Introduction: The Wealth Dilemma of Our Time

It’s the year 2030. You invested ₹10 lakhs in 2025, and now you’re looking at your portfolio. The big question: Did real estate or gold double your money?

This debate isn’t new—Indians have trusted gold for centuries while real estate has been the modern wealth generator. But the coming years are set to be different. Rising inflation, urbanization, global market shifts, and government reforms are reshaping the investment landscape.

So, if you’re planning long-term wealth creation, you need to answer this honestly:

Where should you put your money today—real estate or gold—to double it by 2030?

Why the Real Estate vs Gold Debate Matters in 2025

- Both are safe-haven assets: Unlike stocks, both real estate and gold hold intrinsic value.

- Long-term wealth building: Families pass down both assets across generations.

- Cultural & emotional connect: Gold is tied to weddings, festivals, and savings; real estate represents security and pride.

- Different wealth behaviors: Real estate grows with urban expansion, while gold thrives in uncertainty.

With inflation, global slowdown fears, and geopolitical tensions, investors want clarity: Which asset has the power to double by 2030?

The Case for Gold Investment (2025–2030)

1. Historical Performance of Gold

- In the last 20 years, gold has grown from around ₹6,000 per 10g (2005) to nearly ₹70,000 per 10g (2025).

- That’s a 10x jump in 20 years—an annualized return of ~12–13%.

- During crises (2008 recession, COVID-19, Russia-Ukraine war), gold surged while other assets fell.

Example: In 2020, gold gave 28% returns, while Indian real estate struggled with liquidity.

2. Key Drivers for Gold Prices by 2030

- Global uncertainties: Wars, inflation, and recession fears push investors toward gold.

- Central bank buying: Countries like China and India are stockpiling gold reserves.

- Declining mining supply: Limited new discoveries could create scarcity.

- Rupee depreciation: As INR weakens against the dollar, domestic gold prices rise.

3. Expert Quote on Gold

“Gold is not just a hedge; it’s a global currency that has survived every financial collapse. By 2030, we expect gold to cross ₹1,20,000 per 10 grams in India.”

— Anand Rathi, Wealth Strategist

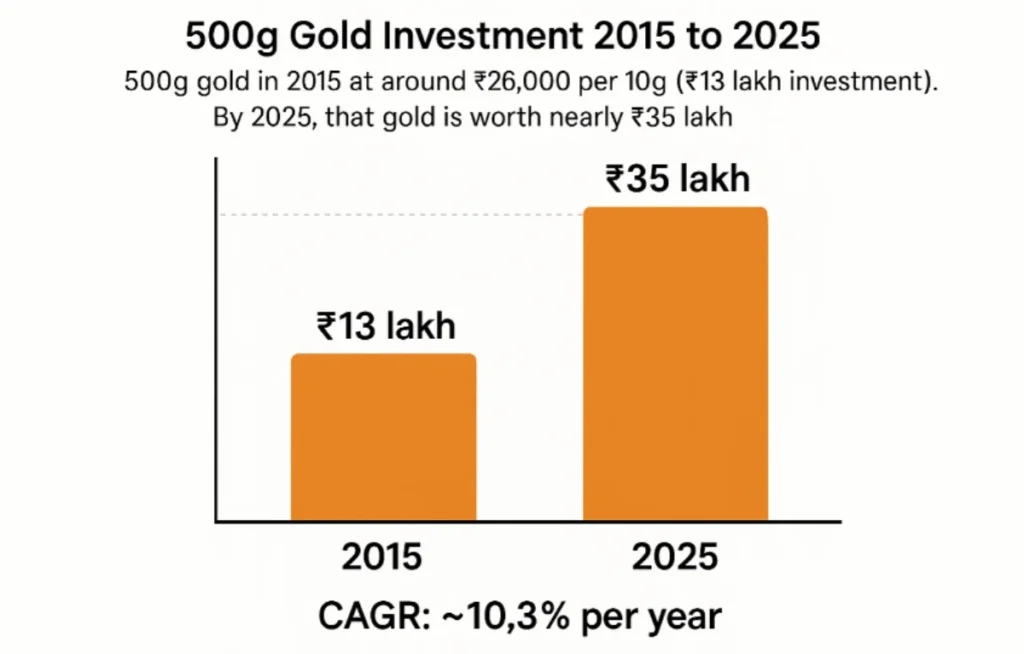

4. Case Study: Gold Investor from 2015–2025

Ramesh, a small businessman in Varanasi, bought 500g gold in 2015 at around ₹26,000 per 10g (₹13 lakh investment).

- By 2025, that gold is worth nearly ₹35 lakh.

- CAGR: ~10.3% per year.

If gold follows the same trajectory, his wealth could double by 2030.

The Case for Real Estate Investment (2025–2030)

1. Historical Performance of Real Estate

- Metro cities (Delhi, Mumbai, Bengaluru, Hyderabad): Prices grew 2–4x between 2005–2015.

- Tier-2 cities: Emerging hubs like Lucknow, Indore, and Jaipur grew faster in the last decade.

- Rental yields: Typically 2–3% in India, lower than global averages, but capital appreciation makes up.

Example: A 2BHK in Gurugram bought for ₹60 lakh in 2010 is now worth ₹1.5 crore (2025).

2. Key Drivers for Real Estate Growth by 2030

- Urbanization: By 2030, 40% of Indians will live in cities (vs 34% today).

- Smart Cities Mission: Government push in Tier-2/3 cities will raise property values.

- Rising incomes: Aspiring middle-class families view property as a primary asset.

- Foreign investments: REITs and FDI inflows boosting commercial real estate.

3. Expert Quote on Real Estate

“While gold is defensive, real estate is offensive. With India’s urban expansion, property in growth corridors could easily double between 2025 and 2030.”

— Dr. Renu Sud Karnad, MD, HDFC Ltd.

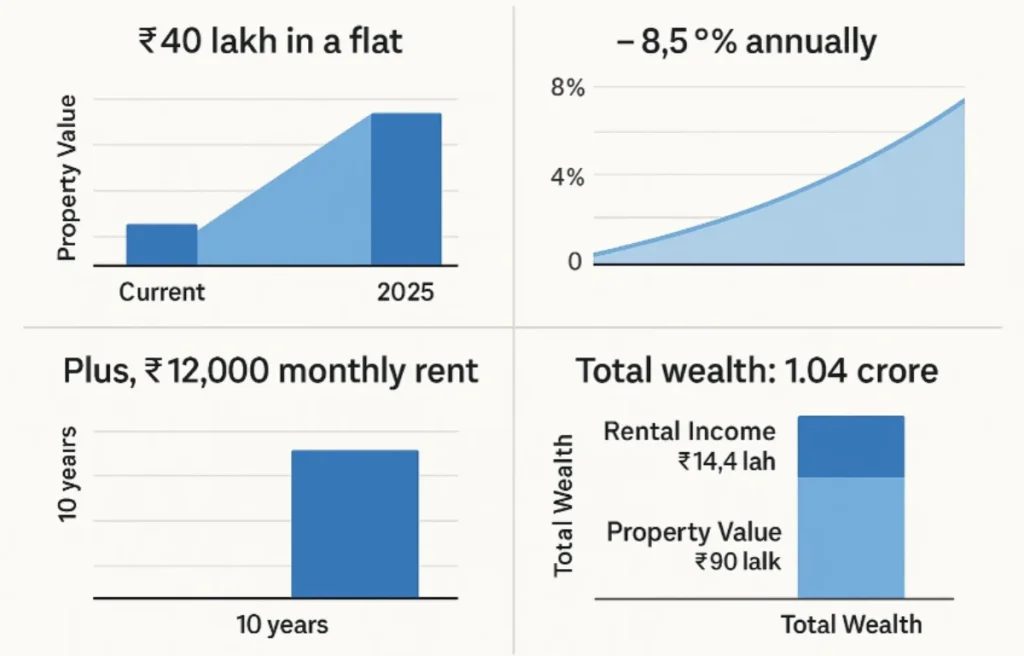

4. Case Study: Real Estate Investor from 2015–2025

Meena invested ₹40 lakh in a flat in Hyderabad (2015).

- By 2025, property value: ₹90 lakh.

- CAGR: ~8.5% annually.

- Plus, ₹12,000 monthly rent = ₹14.4 lakh in 10 years.

- Total wealth: ₹1.04 crore.

If Hyderabad IT growth continues, her wealth may double again by 2030.

Gold vs Real Estate: Side-by-Side Comparison

| Factor | Gold | Real Estate |

|---|---|---|

| Liquidity | Very high (can sell anytime) | Low (can take months) |

| Returns (CAGR 2015–2025) | ~10–12% | ~7–10% |

| Volatility | Medium (depends on global markets) | High (location-specific) |

| Risk | Low (safe-haven) | Medium–High (market & legal risks) |

| Maintenance | None | High (repairs, taxes, registry) |

| Additional Income | None | Rental income (2–3% annually) |

| Cultural Value in India | Very strong | Very strong |

| 2030 Growth Potential | Likely 1.7–2x | Likely 1.8–2.2x |

Real-Life Example: ₹10 Lakh Invested in 2025

| Asset | Investment (2025) | Value in 2030 (Expected) | CAGR |

|---|---|---|---|

| Gold | ₹10 lakh | ₹18–20 lakh | 11–12% |

| Real Estate | ₹10 lakh (down payment + loan) | ₹20–22 lakh (net equity + rental income) | 12–14% |

Verdict: Both can double, but real estate may edge ahead with rentals + leverage.

Key Risks You Must Consider

Gold Risks

- Prices may stagnate if inflation cools.

- No passive income (unlike rent).

- Import restrictions by government.

Real Estate Risks

- Legal disputes, delayed projects.

- Low liquidity—can’t exit quickly.

- High entry barrier (stamp duty, registry).

Expert Insights: Which One to Choose?

- Short-term safety (5 years): Gold is better.

- Long-term wealth (10+ years): Real estate wins due to compounding rental + appreciation.

- Balanced portfolio: Smart investors allocate 60% real estate, 40% gold for 2030 goals.

FAQs

Q1. Which is better for doubling money by 2030—real estate or gold?

Both can double by 2030, but real estate offers slightly higher potential when factoring in rental income and leverage.

Q2. Is gold safer than real estate?

Yes. Gold is highly liquid and less risky, while real estate carries legal and market risks.

Q3. Can I take a loan against gold or property?

Yes. Both allow loans—gold loans are quick, property loans offer larger amounts.

Q4. Which is better for beginners in 2025?

Gold is simpler for beginners; real estate requires higher capital and research.

Q5. How much gold should I keep in my portfolio?

Experts recommend 10–15% portfolio allocation to gold for hedging.

Q6. Will real estate prices crash before 2030?

Unlikely. Demand in Tier-2/3 cities and urban expansion supports steady growth.

Conclusion: The 2030 Winner

By 2030, both gold and real estate can double your money—but in different ways.

- Gold offers stability, liquidity, and inflation protection.

- Real estate offers higher wealth compounding, passive rental income, and leverage benefits.

If you seek safety + quick liquidity → Choose Gold.

If you seek growth + long-term wealth → Choose Real Estate.

If you want the smartest path → Diversify into both.

Call to Action

If you’re serious about building wealth before 2030, don’t just chase one asset.

Balance your portfolio with both real estate and gold.

1 Comment