1. The “Why” Behind Investing: Beating the Stealthy Wealth Eroder

Many individuals operate under the illusion that “saving” cash is enough to secure a future. However, as a financial educator, I must warn you about inflation—the “stealthy wealth eroder” that silently destroys your purchasing power. Inflation isn’t just a statistical number; it is the reason why the money you hold today will buy significantly less tomorrow.

To maintain your current lifestyle, your capital must outpace the rising cost of goods and services. The data below illustrates this relentless upward trend:

The Reality of Rising Costs

| Expense Category | Past/Current Cost | Future Cost / Growth | Timeframe |

| Monthly Living Expenses | ₹30,000 | ₹80,000 | 20 Years |

| Professional Education | ₹20 Lakh | ₹34 Lakh | 11 Years |

| Petrol (per litre) | ₹9.84 (1990) | ₹74.52 (2015) | 25 Years (8x increase) |

| Stock Market (Sensex) | ~700 points | ~28,000 points | 25 Years (34x growth) |

So What? Between FY79 and 2015, inflation averaged 7.62% annually. This results in a staggering 95% erosion of the Rupee’s purchasing power historically. If you aren’t investing in assets that grow, you are effectively becoming poorer every year.

Because traditional savings accounts cannot keep pace with this erosion, we must look toward a mechanism designed specifically for consistent, long-term wealth creation.

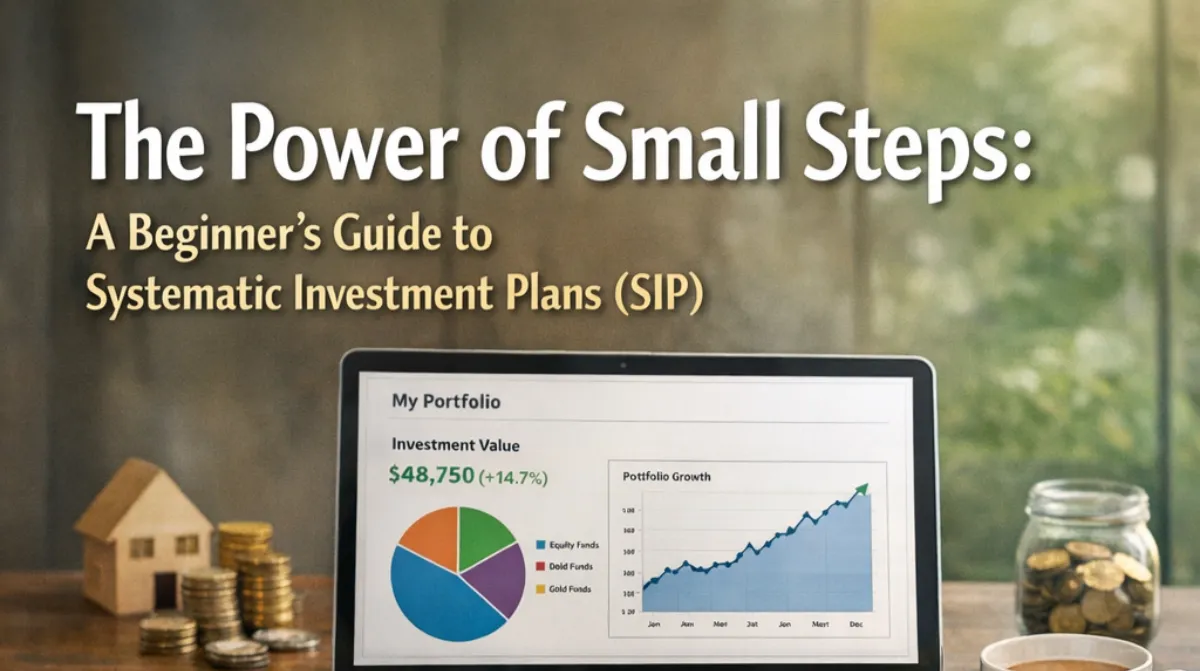

2. Defining the SIP: Your Hassle-Free Wealth Engine

A Systematic Investment Plan (SIP) is a smart, hassle-free methodology for investing in mutual funds. Instead of requiring a massive capital outlay, a SIP allows you to build a substantial corpus through small, disciplined contributions. It is the bridge between your current income and your future financial requirements.

Primary Characteristics of a SIP:

- Small Sums: Accessibility is key; you can start your journey with as little as ₹500 per month.

- Specified Intervals: Investments are automated at regular intervals (e.g., monthly), ensuring consistency.

- Wealth Creation: It is a deliberate, planned approach to accumulating long-term capital.

- Accessibility: By buying units on a specified date every month, you remove the complexity of manual execution.

Pro-Tip: SIPs are designed to inculcate a habit of disciplined saving. The goal is to move away from the “invest if I have money left” mindset to a “savings-first” approach where your wealth grows automatically.

This regular commitment provides the fuel for the most powerful mathematical force in finance.

3. The Growth Engine: The Power of Compounding

The “Power of Compounding” is the core engine of a SIP. In simple terms, compounding is the process where the returns you earn on your investment are reinvested to earn even more returns. Over a long duration, this creates a multiplier effect where your money starts doing the heavy lifting for you.

Staying invested through various market cycles is the most effective way to beat volatility. By starting early and remaining consistent, you allow time to act as a force multiplier, transforming modest monthly contributions into a significant financial safety net.

Key Strategies for Early-Stage Investors:

- Rupee Cost Averaging: This manages the cost of your investment without requiring you to watch the news.

- Compounding: This maximizes growth by ensuring that your earned interest begins earning its own interest over decades.

To truly appreciate how time accelerates this engine, we must examine the difference a few years can make.

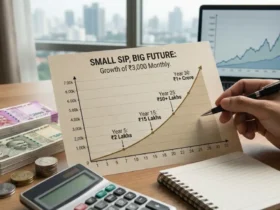

4. Three Scenarios of Success: 5, 10, and 15 Years

The most critical factor in your financial success isn’t the “perfect” stock pick; it is the duration for which you stay invested. The following table illustrates how a monthly SIP of ₹5,000 grows at an assumed annualized return of 18%.

| Investment Tenure | Total Amount Invested | Final Corpus (Accumulated Wealth) |

| Scenario A (5 Years) | ₹3,00,000 | ₹4.93 Lac |

| Scenario B (10 Years) | ₹6,00,000 | ₹16.86 Lac |

| Scenario C (15 Years) | ₹9,00,000 | ₹46.01 Lac |

The Exponential Growth Insight: Look closely at the leap between Scenario A and Scenario C. While your total investment in the 15-year plan (₹9L) is only 3 times what you invested in the 5-year plan (₹3L), your final corpus (₹46.01L) is nearly 10 times larger. This is the reward for patience and time.

While these numbers are compelling, many beginners are paralyzed by the fear of market crashes; however, the SIP structure has a built-in defense mechanism for this.

5. Taming Market Fears: Rupee Cost Averaging

Many investors fail because they try to “time the market”—buying when they think it’s low and selling when they think it’s high. This is a losing game for most. SIPs solve this through Rupee Cost Averaging (RCA).

The 5 Common Investor Fears Defined:

- Illiquidity: The worry that money cannot be accessed in an emergency.

- Downside Risk: The fear that the market value of equities will drop.

- Timing: The anxiety of entering the market just before a crash.

- Volatility: The stress caused by rapid, daily price fluctuations.

- Capital Loss: The fear of losing the principal amount invested.

How Rupee Cost Averaging Works:

| Market Status | Units Purchased | Impact on Average Cost |

| Market is High | Fewer Units | You buy less when the “price” is expensive. |

| Market is Low | More Units | You accumulate more units at a “discount.” |

| Portfolio Impact | Lower Average Cost | Your Average Cost Per Unit becomes lower than the average market price over time. |

By automatically buying more units when prices are low, the SIP “smoothens” the impact of fluctuations. You no longer need to fear a falling market; instead, you can view it as an opportunity to buy more units at a cheaper rate.

6. Investing for a Lifetime: Matching SIPs to Your Stage

Financial planning is a journey that evolves as you do. The ratio of your “Consumption” (spending) to your “Savings and Investments” changes as you move through different milestones.

The Life Stages of an Investor:

- Age 22 (Young Independent): High potential for savings; minimal obligations. This is the most critical time to start.

- Age 27 (Young Married): Increased consumption; beginning to plan for family goals.

- Age 40 (Middle Age): High consumption due to children’s education and home loans; peak earning years.

- Age 60 (Retirement): Focus shifts from accumulation to utilizing the corpus.

Categorizing Your Life Goals:

- Long-term Foundations: Retirement, Child’s higher education, and marriage expenses.

- Lifestyle & Contingencies: Buying a home or car, family vacations, and medical emergency funds.

The Power of Asset Selection: Historical data (1979–2015) proves that Equities are the superior wealth-building tool. If you had invested ₹100 in 1979, by 2015 it would have grown to:

- ₹1,922 in Gold

- ₹3,526 in Bank Deposits

- ₹26,118 in Equities

A Call to Action: The data is clear: the cost of delay is the greatest threat to your wealth. Starting at age 22 vs. age 27 can mean the difference between a comfortable retirement and a financial struggle. Equities outperform every other asset class over the long term, and SIPs are the most disciplined way to access those returns.

Stop waiting for the “right time” to invest. The right time was yesterday; the next best time is today. Start your SIP now.

Leave a Reply