Introduction: The Crore-Club Dream

For most Indian investors, building a ₹1 crore corpus is a financial milestone — the golden figure that promises financial freedom, security, and confidence in the future. But the real question is: Which path will get you there faster — NPS (National Pension System) or SIP (Systematic Investment Plan)?

Table of Contents

If you’ve ever wondered whether a disciplined SIP in mutual funds can beat the tax-advantaged NPS, you’re not alone. Every month, lakhs of investors wrestle with this very decision. And today, we’ll break it down with numbers, real-world examples, expert insights, and strategies so you can choose the right route.

By the end of this blog, you’ll know which option is faster to ₹1 crore, and more importantly, which one is right for your financial goals.

Understanding the Basics: NPS vs SIP

Before diving into the race towards ₹1 crore, let’s set the foundation.

What is NPS?

- National Pension System (NPS) is a government-backed retirement savings scheme.

- You contribute regularly, and the money is invested in equity, corporate debt, and government securities.

- It offers tax benefits under Section 80C (₹1.5 lakh) and 80CCD(1B) (₹50,000).

- However, withdrawals before retirement are restricted, making it more of a long-term wealth + retirement tool.

- Historical average returns: 8–10% p.a.

What is SIP?

- Systematic Investment Plan (SIP) is a disciplined way of investing in mutual funds.

- You invest a fixed amount monthly, which compounds over time.

- Offers flexibility (no lock-in unless ELSS funds are chosen).

- Ideal for wealth creation goals like buying a house, children’s education, or even early retirement.

- Historical average returns: 12–15% p.a. (equity funds).

The ₹1 Crore Question: How Fast Can You Reach?

Let’s do the math with different scenarios.

Case 1: ₹10,000 Monthly Investment

| Investment Type | Expected CAGR | Years to ₹1 Crore | Corpus at 20 Years |

|---|---|---|---|

| NPS | 9% | ~24 Years | ₹75.5 Lakhs |

| SIP (Equity MF) | 12% | ~21 Years | ₹99.9 Lakhs |

| SIP (Aggressive Equity) | 15% | ~19 Years | ₹1.33 Crore |

Winner: SIP grows faster due to higher equity exposure.

Case 2: ₹15,000 Monthly Investment

| Investment Type | Expected CAGR | Years to ₹1 Crore | Corpus at 20 Years |

|---|---|---|---|

| NPS | 9% | ~20 Years | ₹1.13 Crore |

| SIP (Equity MF) | 12% | ~17 Years | ₹1.50 Crore |

| SIP (Aggressive Equity) | 15% | ~15 Years | ₹2.00 Crore |

Winner: SIP again wins — faster and larger corpus.

Case 3: Early Start Advantage (Age 25, ₹5,000 SIP vs NPS)

| Investment Type | Tenure | Corpus at 60 (35 Years) |

|---|---|---|

| NPS @ 9% | 35 Years | ₹1.15 Crore |

| SIP @ 12% | 35 Years | ₹2.20 Crore |

| SIP @ 15% | 35 Years | ₹4.08 Crore |

Starting early drastically changes the game.

“NPS is excellent for disciplined retirement planning with tax benefits. But for faster wealth creation, SIPs in equity mutual funds clearly have the edge.”

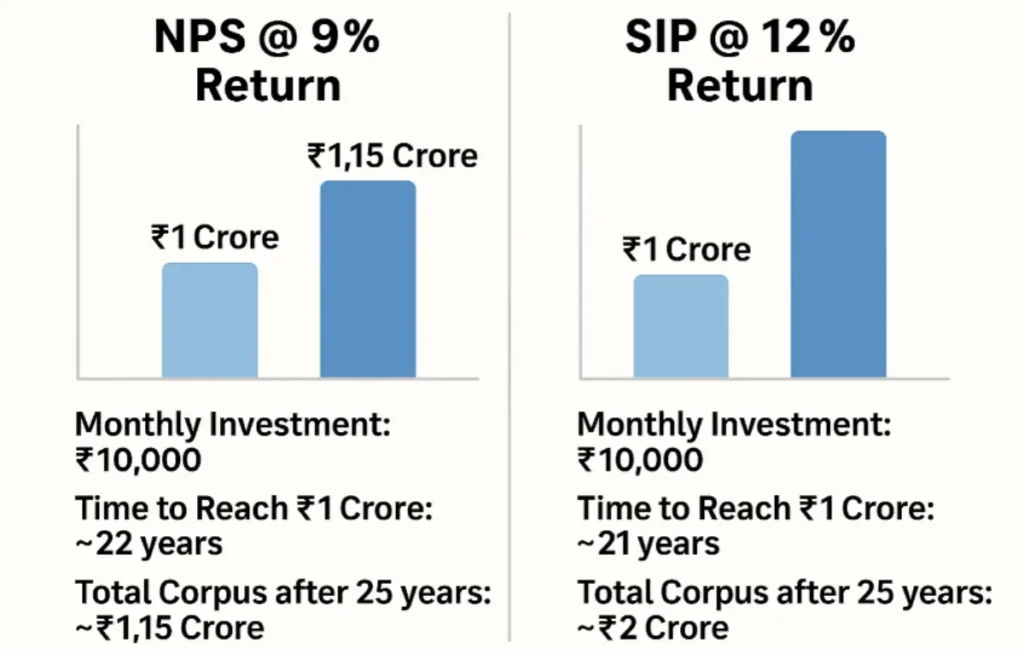

NPS @ 9% Return

- Monthly Investment: ₹10,000

- Time to Reach ₹1 Crore: ~22 years

- Total Corpus after 25 years: ~₹1.15 Crore

SIP @ 12% Return

- Monthly Investment: ₹10,000

- Time to Reach ₹1 Crore: ~21 years

- Total Corpus after 25 years: ~₹2 Crore

Winner: SIP builds ₹1 Crore faster and creates a larger corpus in the long run

NPS vs SIP: Pros & Cons

Advantages of NPS

- Tax benefits up to ₹2 lakhs annually

- Low-cost investment (0.01% fund management charge)

- Government-regulated, safe framework

- Limited liquidity till retirement

- Returns capped (equity capped at 75%)

Advantages of SIP

- Higher return potential (12–15%)

- Complete flexibility & liquidity

- No cap on equity allocation

- No guaranteed returns

- Requires investor discipline

Real-Life Example: Ramesh vs Priya

- Ramesh (30 years old) invests ₹10,000 monthly in NPS. After 25 years, he builds ~₹98 lakhs.

- Priya (30 years old) invests the same in SIP at 12% CAGR. After 25 years, she builds ~₹1.33 crore.

Despite the same discipline, Priya’s SIP beats NPS due to equity compounding power.

Hybrid Strategy: NPS + SIP

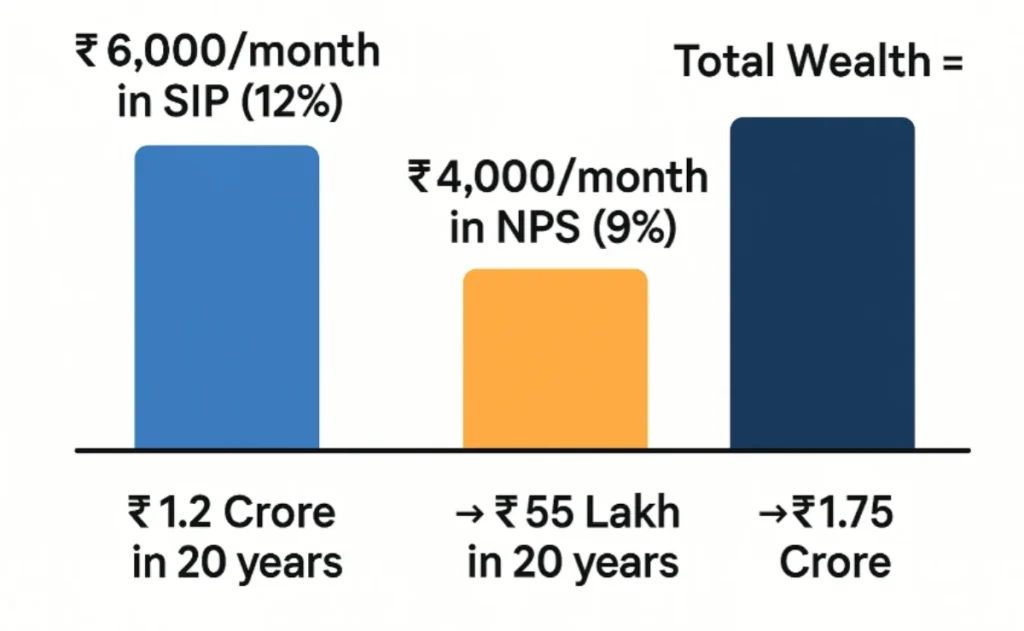

The smartest investors don’t choose one over the other. They combine both:

- Invest in NPS for tax savings and retirement security.

- Invest in SIPs for wealth creation and liquidity.

Example:

- ₹6,000/month in SIP (12%) → ~₹1.2 Crore in 20 years

- ₹4,000/month in NPS (9%) → ~₹55 Lakh in 20 years

- Total Wealth = ~₹1.75 Crore

Taxation Angle

- NPS:

- Contributions eligible for tax deduction.

- 60% withdrawal at retirement is tax-free; 40% must go into annuity (taxable).

- SIP:

- Equity LTCG (above ₹1 lakh) taxed at 10%.

- But since gains are spread annually, tax outgo is manageable.

Tax savings make NPS attractive for salaried investors, but SIP wins for wealth building.

SIP vs NPS: Side-by-Side Comparison

| Feature | NPS | SIP |

|---|---|---|

| Goal | Retirement corpus | Wealth creation (any goal) |

| Returns (CAGR) | 8–10% | 12–15% |

| Liquidity | Low (till 60) | High |

| Tax Benefits | High | Limited |

| Flexibility | Low | High |

| Corpus Speed | Slower | Faster |

Strategies to Build ₹1 Crore Faster

- Start Early: Even ₹5,000 SIP at age 25 beats ₹15,000 SIP at 35.

- Choose Equity SIPs: Long-term equities outperform hybrid/debt-heavy funds.

- Increase SIP with Income: Step-up SIP by 10% annually.

- Use NPS for Tax + SIP for Wealth: Hybrid approach works best.

- Stay Consistent: Market volatility should not break your discipline.

FAQs: NPS vs SIP

Q1. Can SIP give guaranteed ₹1 crore corpus?

No, returns depend on the market, but historically SIPs have delivered 12–15%, making ₹1 crore realistic with consistency.

Q2. Is NPS safer than SIP?

Yes, NPS is more regulated and less volatile. SIPs carry higher risk but also higher reward.

Q3. Which is better for a 25-year-old — NPS or SIP?

SIP is better for wealth creation, while NPS is useful for retirement tax savings. Best to do both.

Q4. How much should I invest monthly to reach ₹1 crore in 15 years via SIP?

Around ₹20,000 per month at 12% CAGR.

Q5. Can I withdraw NPS before 60?

Partial withdrawals (25%) allowed after 3 years, but full withdrawal is only at retirement.

Q6. Which option is more tax-efficient?

NPS wins on tax benefits, but SIPs provide more liquidity despite LTCG tax.

Conclusion: The Clear Winner

So, NPS vs SIP: Which builds ₹1 crore faster?

Answer: SIP — hands down.

While NPS is excellent for disciplined retirement planning and tax-saving, SIPs in equity mutual funds can deliver higher returns, faster wealth, and greater flexibility.

Ideal Strategy: Use NPS for tax-saving and retirement security, and SIPs for faster wealth creation and financial freedom.

Call to Action

If your goal is building ₹1 crore (or more) faster, start a SIP today. Don’t wait for “the right time” — the earlier you start, the sooner compounding works for you.

And if you’re a salaried professional, combine NPS for tax benefits with SIPs for wealth creation — that’s the ultimate winning strategy.

Leave a Reply