 years ago. The second-best time is now.” – Chinese Proverb

Investing is the same—start your ladder today, and let time work its magic.

Quick Tips

- Start Small: Even $50/month builds the habit.

- Stay Consistent: Skip a rung, and you miss the benefit.

- Keep Costs Low: Choose funds with expense ratios under 0.1%.

With index fund portfolio laddering, you’re not just investing—you’re architecting a future of financial freedom. So, grab your tools, pick your funds, and start climbing!

Leave a Reply