Introduction

It’s a calm morning in January 2031. You wake up without an alarm. There’s no rush, no work emails. Your home is quiet, your chai is hot, and your bank account receives a steady ₹30,000 every month — automatically.

What if I told you this lifestyle is achievable?

Not 20 years from now, but by 2030. You don’t need to win the lottery or earn ₹1 crore/year. You need a smart strategy, emotional discipline, and actionable steps starting today.

Table of Contents

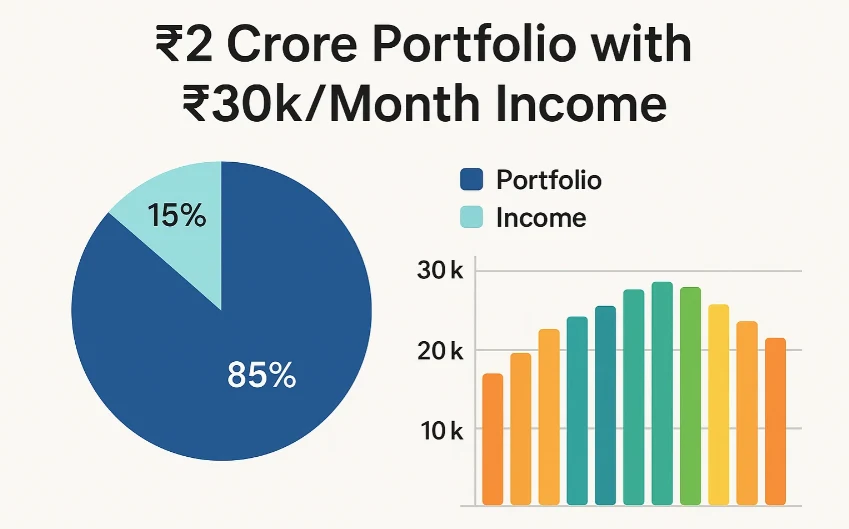

With inflation cooling and interest rates steady in 2025, India is in a position where wealth creation is faster than it was five years ago. This blog is your roadmap to building a ₹2 crore retirement portfolio that ensures a tax-efficient, inflation-adjusted monthly income of ₹30k for years to come.

Why ₹2 Crore?

Understanding the Retirement Math

Let’s break it down.

- You want ₹30,000/month = ₹3.6 lakh/year to cover basic expenses.

- By 2030, at 4% average inflation, ₹30,000/month today becomes ~₹36,500/month.

Table 1: Inflation-Adjusted Monthly Income in 2030

| Year | Monthly Need (₹) | Inflation (4% avg) | Future Value |

|---|---|---|---|

| 2025 | 30,000 | – | 30,000 |

| 2030 | – | 4%/year | ~36,500 |

To safely withdraw ₹36.5k/month from your corpus (without depleting it), you’ll need around ₹2 crore invested across balanced income-generating assets.

Safe Withdrawal Rule

Financial planners recommend the 4% rule, meaning:

“Withdraw 4% of your corpus annually to maintain longevity of funds.”

So, ₹3.6 lakh annually = ₹2 crore corpus. That’s your magic number.

How to Build ₹2 Crore in 5 Years

Your Timeline: 2025 to 2030

Let’s reverse engineer the goal.

If you have no savings yet, you need:

- Monthly SIP of ~₹2.5 lakh/month @10% CAGR over 5 years.

Most people will already have some capital. Let’s explore realistic combinations.

Table 2: Pathways to ₹2 Crore by 2030

| Current Investment | Monthly SIP Needed | Return (10%) | Years |

| ₹50L | ₹1.7L | 10% | 5 |

| ₹1Cr | ₹90k | 10% | 5 |

| ₹1.5Cr | ₹25k | 10% | 5 |

Choose the Right Investment Mix

Aim for a growth + income hybrid portfolio:

- 60% Equity Mutual Funds (large-cap, index, flexi-cap)

- 30% Debt Mutual Funds / Bonds

- 10% Retirement Instruments (NPS, PPF, annuity plans)

Portfolio Snapshot:

| Asset Class | Allocation | Returns (Est.) | Purpose |

| Equity MFs | 60% | 11-14% | Growth |

| Debt MFs | 30% | 6-8% | Stability & liquidity |

| NPS/PPF | 10% | 7-10% | Tax-free long-term |

Expert Insight:

“A 60:40 equity-debt strategy is ideal for investors in their 30s and 40s targeting 2030 retirement. It ensures growth while protecting downside,” says Swati Jain, Senior Planner at Scripbox.

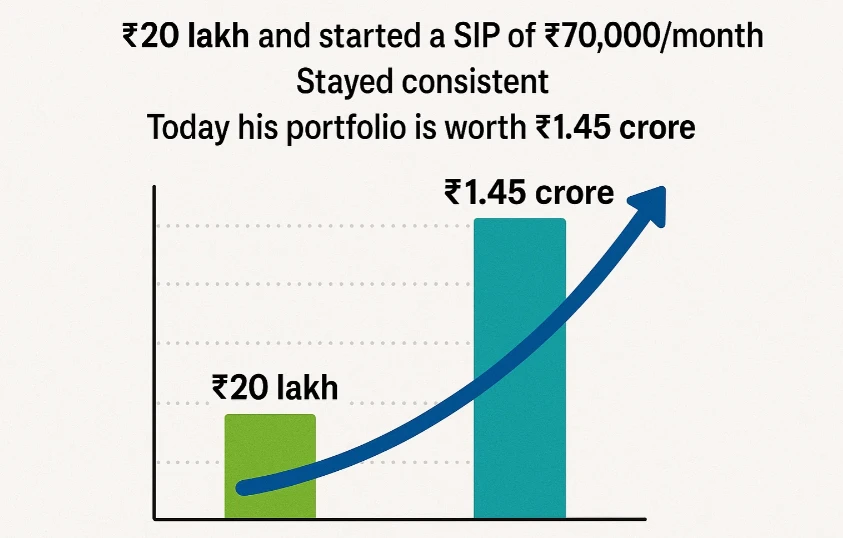

Real-Life Case Study: Rajeev’s Journey

Rajeev Verma, 39, works in Noida’s IT sector. In 2020, he had ₹20 lakh and started a SIP of ₹70,000/month. Despite COVID, he stayed consistent. Today (August 2025), his portfolio is worth ₹1.45 crore.

His strategy:

- Invested in Mirae Large Cap, Parag Flexi Cap, and ICICI Balanced Advantage Fund.

- Used PPF for stability (lock-in for 15 years).

- Kept 6 months emergency cash in liquid fund.

He’s now 4 years from retirement, aiming for ₹2.1 crore.

Rajeev says:

“My SIPs are boring, but they work. I track them quarterly, not daily. That’s my peace plan.”

Key Fund Recommendations (2025 Update)

Top Equity Funds for Growth

| Fund Name | 5Y CAGR (2025) | Category |

| Parag Parikh Flexi Cap Fund | 18.7% | Flexi Cap |

| Mirae Asset Large Cap Fund | 16.2% | Large Cap |

| Quant ELSS Tax Saver | 20.1% | ELSS |

Debt Options for Income Stability

| Fund Name | Return (5Y) | Category |

| HDFC Corporate Bond Fund | 7.3% | Corporate Bond |

| SBI Magnum Ultra Short Fund | 6.4% | Ultra Short |

| ICICI Pru Savings Fund | 6.8% | Low Duration |

Quote from Vinay Joshi (Axis MF):

“Ultra short-term debt funds are essential for retirees to get safe, liquid income without locking funds for long periods.”

How to Create ₹30k Monthly Post Retirement

SWP – Systematic Withdrawal Plan

Once you reach ₹2 crore, opt for SWP from balanced or debt funds.

- Withdraw ₹30k/month

- Ensure returns > withdrawal to protect principal

- Choose low volatility funds

PPF + NPS = Tax-Free Edge

- PPF gives 7.1% (tax-free, sovereign backed)

- NPS gives annuity + lump sum withdrawal with tax benefits under 80CCD

Emotional Challenges to Overcome

Retirement planning is not just numbers.

- Fear of falling short: Start SIPs now to shrink the gap

- Lifestyle creep: Stick to budget, track spends via apps

- Family pressure: Align financial goals with spouse and dependents

Remember, your peace is worth protecting.

FAQs

Q1. Can I retire by 2030 with ₹2 crore corpus?

Yes. With consistent SIPs and correct asset allocation, ₹2 crore can deliver inflation-adjusted income of ₹30-36k/month.

Q2. Is ₹30k/month enough for retirement?

Depends on your location & lifestyle. In Tier 2 cities, it covers basics. In metros, add rent/healthcare buffer.

Q3. Which SIPs give best returns in 2025?

Parag Flexi Cap, Mirae Large Cap, Quant ELSS are top performers this year.

Q4. What’s better – SWP or annuity?

SWP offers flexibility and tax control. Annuity gives stability but low returns.

Q5. How to manage tax post-retirement?

Use SWP from debt funds (taxed on gains), PPF (tax-free), NPS (partial tax-free), and senior citizen benefits.

Final Thoughts: Your Peace Blueprint

Imagine the freedom of having money work for you. No chasing clients, no monthly salaries, no fear of job loss. With ₹2 crore invested smartly, you create a cash machine that gives you dignity, comfort, and control.

Here’s your 3-step plan:

- Start SIPs today – even if small, consistency beats size.

- Rebalance annually – adjust risk vs return.

- Visualize your goal – make your future lifestyle part of your WHY.

Take Action Now: Use a calculator. Set your first SIP. Talk to your advisor.

Your 2030 freedom starts in 2025.

Leave a Reply