Introduction

In the fast-paced world of tech giants, Google stands tall as a shining example of innovation, adaptability, and consistent growth. Beyond its status as a search engine powerhouse, Google’s foray into various industries has made its stock a subject of great interest to investors. In this comprehensive article, we’ll delve even deeper into the world of Google stock. We’ll explore its historical performance, the core elements that drive its value, the competition it faces, and the key factors influencing its growth prospects. By the end, you’ll have a well-rounded understanding of Google’s stock, and why it remains a compelling investment option.

1. The Rise of Google

Let’s begin by taking a closer look at Google’s fascinating journey from a small garage-based startup to a global tech conglomerate. The story of Google is not just a tale of success but an inspiration for many aspiring entrepreneurs.

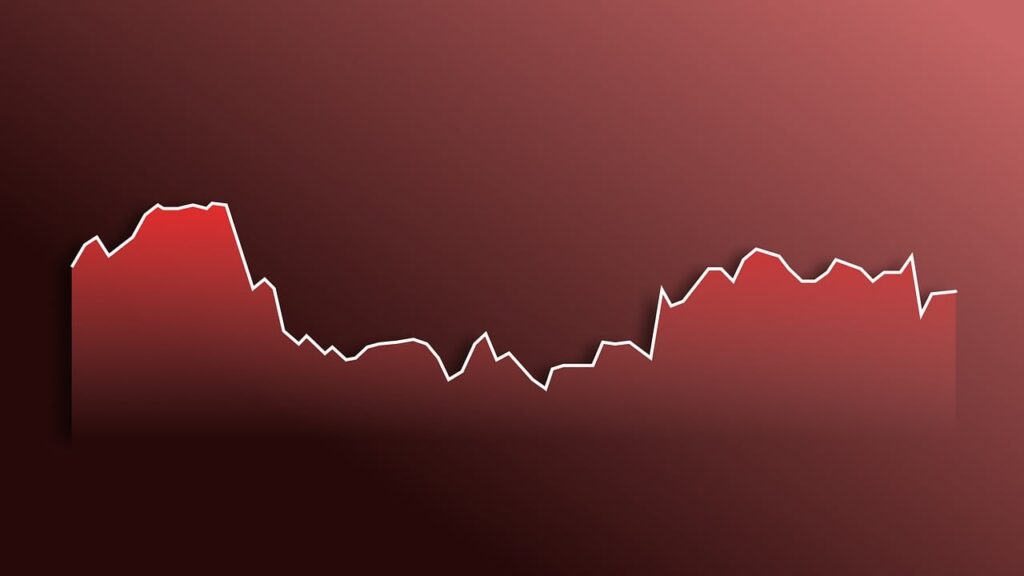

2. Historical Stock Performance

A fundamental aspect of understanding Google’s stock is to analyze its historical performance. We’ll explore the ups and downs it has encountered over the years, and what lessons we can draw from its past.

Table of Contents

The Tech Behind the Empire

3. Google’s Core Business

At the heart of Google’s success lies its search engine. We’ll delve into how this core business continues to drive the company’s revenue and influence its stock value.

4. Alphabet Inc.: The Parent Company

Google operates under the umbrella of Alphabet Inc. We’ll examine the conglomerate structure, its subsidiaries, and how this impacts Google’s stock.

Key Factors Affecting Google’s Stock

5. Advertising Revenue

One of Google’s primary sources of income is advertising. We’ll uncover how the company’s advertising model affects its stock value and its sustainability.

6. Competition in the Tech Industry

The tech industry is highly competitive, with giants vying for dominance. We’ll dissect the ever-intensifying competition and how it impacts Google’s stock.

7. Google Cloud

The cloud computing sector is a significant contributor to Google’s growth. We’ll explore the potential of Google Cloud in boosting Google’s stock performance.

8. Expansion into Other Ventures

Beyond search and cloud computing, Google has ventured into various industries. We’ll take a closer look at these ventures and their potential impact on Google’s stock.

The Impact of Regulatory Changes

9. Privacy Concerns

Privacy concerns have been in the limelight recently. We’ll delve into how increased scrutiny on data privacy affects Google’s stock and what the company is doing to address these concerns.

10. Antitrust Concerns

Government actions and antitrust concerns can have significant implications for Google’s stock. We’ll explore these challenges and how Google is responding to them.

Google’s Response to Challenges

11. Innovation and Adaptation

One of Google’s key strengths is its ability to innovate and adapt. We’ll discuss how Google addresses challenges and stays ahead of the curve.

12. Sustainability Efforts

Sustainability is a growing concern globally. Google is committed to environmental sustainability. We’ll see how these efforts impact investor sentiment and potentially contribute to stock performance.

Investment Opportunities

13. Investing in Google Stock

What makes Google stock an appealing investment? We’ll explore the reasons that make it an attractive option for investors.

14. Diversification and Risk Management

Diversifying your investment portfolio is crucial. We’ll discuss how Google stock can be a valuable addition and how it helps in risk management.

15. Long-term Prospects

While short-term gains are enticing, we’ll also discuss the long-term prospects of investing in Google stock and why it’s a strategic choice.

Conclusion

In conclusion, Google’s stock performance is a testament to its adaptability and resilience in the dynamic tech landscape. With a strong core business, expansion into new ventures, and a commitment to addressing challenges proactively, Google remains an enticing investment choice for those looking to navigate the world of tech stocks.

FAQs

1. Is Google stock a safe long-term investment?

Yes, Google stock is generally considered a safe long-term investment due to its consistent growth and diversified business model.

2. How does competition impact Google’s stock performance?

Competition can put pressure on Google’s stock performance, but the company’s innovative approach often mitigates these challenges.

3. What are the key factors to watch when investing in Google stock?

When investing in Google stock, it’s essential to monitor advertising revenue, regulatory changes, and the company’s expansion efforts.

4. How does Google address privacy concerns?

Google is actively working on enhancing user data privacy to navigate regulatory challenges and maintain stock value.

5. Can Google’s sustainability efforts impact its stock performance?

Efforts toward sustainability can positively influence investor sentiment and contribute to stock performance, aligning with environmental and ethical concerns.

Exploring the Potential of Google Stock

Google stock is not just about investing in a company; it’s about investing in the future of technology and innovation. As you consider your investment options, remember that Google’s journey is far from over, and its stock remains a beacon of opportunity in the vast ocean of tech stocks. Stay informed, stay curio

Unlocking the Potential of Google Stock

In the ever-evolving world of finance, Google Stock has consistently been a symbol of excellence and innovation. This article aims to delve deep into the dynamics of Google Stock, offering a comprehensive analysis that will provide valuable insights for both seasoned investors and those who are just embarking on their financial journey.

The History of Google Stock

Google, now a subsidiary of Alphabet Inc., has come a long way since its inception. The journey of Google Stock began in August 2004 when the company went public, marking a significant milestone in the tech industry. Over the years, Google Stock has grown to become one of the most sought-after investments in the market.

Key Financial Indicators

1. Stock Price Trends

One of the primary factors that attract investors to Google Stock is its impressive price trends. The stock has consistently demonstrated an upward trajectory, making it a lucrative option for those looking to grow their investments. Its performance has been a testament to the company’s resilience and its ability to adapt to changing market conditions.

2. Market Capitalization

Google’s market capitalization is nothing short of remarkable. With a substantial market cap, Google Stock offers investors a stable and secure opportunity to park their funds. This is particularly appealing to institutional investors and those who seek long-term growth prospects.

3. Earnings Per Share (EPS)

Earnings Per Share is a critical indicator of a company’s profitability. Google Stock boasts a healthy EPS, which demonstrates the company’s consistent ability to generate revenue and distribute profits to its shareholders. This is a significant factor that attracts investors seeking steady income streams.

The Google Ecosystem

1. Google Search

Google Search is the cornerstone of the company’s success. As the world’s leading search engine, it generates vast amounts of revenue through advertising. This robust revenue stream significantly contributes to the strength of Google Stock.

2. Advertising Revenue

Google’s advertising platform is a powerhouse. The company’s ability to target ads effectively and provide businesses with a high return on investment has translated into impressive advertising revenue. This, in turn, bolsters the value of Google Stock.

3. Alphabet Inc. Portfolio

Alphabet Inc., Google’s parent company, is a conglomerate of various businesses, including Waymo, Google Cloud, and Verily. These subsidiary companies contribute to the diversification of Google Stock, making it a compelling investment choice for those looking for exposure to multiple sectors.

Google Stock and Technological Advancements

1. Innovations in Artificial Intelligence

Google has consistently been at the forefront of technological advancements, particularly in the field of artificial intelligence. Their investments in AI research and development have not only led to groundbreaking products but have also positively impacted Google Stock’s performance.

2. Cloud Computing Dominance

Google Cloud is a major player in the cloud computing industry. The company’s expanding footprint in this sector is indicative of their commitment to diversification. Investors looking for exposure to the cloud computing market can find it through Google Stock.

Risks and Considerations

While Google Stock offers a multitude of advantages, it’s important to acknowledge the potential risks. Factors such as regulatory challenges, competition, and economic downturns can affect the stock’s performance. However, Google’s track record of overcoming such hurdles provides investors with a level of confidence

us, and explore the world of Google stock. It might just be your ticket to a tech-savvy investment future.

Exploring the Google Stock Phenomenon

In the fast-paced world of investments, Google stock has stood the test of time as a shining star, consistently outperforming many other options in the market. In this article, we’ll delve into the intricacies of Google stock, exploring its history, performance, and what sets it apart from the rest. By the end of this comprehensive guide, you’ll have a better understanding of Google stock and why it remains an attractive investment opportunity.

The Beginnings of Google Stock

Google, founded by Larry Page and Sergey Brin in 1998, has become a household name, synonymous with internet search and innovation. The company made its debut on the stock market in 2004 with an initial public offering (IPO) that was nothing short of groundbreaking. Google’s stock ticker symbol, “GOOGL,” became a familiar sight to investors and financial enthusiasts around the world.

A History of Impressive Performance

Google stock has a track record of impressive performance that has made it a standout choice for investors. Over the years, it has consistently shown significant growth and resilience in the face of economic challenges. Let’s take a closer look at some of the key factors that contribute to this remarkable performance.

1. Market Dominance

Google’s dominance in the search engine industry is unparalleled. With over 92% of the global search engine market share, it continues to be the go-to choice for people seeking information online. This dominance translates into consistent revenue and profitability, making Google stock a reliable choice for investors.

2. Diverse Revenue Streams

Beyond search, Google has diversified its revenue streams. The company’s products and services, such as Google Ads, Google Cloud, and YouTube, contribute significantly to its overall earnings. This diversification provides a cushion against market fluctuations, making Google a stable investment.

3. Innovation and Acquisition

Google’s commitment to innovation and strategic acquisitions keeps it ahead of the competition. From the development of Android and Chrome to acquisitions like YouTube and Nest Labs, Google consistently adapts to the evolving tech landscape, ensuring its long-term relevance.

4. Financial Stability

A strong balance sheet and cash reserves allow Google to weather economic storms effectively. This financial stability reassures investors and provides a sense of security in an ever-changing market.

Google Stock vs. the Competition

To truly understand the appeal of Google stock, it’s essential to compare it to its competitors. Google competes with tech giants like Apple, Amazon, Facebook (now Meta), and Microsoft. Let’s examine what sets Google apart from these formidable rivals.

Google vs. Apple

Both Google and Apple are leaders in the smartphone industry with their respective operating systems, Android and iOS. However, Google’s business model, focused on advertising and cloud services, differs significantly from Apple’s hardware-centric approach. This diversity in revenue sources gives Google an edge in terms of financial stability.

Google vs. Amazon

While Amazon dominates the e-commerce sector, Google’s core business revolves around search and online advertising. However, Google’s cloud services division is a direct competitor to Amazon Web Services (AWS). This competition intensifies in the cloud computing market, where both companies strive for supremacy.

Google vs. Meta (formerly Facebook)

Google’s presence in the social media space with Google+ was short-lived, and it couldn’t rival Facebook’s influence. However, Google continues to focus on data collection and advertising, making it a direct competitor in the digital advertising space. Meta, on the other hand, is now exploring the metaverse, taking a different strategic direction.

Google vs. Microsoft

Google’s cloud services, known as Google Cloud, compete head-to-head with Microsoft’s Azure. Both companies offer a range of cloud solutions, and this competition fuels innovation and drives the growth of their respective cloud businesses.

The Future of Google Stock

As we look ahead, it’s clear that Google stock is well-positioned for continued success. The company’s commitment to innovation, diversified revenue streams, and market dominance make it a reliable choice for long-term investors. With a focus on emerging technologies, such as artificial intelligence and self-driving cars, Google remains at the forefront of technological advancement.

In conclusion, Google stock’s rich history, impressive performance, and unique position in the market make it a compelling investment option. Its ability to adapt to changing landscapes and maintain financial stability ensures that it stands out in the ever-evolving world of investments.

1 thought on “The Expanding Horizon of Google Stock”