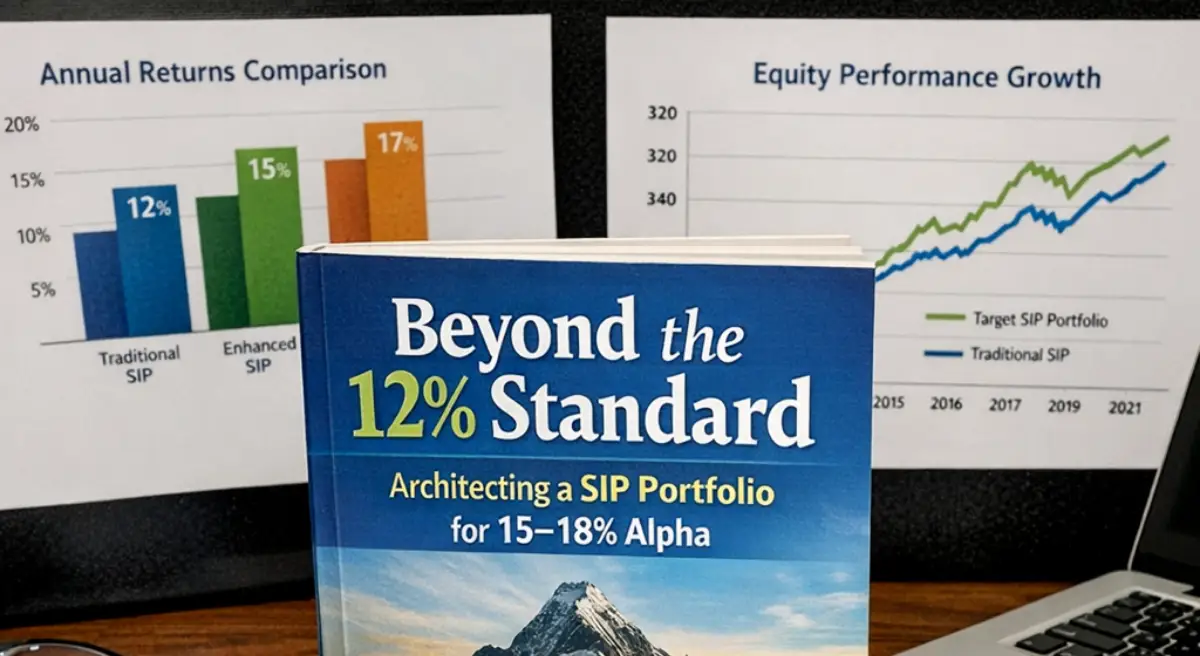

The traditional investment playbook is undergoing a silent, high-stakes crisis. I’ve sat across from countless professionals in 2025 who are just now realizing that the 8% Fixed Deposit or the 12% Large-Cap SIP—once the gold standard—simply won’t bridge the gap to their 2035 goals. In an era of shifting inflation and rising aspirations, what was once a “safe” return has become a strategic shortfall. Achieving a 15–18% CAGR is no longer just an ambitious goal for the aggressive; for anyone seeking true financial autonomy in India’s evolved economy, it has become a tactical necessity.

Historically, the Nifty 50 TRI has delivered between 12.1% and 14.0% over 15 to 20 years. While respectable, “playing it safe” with only blue-chip indices now carries the hidden risk of underfunding your future. I’ve watched this market expansion first-hand; in 2017, the country’s leader had a market cap of 5.5 lakh crore, but by 2025, that figure surged to 17 lakh crore. This tells us the alpha floor has moved. The real excess returns now reside in segments where growth isn’t just steady, but explosive. To capture this, we have to look past the comfort of the Top 100.

Decoding the 15–18% Target: Asset Classes That Move the Needle

To hit a consistent 18% CAGR, you cannot rely on the mature giants alone. “Selection Alpha” is a mathematical game of positioning yourself in segments where earnings expansion happens at a faster clip. We look at the “Triangle of Capitalization”: Large Caps (Top 100), Mid Caps (101–250), and Small Caps (251+).

One common psychological trap is thinking small caps are still “small.” They aren’t. Today, the 500th company in the index has a market cap of approximately ₹11,000 Cr ($1.5 Billion). These are stable, mid-sized businesses, not fragile startups.

| Index Name | 15-Year CAGR (%) | 20-Year CAGR (%) |

| Nifty 50 TRI (Large Cap) | 12.1% | 14.0% |

| Nifty Midcap 150 TRI | 16.3% | 16.9% |

| Nifty Smallcap 250 TRI | 13.9% | 15.3% |

Index data as of July 31, 2025.

But here is the catch: while the indices are your foundation, identifying the “titan” funds that consistently crush these benchmarks is how we bridge the gap from 15% to 18%.

The Small-Cap Powerhouse: A Deep Dive into High-Octane Growth

Small caps are the nursery of India’s future industrial giants, offering sector exposure that the Nifty 50 completely ignores. If you want a stake in India’s Realty or Chemicals boom, you won’t find it in the Top 50. The Nifty Smallcap 250 features 15 Chemical companies and 4 Realty firms, providing the diversification and “multibagger” potential required for high-alpha portfolios.

When we architect this layer, two distinct philosophies dominate the landscape: Nippon India Small Cap Fund and Quant Small Cap Fund.

The Battle of Styles

| Parameter | Nippon India Small Cap (The Goliath) | Quant Small Cap (The Technician) |

| AUM (Cr) | ₹68,287 | ₹30,170 |

| 10Y CAGR | 21.29% | 20.04% |

| 5Y CAGR | 28.08% | 30.79% |

| Expense Ratio | 0.64% | 0.70% |

| Sharpe Ratio | 1.09 | 0.95 |

| Portfolio Concentration | 212 Stocks (Diversified) | 94 Stocks (Concentrated) |

If you look deeper at the numbers, Nippon India Small Cap Fund uses its massive scale to provide resilience. By holding over 200 stocks, it manages liquidity risks and provides a “sturdier” return profile, evidenced by its higher Sharpe Ratio of 1.09. On the other hand, Quant Small Cap Fund is a technician’s dream. It uses data-driven quantitative models and derivatives to hunt for extreme alpha. While it delivered a staggering 30.79% over the 5-year cycle, its higher Beta of 0.81 means you must have the stomach for more aggressive price swings.

The Mid-Cap Anchor: Balancing Consistency with Explosive Momentum

Mid-cap companies (ranked 101–250) are the “Sweet Spot” of the Indian economy. They have matured past the fragility of small-cap status but haven’t yet hit the growth ceiling of the blue-chip giants.

For a 10-year journey, two funds stand out as primary candidates for the 15–18% bracket:

- Edelweiss Mid Cap Fund: Delivers a 20.38% 10Y CAGR. With an AUM of ₹13,650 Cr, it remains nimble enough for aggressive stock picking.

- HDFC Mid Cap Fund: Boasts a 19.76% 10Y CAGR.

There is an important lesson here regarding “AUM Drag.” While HDFC Mid Cap Fund is a powerhouse, its massive AUM of ₹92,641 Cr can sometimes act as a weight on alpha in certain market cycles. Edelweiss Mid Cap Fund, being smaller, often has the flexibility to move in and out of high-conviction positions more effectively. Both, however, rely on a bottom-up selection of quality management that has proven its ability to survive the 2020 and 2024 volatilities.

The Expert’s Factor Model: How to Filter for 2026 and Beyond

Strategic advice means looking past last year’s winners. I use a 5-factor screening process to find funds that aren’t just lucky, but skillful:

- Up-to-Down Capture Ratio: The goal is to capture 90% of the upside but only 70% of the downside. Falling less is the secret to compounding faster.

- Rolling Returns (3Y/5Y): Point-to-point returns are a trap. We look at averages across various entry points to ensure the fund delivers regardless of when you start.

- Volatility Score: This measures the “emotional churn.” If a fund’s volatility is too high, most investors will panic and exit before the compounding works its magic.

- Sharpe Ratio: Evaluating returns per unit of risk.

- Benchmark Beating Consistency: Consistently outperforming the Nifty 500 or category index.

Pro-Tip: You might notice funds like Bandhan Small Cap Fund missing from 3-year rolling return leaderboards. This is a tactical vs. strategic distinction. A fund needs a 6-year operational threshold for these rolling metrics to be statistically significant. While Bandhan Small Cap Fund shows strong 1-year momentum, seasoned leads often wait for that 6-year mark before making it a core strategic anchor.

Risk Management & The “Survivor’s” Strategy

Achieving 18% returns has a psychological cost. The fear of a “Negative Return” is what keeps most investors in the 12% slow lane. However, if we look at the historical Rolling Returns of the Nifty Smallcap 250 Index, we see a “Zero-Risk Horizon”:

- 3-Year Hold: 18% chance of negative returns.

- 5-Year Hold: 8% chance.

- 7-Year+ Hold: 0% chance of negative returns.

Essentially, time is your ultimate hedge. Furthermore, the 2024 Union Budget increased LTCG to 12.5% and STCG to 20%. Because the government is taking a larger slice, generating that 3–5% alpha over the Nifty 50 is now the only way to maintain the net purchasing power you’ll need by 2035.

Strategic FAQs: Clearing the Behavioral Blind Spots

Is it too late to enter Small-caps given the high valuations? Valuations are at a premium to historical averages, but remember: small caps are the engine of a developing economy. I advise avoiding large lumpsum entries now; use SIPs to average out your cost over the next 12–18 months.

SIP vs. Lumpsum: Which is safer for a 10-year horizon? For volatile segments like Mid and Small caps, SIPs are mathematically superior. They prevent you from accidentally entering at a singular “valuation peak” and provide the discipline to buy more when the market is on sale.

Should I exit if the market drops 20% next month? I’ve navigated many 20% drops. They are temporary. Historical data shows they are “clearance sales” for the disciplined. If your horizon is 7+ years, a drop next month is noise, not a signal.

What is the role of Gold/Debt in a 15–18% equity-heavy portfolio? They are your shock absorbers. Aggressive Hybrid Funds, which hold about 25% in debt/gold, have delivered 11–14% returns. They won’t give you the 18% alpha, but they provide the emotional stability to stay invested in your equity funds when the market turns red.

From Curiosity to Compounding

Achieving 15–18% isn’t a matter of luck; it’s the result of disciplined architecture. It requires combining the explosive growth of Small-cap nurseries like Nippon India Small Cap Fund or Quant Small Cap Fund with the steady, nimble anchors of Mid-cap leaders like Edelweiss Mid Cap Fund.

Wealth is built by those who have the patience to survive the 7-year volatility cycle. Audit your current portfolio against the Factor Model today. If you are still lingering in the “comfort zone” of Large Caps and FDs, you aren’t just playing it safe—you are risking your future financial freedom. The journey to high-alpha compounding starts with the first SIP and the resolve to stay the course.

Leave a Reply