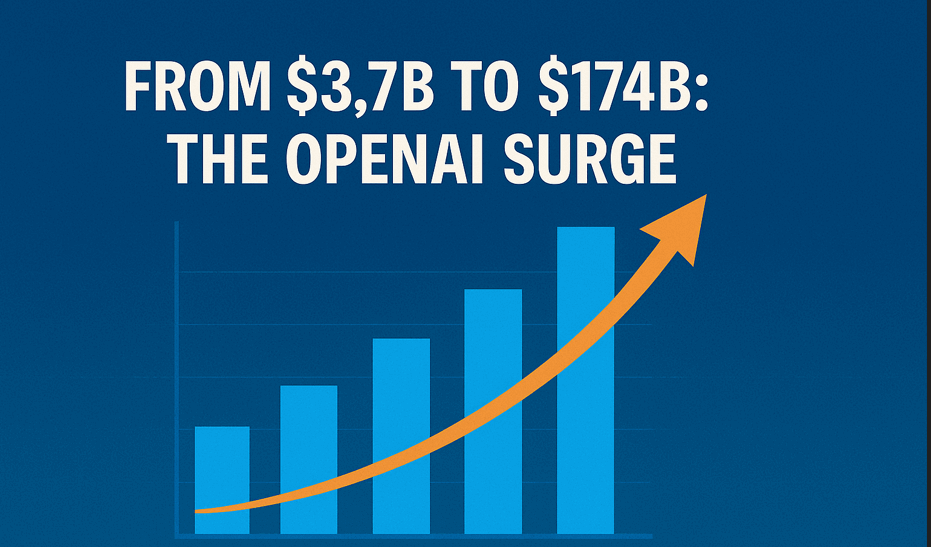

The company has shared an eye-popping forecast with investors: $126 billion in revenue by 2030. That’s not a typo—OpenAI expects to leap from a projected $3.7 billion in 2024 to a figure that could rival some of the biggest names in tech by the end of the decade.

The OpenAI Story: From Humble Beginnings to AI Powerhouse

OpenAI’s journey is a classic tale of transformation. Launched in 2015 by founders including Elon Musk and Sam Altman, the organization began as a nonprofit dedicated to advancing AI research with a focus on safety and ethics. Fast forward to today, and OpenAI has morphed into a commercial juggernaut, valued at $157 billion as of January 2024. Its flagship product, ChatGPT, took the world by storm, amassing millions of users and cementing OpenAI’s place at the forefront of the generative AI revolution.

Table of Contents

What’s fueling this shift? A combination of groundbreaking technology—like DALL-E for image generation and GPT-4 for advanced language processing—and a strategic pivot toward monetization. OpenAI’s latest revenue forecast of $126 billion by 2030 signals its intent to dominate the AI market, competing with tech titans like Nvidia and Meta. But to understand how they’ll get there, let’s break down the numbers and the strategies behind them.

The Numbers Game: OpenAI’s Revenue Projections Unveiled

OpenAI’s financial projections are nothing short of staggering. Based on internal documents reviewed by The Information, here’s how the company sees its revenue unfolding over the next few years:

| Year | Projected Revenue |

|---|---|

| 2024 | $3.7 billion |

| 2025 | $12.7 billion |

| 2029 | $125 billion |

| 2030 | $174 billion |

The $126 billion figure for 2030 isn’t explicitly listed but appears to be a specific milestone or a rounded estimate within this trajectory. Starting at $3.7 billion in 2024, OpenAI anticipates a meteoric rise, hitting $125 billion by 2029 and soaring to $174 billion by 2030. That’s a growth rate that would make even the most optimistic investor do a double-take.

So, what’s powering this exponential leap? OpenAI isn’t just banking on ChatGPT’s popularity—it’s diversifying its revenue streams and betting on the next big thing in AI. Let’s dive into the key drivers that could turn this forecast into reality.

What’s Driving OpenAI’s $126 Billion Ambition?

OpenAI’s revenue strategy is a masterclass in diversification and innovation. Here are the core pillars that could propel the company to its $126 billion target by 2030:

- AI Agents: The Next Frontier

OpenAI is shifting gears from chatbots to AI agents—autonomous tools that don’t just respond to prompts but actively perform tasks. Think booking flights, managing emails, or even running complex workflows. By 2029, AI agents are projected to bring in $29 billion, with pricing tiers potentially reaching $2,000 to $20,000 per month per agent. - Monetizing the Free User Base

With 500 million weekly active users on ChatGPT, fewer than 5% currently pay for the service. OpenAI plans to change that by targeting its massive free user pool, aiming for three billion monthly active users by 2030. Strategies like affiliate marketing, ads, or usage-based billing could unlock an additional $25 billion by 2029. - ChatGPT Subscriptions: The Steady Cash Cow

ChatGPT isn’t going anywhere. Paid subscriptions, currently at $20/month, are expected to rise to $44/month by 2029, driving revenue from $8 billion in 2025 to $50 billion in 2029. That’s roughly 40% of OpenAI’s total revenue that year. - API Sales: Powering the Ecosystem

Businesses integrating OpenAI’s models via APIs are a growing revenue stream. From $2 billion in 2025, API sales are forecasted to hit $22 billion by 2029, as more companies build on OpenAI’s tech.

These drivers paint a picture of a company evolving from a single-product wonder to a comprehensive AI platform. But as exciting as this sounds, the road to $126 billion is paved with obstacles.

The Roadblocks: Challenges That Could Derail OpenAI’s Plans

No forecast this bold comes without risks. OpenAI faces a gauntlet of challenges that could threaten its $126 billion goal. Here’s what’s at stake:

1. The Cost Conundrum

AI isn’t cheap. Training and running models like GPT-4 require massive computational resources, top-tier talent, and cutting-edge infrastructure. OpenAI’s losses are projected to hit $14 billion in 2026, nearly triple its 2024 losses, before the company turns cash-flow positive in 2029.

“The compute costs are eye-watering,” Sam Altman, OpenAI’s CEO, tweeted earlier this year, hinting at the financial tightrope the company is walking.

2. A Crowded Battlefield

The AI landscape is heating up. Competitors like Anthropic (with its Claude chatbot hitting $120 million ARR in 2024), Google (investing $75 billion in AI for 2025), and Meta (rolling out LLaMA 3 to 1.1 billion users) are all gunning for supremacy. OpenAI’s edge depends on staying ahead in innovation and user adoption.

3. Monetization Uncertainty

Turning free users into paying customers is easier said than done. While OpenAI is exploring affiliate marketing and ads, these strategies might not resonate with users accustomed to a clean, ad-free ChatGPT experience. Raising subscription prices could also backfire if competitors offer cheaper or free alternatives.

4. Structural and Regulatory Headaches

OpenAI’s “capped-profit” model, designed to balance mission and money, is under strain as it transitions to a for-profit entity. This shift could spark legal battles or regulatory scrutiny, especially as AI’s societal impact comes under the microscope.

AI Agents: The Game-Changer in OpenAI’s Arsenal

Let’s zoom in on AI agents, which OpenAI sees as a cornerstone of its future. Unlike ChatGPT, which excels at conversation, AI agents are built to act. They’re autonomous systems that can execute tasks based on simple instructions—think of them as the evolution of virtual assistants.

OpenAI’s Operator, for instance, is an AI agent that integrates with ChatGPT to handle real-world tasks. The company projects that agents could generate $29 billion by 2029, with premium pricing reflecting their advanced capabilities.

“AI agents represent a step change in ChatGPT’s capabilities,” an OpenAI spokesperson noted in a recent blog post.

But here’s the catch: AI agents need to deliver tangible value. If they’re clunky, unreliable, or overpriced, users might stick with simpler tools, putting a dent in OpenAI’s projections.

Monetizing Free Users: Opportunity or Overreach?

OpenAI’s free user base is a goldmine waiting to be tapped. With 500 million weekly users today and a goal of three billion monthly active users by 2030, the company is poised to redefine how free tiers contribute to revenue. Potential strategies include:

- Affiliate Marketing: Earning commissions by linking users to products or services.

- Ads: Displaying targeted ads within ChatGPT or other tools.

- Usage-Based Billing: Charging based on how much users engage with the AI.

The upside is huge—monetizing free users could add $25 billion by 2029. But there’s a flip side. Ads could alienate users who value ChatGPT’s simplicity, and affiliate links might feel out of place in an AI research tool. Plus, competitors like Meta are offering free AI features, raising the stakes for OpenAI to get this right.

The Competition: Who’s Challenging OpenAI’s Crown?

OpenAI isn’t running this race alone. The AI market is a battleground, with heavy hitters and nimble startups alike vying for dominance. Here’s a snapshot of the key players:

- Anthropic: Its Claude chatbot is gaining traction, with $120 million in annual recurring revenue in 2024.

- Google: With $328 billion in trailing twelve-month revenue and the upcoming Gemini 2.5, Google is a titan in AI.

- Meta: Leveraging LLaMA 3 across its platforms, Meta reaches 1.1 billion users in 14 countries.

OpenAI’s ability to outpace these rivals will depend on innovation, execution, and keeping users hooked on its ecosystem.

Is $126 Billion by 2030 Achievable?

So, can OpenAI hit its $126 billion target by 2030? The answer lies in the balance of opportunity and execution. On the plus side, OpenAI has a proven track record—ChatGPT’s viral success and a $157 billion valuation show it can move fast and win big. Its diversification into AI agents and API sales broadens its revenue base, while its massive user pool offers untapped potential.

But the hurdles are real. Losses ballooning to $14 billion in 2026, fierce competition, and untested monetization plans could trip up even the best-laid strategies. For context, Nvidia reported $60 billion in revenue in 2023, and Meta hit $134 billion. OpenAI’s 2030 goal would put it in their league—an impressive feat, but not a guaranteed one.

History offers cautionary tales. The dot-com boom saw companies with lofty valuations crumble when promises outpaced delivery. OpenAI’s success will hinge on flawless execution, cost management, and staying one step ahead of the pack.

FAQ: Your Top Questions Answered

1. What Are AI Agents?

AI agents are autonomous tools that perform tasks based on user instructions. Unlike chatbots, they’re action-oriented, handling everything from scheduling to research.

2. How Will OpenAI Monetize Free Users?

Options include affiliate marketing, ads, or usage-based billing. The details are still fuzzy, but OpenAI aims to unlock billions from its free tier starting in 2026.

3. What Risks Does OpenAI Face?

High costs, competition, and monetization challenges top the list. Regulatory hurdles and its for-profit transition could also complicate things.

4. Is $126 Billion Realistic?

It’s ambitious but possible. OpenAI’s growth trajectory is steep, requiring perfect timing and execution. Skepticism is warranted, but so is excitement.

Conclusion: OpenAI’s High-Stakes Gamble

OpenAI’s forecast of $126 billion in revenue by 2030 is a bold declaration of intent. With AI agents, free user monetization, and ChatGPT’s enduring appeal, the company is laying the groundwork to become an AI titan. Yet, the path is fraught with risks—skyrocketing costs, relentless competitors, and uncharted monetization waters could all test OpenAI’s resolve.

If OpenAI pulls it off, it could redefine the tech landscape, joining the ranks of Nvidia and Meta as a global powerhouse. But if it stumbles, this forecast might join the long list of Silicon Valley dreams that never quite materialized. For now, all eyes are on OpenAI as it races toward 2030. Will they soar or falter? Only time will tell—but one thing’s certain: it’s going to be a wild ride.

Leave a Reply