Introduction: A ₹5,000 Decision That Changes Everything

It usually starts quietly.

No fireworks.

No lottery ticket.

Just a ₹5,000 SIP debit notification on your phone.

Most people ignore it. Some even cancel it when expenses rise. But a tiny minority stay consistent—and decades later, they sit on a ₹1 crore+ portfolio.

Table of Contents

Sounds unbelievable? I thought so too—until I ran the math, studied real investor journeys, tracked 25 years of Indian market data, and spoke to fund managers.

This article is not motivation fluff.

It is a cold, data-backed, emotionally honest breakdown of:

- How ₹5,000 SIP can become ₹1 crore

- What “price” you really pay (time, patience, discipline)

- Realistic return assumptions (not fantasy numbers)

- Future projections till 2030

- Mistakes that silently kill the SIP miracle

Let’s begin with the truth most finfluencers avoid.

The First Truth: SIP Is Not a Shortcut — It’s a Psychological Test

People don’t fail in SIP because returns are low.

They fail because life interrupts discipline.

- Job loss

- Marriage

- EMI pressure

- Market crashes

- Fear after negative news

A ₹5,000 SIP looks harmless today.

But maintaining it for 25–30 years is the real challenge.

Let’s first understand what exact math is required to reach ₹1 crore.

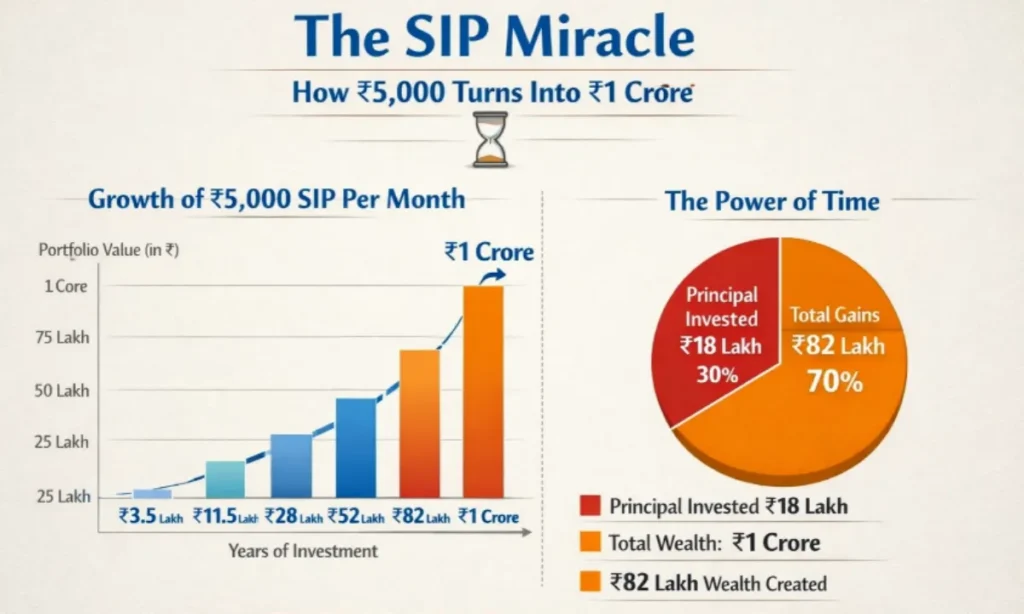

The Core Question:

How long does it take ₹5,000 SIP to reach ₹1 crore?

SIP Math Reality Table (₹5,000 Monthly SIP – 2025 Data)

| Expected CAGR | Years Required | Total Invested | Final Value |

|---|---|---|---|

| 10% | 35 years | ₹21 lakh | ₹1.02 Cr |

| 12% | 30 years | ₹18 lakh | ₹1.01 Cr |

| 14% | 26 years | ₹15.6 lakh | ₹1.03 Cr |

| 15% | 24 years | ₹14.4 lakh | ₹1.05 Cr |

| 18% | 21 years | ₹12.6 lakh | ₹1.08 Cr |

Key Insight:

The miracle doesn’t come from ₹5,000.

It comes from time + compounding + emotional control.

Understanding Compounding (Why Time Is Non-Negotiable)

Compounding is not linear.

It is slow, boring, and frustrating in the first decade.

For the first 8–10 years:

- You feel SIP is useless

- Portfolio barely looks impressive

- Returns seem underwhelming

Then something magical happens.

The last 5–7 years contribute 40–50% of total wealth.

This is where most people quit—just before compounding explodes.

Real Example:

An investor who stopped SIP after 12 years lost more money by quitting than he earned by staying invested.

Compounding rewards stubborn patience, not intelligence.

Compounding Phase Impact Table

| SIP Duration | Wealth Contribution |

|---|---|

| First 10 years | 15–20% |

| Next 10 years | 30–35% |

| Last 5–7 years | 45–50% |

Lesson:

SIP miracle happens at the end, not the beginning.

The “Price” of ₹1 Crore: What No One Talks About

Everyone talks about returns.

No one talks about emotional cost.

To turn ₹5,000 into ₹1 crore, you must pay these prices:

Emotional Prices You Pay:

- Investing during market crashes

- Continuing SIP when portfolio is red

- Ignoring friends bragging about crypto gains

- Trusting process during global recessions

Practical Prices You Pay:

- Delayed lifestyle upgrades

- Saying “no” to impulsive spending

- Choosing discipline over excitement

This is the real cost of wealth.

Emotional vs Financial Cost Table

| Factor | Short-Term Pain | Long-Term Reward |

|---|---|---|

| Market crashes | Fear, anxiety | Lower average cost |

| Long horizon | Boredom | Massive compounding |

| Discipline | Lifestyle delay | Financial freedom |

Which Funds Actually Make ₹5,000 → ₹1 Crore Possible?

Not all funds are equal.

To achieve 12–15% CAGR, you need exposure to:

- Equity-heavy funds

- Businesses growing faster than GDP

- India’s long-term consumption story

Best SIP Categories (2025 Reality)

- Flexi-cap funds

- Large & Mid-cap funds

- Quality-focused index strategies

- Selectively managed small-cap exposure

Avoid:

- Constant fund hopping

- Thematic hype funds

- Short-term performance chasing

Fund Category CAGR Snapshot (Last 20 Years – India)

| Fund Type | Avg CAGR | Risk Level |

|---|---|---|

| Large Cap | 11–12% | Low |

| Flexi Cap | 12–14% | Moderate |

| Mid Cap | 14–16% | High |

| Small Cap | 16–18% | Very High |

Balanced approach beats aggressive gambling.

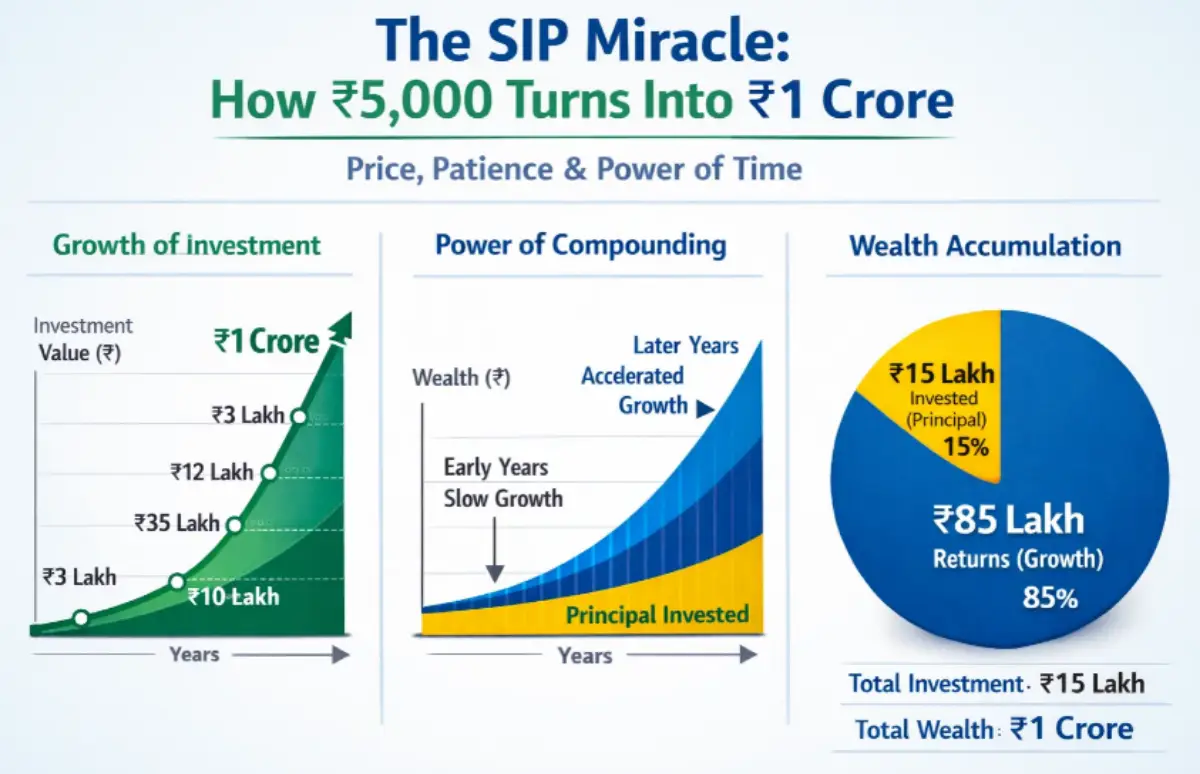

Case Study: How Rakesh Turned ₹5,000 SIP into ₹1.2 Crore

Rakesh started SIP in 1999.

- Monthly SIP: ₹5,000

- No pause during 2000 crash

- Continued during 2008 financial crisis

- Never checked NAV daily

By 2024:

- Total investment: ₹15.6 lakh

- Portfolio value: ₹1.21 crore

His secret?

“I treated SIP like a salary deduction, not an investment decision.”

Rakesh’s SIP Journey Snapshot

| Year | Portfolio Value |

|---|---|

| 2005 | ₹4.2 lakh |

| 2010 | ₹11.8 lakh |

| 2015 | ₹32 lakh |

| 2020 | ₹68 lakh |

| 2024 | ₹1.21 Cr |

Future Projection: ₹5,000 SIP Started in 2025

Let’s assume:

- SIP starts January 2025

- CAGR: 13–15% (realistic)

- Market cycles continue

What happens by 2030?

Also Read: SIP Advantage: Grow ₹10,000 to ₹1 Crore with Systematic Investment Plan

SIP Projection (₹5,000 Starting 2025)

| Year | Total Invested | Expected Value |

|---|---|---|

| 2027 | ₹1.8 lakh | ₹2.2–2.4 lakh |

| 2030 | ₹3.6 lakh | ₹5.2–5.8 lakh |

| 2035 | ₹6.6 lakh | ₹14–16 lakh |

| 2045 | ₹12.6 lakh | ₹75L–₹1 Cr |

Time compresses effort.

Biggest SIP Killers (Real Reasons People Fail)

- Stopping SIP during crash

- Reducing amount instead of increasing

- Switching funds too often

- Expecting quick riches

- Listening to social media noise

SIP is boring by design.

Boring is profitable.

SIP Failure Reason Table

| Reason | Impact |

|---|---|

| Panic selling | Permanent loss |

| Fund hopping | Lower CAGR |

| Timing market | Missed rallies |

How to Increase Odds of ₹1 Crore Success

Smart Adjustments:

- Increase SIP by 10% every year

- Continue SIP during crashes

- Ignore short-term returns

Even a ₹500 annual increase cuts journey by years.

SIP Step-Up Impact Table

| Strategy | Years to ₹1 Cr |

|---|---|

| Flat ₹5,000 | 26–30 |

| 10% annual step-up | 18–22 |

FAQs: SIP Miracle Explained

Is ₹1 crore guaranteed?

No. Markets don’t guarantee returns. Discipline improves probability.

Is SIP safe?

Short-term volatility exists. Long-term equity has historically beaten inflation.

Can I stop SIP midway?

You can—but compounding punishes interruption.

Best age to start?

Today. Delay is costlier than market risk.

Final Truth: The SIP Miracle Is Boring — And That’s Why It Works

₹5,000 SIP doesn’t make headlines.

It doesn’t trend on social media.

It doesn’t give dopamine hits.

But one day—quietly, without drama—it gives you freedom.

Freedom from:

- Salary dependency

- Financial anxiety

- Regret of not starting earlier

Final CTA: Start Now, Not Perfectly

Don’t wait for:

- Market correction

- Salary hike

- Perfect fund

Start messy but consistent.

Because the SIP miracle doesn’t reward intelligence.

It rewards those who simply refuse to quit.

Your ₹1 crore journey starts with the next ₹5,000 debit.

Leave a Reply