Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Introduction

Table of Contents

PayPal Holdings, Inc. (PYPL) is a digital payments giant that has experienced significant growth in its revenue over the years. This growth has had a significant impact on the company’s stock price, which has been closely tied to its financial performance. In this blog post, we will explore the relationship between PayPal’s revenue growth and its stock price, focusing on key factors that have influenced the company’s stock performance.

Revenue Growth and Stock Performance

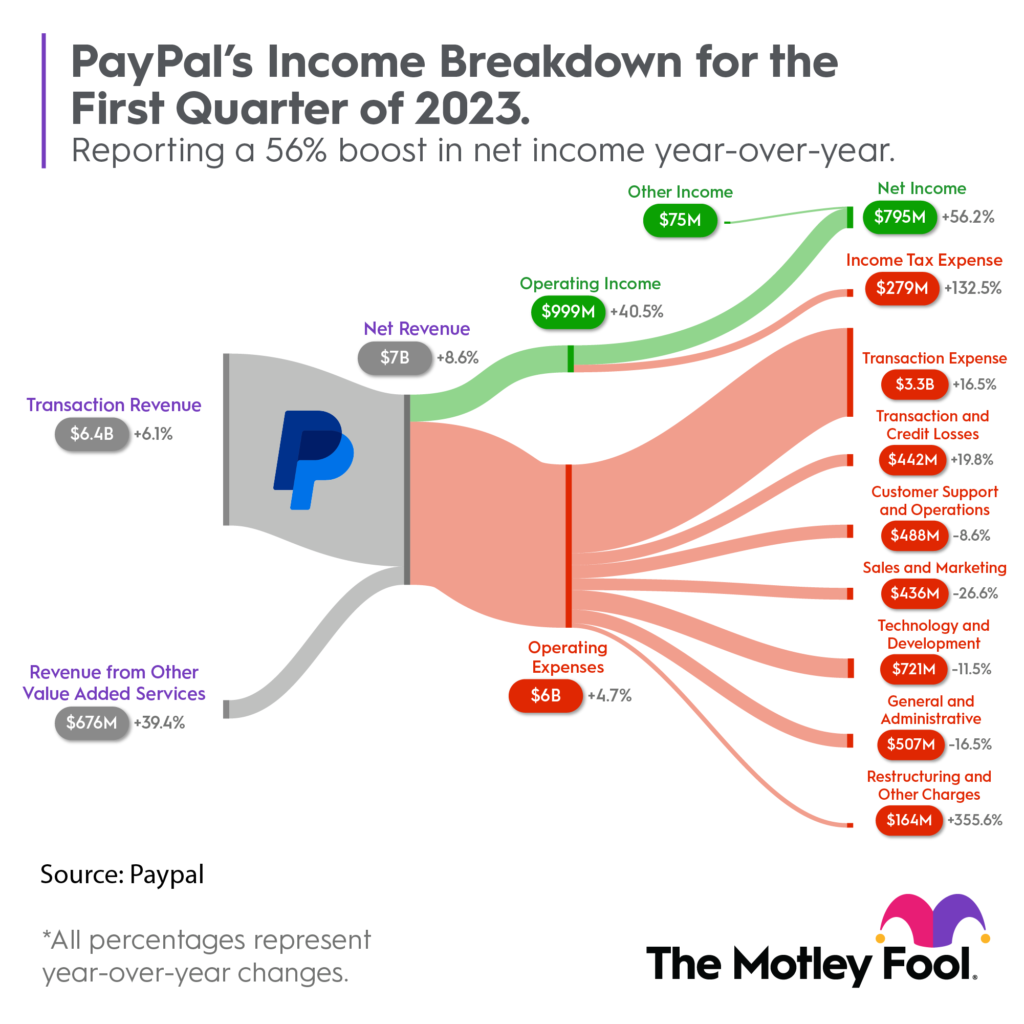

PayPal’s revenue growth has been a key factor in shaping its stock performance. From 2015 to 2022, the company’s annual revenue grew from $9.2 billion to $27.5 billion, representing a compound annual growth rate (CAGR) of 17%. This consistent revenue growth has been a major driver of the company’s stock price.

In the third quarter of 2023, PayPal’s revenue jumped 9% to $7.4 billion on an FX-neutral basis, while its total payments volume increased by 13%. This revenue growth positively impacted the company’s stock performance, as investors were encouraged by the company’s financial performance.

Factors Influencing Stock Performance

However, concerns about PayPal’s profitability and increasing competition have also influenced the company’s stock price. Despite the revenue growth, the company’s margins remained under pressure, which raised questions about its profitability. Additionally, the growth of e-commerce, which had been a major driver of PayPal’s revenue, began to decelerate. This slowdown in e-commerce growth, combined with the increasing competition in the digital payment space, led to a slowdown in the company’s stock growth.

Competition and Market Share

One of the primary reasons for PayPal’s stock decline is the increasing competition in the payments space. Analysts have cautioned that the company’s market share could face challenges from newer payment methods such as Apple Pay and buy now, pay later (BNPL) financing options. Additionally, PayPal has been lagging behind its rivals in mobile checkout services. This increased competition has led to concerns about the company’s ability to maintain its market share and grow its business.

Technical Analysis

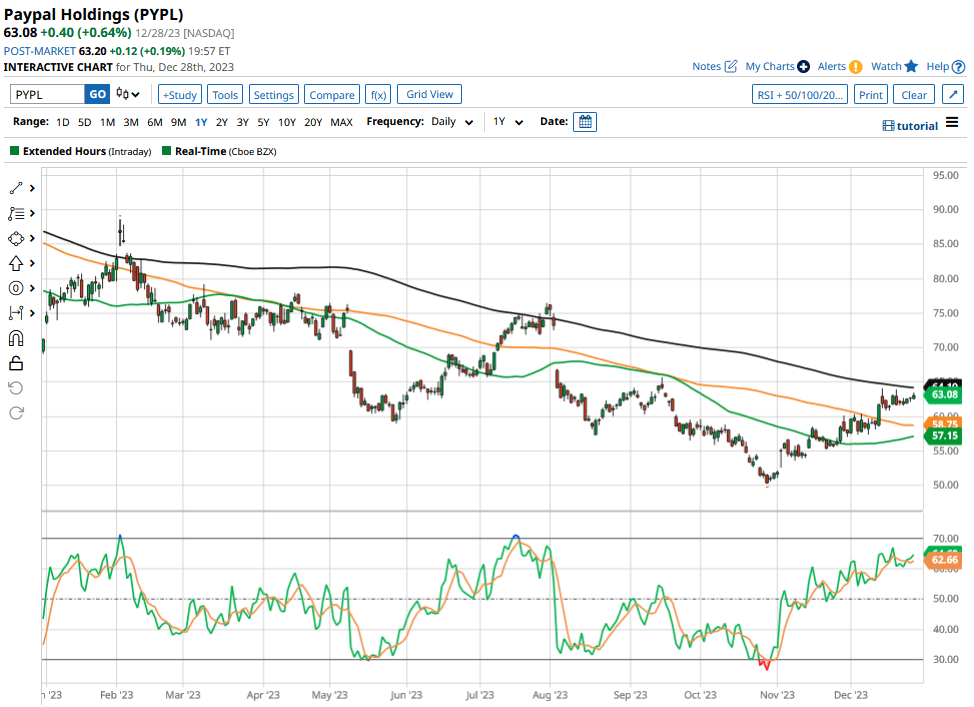

PayPal’s stock has been oscillating within an orderly descending channel over the past 12 months, which has helped establish clear support and resistance areas on the chart. The stock has failed to climb above $65, finding overhead resistance from the channel’s top trendline, which roughly aligns with the 200-day moving average. If the stock continues to fall, it may face further challenges in the short term.

Balance Sheet and Management

Despite the challenges, some analysts remain bullish on PayPal’s stock. They like the company’s balance sheet, its new management team, and its strategy. The parent of Venmo, acquired in 2013, now accounts for 30% of PayPal’s payment volume. Additionally, the company’s price-to-earnings ratio is half that of its payment rivals, making it appear dirt cheap.

Cloud Czars and Disruption

However, there are concerns about the impact of the “Cloud Czars” on the payments industry. These companies, such as Amazon, Apple, and Google, are making significant efforts to disrupt the payments space, which could pose a significant risk to PayPal’s future prospects. The company’s stock has been hit by the 2022 bear market, and it has yet to recover.

Future Prospects

In conclusion, PayPal’s stock price has been closely tied to its revenue growth. While strong revenue growth has historically been associated with positive stock performance, concerns about profitability and increasing competition have also influenced the company’s stock price. The company will need to adapt to the changing landscape and find ways to maintain its market share and grow its business. If it can successfully navigate these challenges, PayPal may be able to recover and continue its growth in the future.

Why is paypal stock down

PayPal’s stock has experienced a significant decline due to several factors, including increasing competition in the payments space, concerns about the company’s market share, and challenges related to profitability and revenue growth. The stock dropped 11% in October 2023 and has been down 27% year to date after falling 63% in 2022[2]. Analysts have cautioned that the company’s market share could face challenges from newer payment methods such as Apple Pay and buy now, pay later (BNPL) financing options[4]. Additionally, concerns about the company’s profitability, slowing revenue growth, and a decline in active accounts have contributed to the stock’s decline. The impact of “Cloud Czars” such as Amazon, Apple, and Google, who are disrupting the payments industry, has also been a concern for the company’s future prospects[3]. Technical factors, such as the stock’s performance within a descending channel and challenges in surpassing key resistance levels, have further contributed to the stock’s decline[4]. Overall, a combination of competitive pressures, concerns about profitability, and technical factors has led to the decline in PayPal’s stock.

Frequently Asked Questions

- Why has PayPal’s stock price declined?

- PayPal’s stock has experienced a significant decline due to several factors, including increasing competition in the payments space, concerns about the company’s market share, and challenges related to profitability and revenue growth.

- The stock dropped 11% in October 2023 and has been down 27% year to date after falling 63% in 2022.

- Analysts have cautioned that the company’s market share could face challenges from newer payment methods such as Apple Pay and buy now, pay later (BNPL) financing options.

- Concerns about the company’s profitability, slowing revenue growth, and a decline in active accounts have also contributed to the stock’s decline.

- The impact of “Cloud Czars” such as Amazon, Apple, and Google, who are disrupting the payments industry, has also been a concern for the company’s future prospects.

- Technical factors, such as the stock’s performance within a descending channel and challenges in surpassing key resistance levels, have further contributed to the stock’s decline.

- What is the current state of PayPal’s stock?

- As of January 23, 2024, PayPal’s stock is down 27% year to date and has been trading within a descending channel.

- The stock has failed to climb above $65, finding overhead resistance from the channel’s top trendline, which roughly aligns with the 200-day moving average.

- What are the potential future prospects for PayPal?

- The company will need to adapt to the changing landscape and find ways to maintain its market share and grow its business.

- If it can successfully navigate these challenges, PayPal may be able to recover and continue its growth in the future.

- What is the impact of “Cloud Czars” on the payments industry?

- Companies such as Amazon, Apple, and Google are making significant efforts to disrupt the payments space, which could pose a significant risk to PayPal’s future prospects.

- What is the current state of PayPal’s revenue growth?

- In the third quarter of 2023, PayPal’s revenue jumped 9% to $7.4 billion on an FX-neutral basis, while its total payments volume increased by 13%.

- Despite the revenue growth, the company’s margins remained under pressure, raising questions about its profitability.

Conclusion

PayPal’s stock has experienced a significant decline due to several factors, including increasing competition in the payments space, concerns about the company’s market share, and challenges related to profitability and revenue growth. Despite these challenges, some analysts remain bullish on PayPal’s stock, citing the company’s balance sheet, new management team, and strategy. However, the impact of “Cloud Czars” such as Amazon, Apple, and Google, who are disrupting the payments industry, has also been a concern for the company’s future prospects. The company will need to adapt to the changing landscape and find ways to maintain its market share and grow its business. If it can successfully navigate these challenges, PayPal may be able to recover and continue its growth in the future. As with any investment, investors should carefully consider the risks and potential rewards before making any investment decisions.