You look at your paycheck, then at your bills, and that nagging thought returns: “Is there anything left to save? And even if I save, will it ever be enough?” You’re not alone. In a world of rising costs and financial noise, the dream of building real wealth can feel like a distant fantasy, reserved for those with hefty salaries or a lucky stock pick. But what if I told you that the most powerful wealth-building tool isn’t a massive lump sum or a magic formula? It’s a disciplined, steady habit of investing a small, manageable amount—like ₹2000 a month—into the right vehicle.

Table of Contents

This isn’t a get-rich-quick scheme. This is a get-rich-sure strategy. It’s about turning your daily cup of coffee money into a future of financial freedom. This is the real-life magic of a SIP plan of ₹2000 monthly.

Why a ₹2000 Monthly SIP is a Game-Changer for Every Indian

Let’s be real. For most of us, ₹2000 feels… doable. It’s roughly ₹67 a day. It’s the money we might spend on impulsive food deliveries, a couple of movie tickets, or a quick online shopping spree. By consciously redirecting this amount, you’re not making a painful sacrifice; you’re making a strategic trade. You’re trading fleeting satisfaction for lasting security.

The beauty of a Systematic Investment Plan (SIP) is that it democratizes investing. It doesn’t care if you’re a fresh graduate starting your first job, a parent juggling household expenses, or someone in their 40s playing catch-up. A ₹2000 SIP is your entry ticket to the world of equity markets, allowing you to harness the power of compounding without the fear of market timing or needing a large capital.

Expert Quote:

Mr. Nilesh Shah, MD of Kotak Mahindra Asset Management Company, often emphasizes, “SIP is not just a product, it’s a process. It’s a discipline. It’s a habit which transforms your future. For the common Indian, a SIP of even ₹2000 per month, if started early and continued with patience, can create wealth which can take care of critical financial goals.”

SIP 101: It’s Simpler Than Your Monthly Phone Recharge

For the uninitiated, let’s break it down. A Systematic Investment Plan (SIP) is a method of investing a fixed amount regularly (monthly, quarterly) into a mutual fund scheme. Think of it as a recurring deposit (RD) in a bank, but instead of earning a fixed, often low interest, your money is invested in the stock market through professionally managed mutual funds.

- You instruct your bank to auto-debit a fixed sum (e.g., ₹2000) every month.

- This money is automatically used to buy units of a chosen mutual fund scheme.

- The number of units you get depends on the fund’s Net Asset Value (NAV) that day.

- When markets are down, your fixed ₹2000 buys more units. When markets are up, it buys fewer units. This is called rupee-cost averaging, and it’s your built-in shield against market volatility. You buy low automatically, without even trying.

The Math That Will Blow Your Mind: What Can ₹2000/Month Really Achieve?

This is where the magic happens. Let’s move from abstract concepts to cold, hard numbers. The key variable here is the expected rate of return. Historically, a well-diversified equity mutual fund SIP has delivered an average annualized return of 12-15% over long periods (15+ years).

Let’s project the future value of your ₹2000 monthly SIP at different return rates and time horizons.

Table 1: The Future Value of Your ₹2000 Monthly SIP

| Investment Horizon | Total Amount Invested | @12% Annual Return | @15% Annual Return |

|---|---|---|---|

| 10 years | ₹ 2,40,000 | ₹ 4.6 Lakhs | ₹ 5.5 Lakhs |

| 15 years | ₹ 3,60,000 | ₹ 8.9 Lakhs | ₹ 11.8 Lakhs |

| 20 years | ₹ 4,80,000 | ₹ 17.9 Lakhs | ₹ 28.9 Lakhs |

| 25 years | ₹ 6,00,000 | ₹ 33.8 Lakhs | ₹ 66.7 Lakhs |

| 30 years | ₹ 7,20,000 | ₹ 64.9 Lakhs | ₹ 1.4 Crores |

Stop and read that last line again.

A consistent investment of just ₹2000 a month, over 30 years, can potentially grow to over One Crore Rupees at a 15% return. That’s the unparalleled power of compounding. Your money starts earning money, and then that money earns even more money. It’s a snowball effect that starts small but grows into an avalanche of wealth.

Choosing the Right SIP for Your ₹2000: A Practical Guide

Not all mutual funds are created equal. Where should you put your hard-earned ₹2000? The choice depends on your financial goals, risk appetite, and investment horizon.

1. For Long-Term Wealth Creation (10+ years): Equity SIPs

| Mirae Asset Large Cap Fund | Large Cap Equity | 15% | Stable returns, lower volatility |

| Axis Bluechip Fund | Large Cap Equity | 14% | Strong track record of consistency |

| SBI Small Cap Fund | Small Cap Equity | 20% | High growth potential for long term |

| ICICI Prudential Technology Fund | Thematic/Tech | 22% | Tech sector growth in India |

| HDFC Hybrid Equity Fund | Hybrid | 12% | Balanced risk-return for new investors |

This is where you can potentially achieve the 12-15% returns we discussed.

- Flexi-Cap Funds: Invest across large, mid, and small-cap stocks. They offer great diversification and are an excellent “one-stop-shop” for most beginners. (e.g., Mirae Asset Flexi Cap Fund, Parag Parikh Flexi Cap Fund).

- Index Funds (Nifty 50 or Sensex): These funds simply mirror the index. They have very low fees and are a passive, low-effort way to capture the overall market’s growth. A fantastic starting point.

- Small-Cap Funds: Higher risk, but potentially higher return. Best for investors with a very high-risk appetite and a long horizon. Your ₹2000 SIP can be a great way to dabble in this space without overexposing yourself.

2. For Medium-Term Goals (5-10 years): Hybrid or Debt SIPs

If you’re saving for a car, a down payment, or a child’s education in a decade, you may want to de-risk a bit.

- Aggressive Hybrid Funds: Invest roughly 65-80% in equity and the rest in debt. Offers a balance of growth and stability.

- ELSS (Equity Linked Savings Scheme): A category of equity funds that comes with a tax deduction under Section 80C. The lock-in period of 3 years enforces discipline. A great two-in-one product for tax saving and wealth creation.

3. For Short-Term Goals (<5 years): Avoid Equity SIPs

For goals less than 5 years away, the market’s short-term volatility is too risky. Opt for Debt Funds, FDs, or RDs instead.

Table 2: Which SIP Type is Right for Your ₹2000?

| Goal | Time Horizon | Recommended Fund Type | Risk Profile |

|---|---|---|---|

| Retirement | 20+ years | Flexi-Cap / Index Fund | Very High |

| Child’s Education | 15 years | Flexi-Cap / Multi-Cap | High |

| Down Payment for House | 8-10 years | Aggressive Hybrid Fund | Moderate |

| World Tour | 5-7 years | Conservative Hybrid Fund | Low to Moderate |

| Tax Saving (with growth) | 3 years (lock-in) | ELSS Fund | High |

Real Stories, Real Wealth: Case Studies of ₹2000 SIPs

Let’s move from theory to practice. Here are two fictional but highly realistic scenarios based on actual market performance.

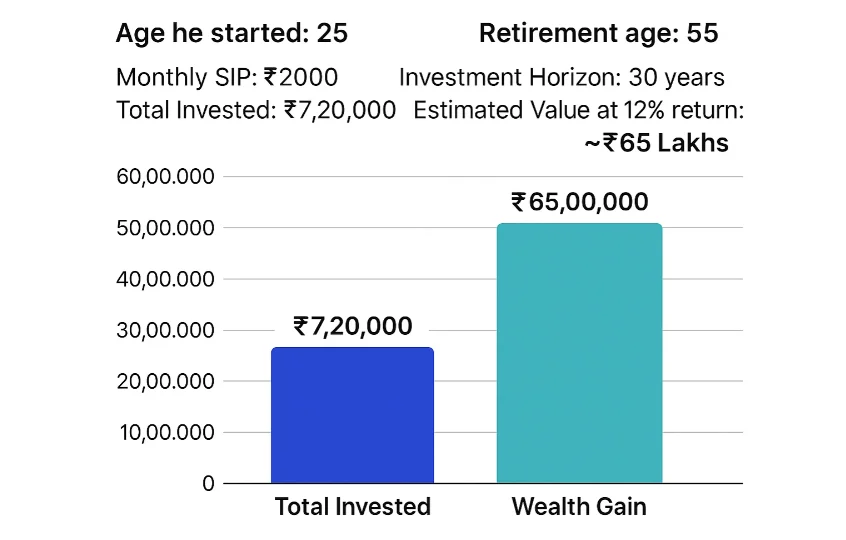

Case Study 1: The Early Bird (Rohan, started at age 25)

Rohan landed his first job at 25. He knew nothing about the market but started a ₹2000 monthly SIP in a Nifty 50 Index Fund. He never stopped, never wavered. He simply set up the auto-debit and forgot about it, focusing on his career.

- Age he started: 25

- Retirement age: 55

- Monthly SIP: ₹2000

- Investment Horizon: 30 years

- Total Invested: ₹7,20,000

- Estimated Value at 12% return: ~₹65 Lakhs

- Lesson: Time is the most potent ingredient in the wealth recipe. Starting early is half the battle won.

Case Study 2: The Determined Parent (Priya, started at age 35)

Priya had her first child at 35. Feeling the pressure of future expenses, she started a ₹2000 SIP in a Flexi-Cap fund specifically for her daughter’s higher education, aiming for a 20-year horizon.

- Age she started: 35

- Goal Age (Child turns 18): 53

- Monthly SIP: ₹2000

- Investment Horizon: 18 years

- Total Invested: ₹4,32,000

- Estimated Value at 12% return: ~₹13.5 Lakhs

- Lesson: It’s never too late to start. Even with a later beginning, a disciplined SIP can build a significant corpus for crucial life goals.

Beyond the Numbers: The Behavioral Superpower of a ₹2000 SIP

The greatest benefit of a small SIP might not be financial—it’s psychological.

- It Builds Discipline: Automating investing makes it a habit, not an afterthought.

- It Reduces Fear: Investing a small amount feels less scary than committing a large lump sum, especially when markets are jittery.

- It Keeps You Invested: You’re less likely to panic-sell during a downturn when you’re only in for a small, regular amount. You learn to ride the waves.

Expert Quote:

Ms. Kalpen Parekh, MD & CEO of DSP Mutual Fund, aptly says, “The biggest return in SIP is not on capital, but on behavior. It teaches you patience, discipline and the power of staying invested. A small SIP of ₹2000 is the best tuition fee the market can charge to teach you these invaluable lessons.”

Your Action Plan: How to Start Your ₹2000 SIP Today

Stop planning. Start doing. Here’s your 5-step guide to launching your wealth journey this very week.

- Define Your Goal: Is this for retirement? A dream vacation? Just general wealth? Naming your goal makes you more likely to stick to the plan.

- Choose Your Platform (App): Use a user-friendly mutual fund platform like Groww, Zerodha Coin, Kuvera, or ET Money. They make KYC and investing seamless.

- Complete Your KYC: You’ll need your PAN, Aadhaar, and a bank account. The apps guide you through this video-based process in minutes.

- Select Your Fund: Based on your goal and horizon, pick one fund to start with. As a beginner, an Index Fund or a large-cap fund is a safe, solid bet. Don’t overcomplicate it.

- Set Up Auto-Debit: Link your bank account and mandate a monthly auto-debit of ₹2000. Set it and forget it.

Frequently Asked Questions

Q1: Is investing ₹2000 per month in SIP really enough to build significant wealth?

A: Absolutely. As the math above shows, the key is not the amount but the consistency and the time horizon. The power of compounding does the heavy lifting. A ₹2000 SIP started early can easily grow into a corpus of tens of lakhs, even crossing a crore over 25-30 years.

Q2: What is the best mutual fund for a ₹2000 SIP?

A: There is no single “best” fund for everyone. The best fund depends on your goal and risk tolerance. For most beginners looking for a hands-off approach, a Nifty 50 Index Fund is a highly recommended, low-cost, and effective starting point for a long-term SIP.

Q3: Can I start a SIP with just ₹2000? Or do I need more?

A: Yes, you can absolutely start with ₹2000. In fact, many mutual funds have minimum SIP amounts as low as ₹100 or ₹500. ₹2000 is a perfect and very common entry point. You can always increase the amount later as your income grows.

Q4: What are the risks involved in a SIP?

A: Since SIPs often invest in equity mutual funds, they are subject to market risks. The value of your investment can go up and down in the short term. However, the strategy of rupee-cost averaging and a long investment horizon significantly mitigates this risk. It’s not risk-free, but it is risk-managed.

Q5: When should I stop my SIP?

A: The ideal time to stop a SIP is when you need the money for the goal you invested for. Unless there is a fundamental change in the fund’s strategy or performance, or a drastic change in your own financial situation, you should continue your SIP through market cycles. Stopping a SIP during a market crash is the worst thing you can do, as you lose the chance to buy units at lower prices.

Conclusion: Your Fortune Awaits, One ₹2000 Step at a Time

We began with a question of doubt: “Will it ever be enough?” Now you have the answer. The path to financial freedom isn’t hidden behind a complex secret. It’s built on a foundation of simple, disciplined steps. Your ₹2000 monthly SIP is more than an investment; it’s a vote of confidence in your future self. It’s a commitment to a dream that is 100% achievable.

The market will have good years and bad years. There will be headlines that scare you and ones that excite you. Your job is not to react to them. Your job is to stay the course. Let your SIP run like clockwork, month after month, year after year.

Don’t let the simplicity of this strategy fool you. Underestimate it, and you underestimate your own potential.

Expert Quote:

Mr. Arun Kumar, Vice President & Head of Research at FundsIndia, concludes, “In the pursuit of wealth, consistency trumps brilliance. A ₹2000 SIP, faithfully executed over decades, will almost always outperform a larger but erratic investment strategy. It is the ultimate proof that in investing, slow and steady doesn’t just win the race—it builds an empire.”

Your Call to Action: Start Today. Thank Yourself in 2030.

Open a new tab right now. Search for “Groww” or “Zerodha Coin”. Begin your KYC. Before this week ends, make sure your first ₹2000 SIP is set up and running. Your future self will look back at this single decision as the moment everything changed.

Leave a Reply