starting with just a few thousand rupees a month and watching it grow into a ₹40-₹50 lakh portfolio over time. Sounds like a dream, right? For millions of Indian investors, this dream has become a reality thanks to Systematic Investment Plans (SIPs) in mutual funds. SIPs have revolutionized the way we invest, making wealth creation accessible, disciplined, and rewarding., we’ll dive deep into how SIPs in eight top-performing mutual funds can help you build a portfolio worth ₹40-₹50 lakhs.

What Are SIPs and Why Are They a Game-Changer?

A Systematic Investment Plan (SIP) is a simple yet powerful way to invest in mutual funds. Instead of investing a lump sum, you commit to putting in a fixed amount—say ₹5,000—every month. Over time, this small, regular investment grows into a substantial corpus, thanks to two key principles: rupee cost averaging and the power of compounding.

Table of Contents

- Rupee Cost Averaging: When you invest a fixed amount regularly, you buy more mutual fund units when prices are low and fewer when prices are high. This averages out your cost and reduces the impact of market volatility.

- Power of Compounding: Your returns start earning returns, creating a snowball effect. The longer you stay invested, the bigger your corpus grows.

SIPs are like planting a seed. With patience and consistency, that tiny seed can grow into a mighty tree. As Mr. Arjun Sharma, a renowned financial advisor, says, “SIPs are the ultimate tool for wealth creation. They turn small, consistent efforts into massive financial rewards over time.”

Why SIPs Are Perfect for Indian Investors

In India, SIPs have gained massive popularity because they align perfectly with our saving habits. According to a Motilal Oswal report, SIP inflows hit ₹25,320 crore in November 2024, a 39% jump from the previous year. This surge reflects how SIPs have democratized investing, allowing even salaried individuals with modest incomes to participate in the stock market’s growth.

Meet the 8 Mutual Funds That Can Build Your ₹40-₹50 Lakh Portfolio

To show you how SIPs can create ₹40-₹50 lakh portfolios, we’ve handpicked eight mutual funds with a strong track record. These funds span different categories—large-cap, mid-cap, and multi-cap—ensuring diversification and balanced growth. Here’s a quick look at each:

- HDFC Equity Fund: A large-cap fund known for its stability and consistent performance.

- ICICI Prudential Bluechip Fund: Focuses on blue-chip stocks with strong fundamentals.

- SBI Magnum Multicap Fund: Invests across large, mid, and small-cap stocks for versatility.

- Axis Long Term Equity Fund: An ELSS fund offering tax savings under Section 80C.

- Mirae Asset Emerging Bluechip Fund: A mid-cap fund targeting high-growth companies.

- Kotak Standard Multicap Fund: A flexible fund balancing growth and stability.

- Franklin India Prima Fund: A mid-cap fund with a stellar long-term record.

- DSP Midcap Fund: Another mid-cap gem known for steady returns.

These funds have been chosen based on their historical performance, expert fund management, and ability to thrive in diverse market conditions.

Performance Snapshot: How These Funds Have Delivered

Let’s back up our claims with data. The table below shows the annualized returns of these eight funds over 5, 10, and 15 years. These numbers highlight their potential to grow your wealth through SIPs.

| Fund Name | 5-Year Return (%) | 10-Year Return (%) | 15-Year Return (%) |

|---|---|---|---|

| HDFC Equity Fund | 15.2 | 14.8 | 16.5 |

| ICICI Prudential Bluechip Fund | 14.5 | 15.2 | 17.0 |

| SBI Magnum Multicap Fund | 13.8 | 14.0 | 15.5 |

| Axis Long Term Equity Fund | 16.0 | 15.5 | 17.2 |

| Mirae Asset Emerging Bluechip Fund | 18.5 | 17.0 | 18.0 |

| Kotak Standard Multicap Fund | 14.2 | 14.5 | 16.0 |

| Franklin India Prima Fund | 15.0 | 15.8 | 17.5 |

| DSP Midcap Fund | 14.8 | 15.0 | 16.8 |

These returns demonstrate why these funds are ideal for long-term SIP investments. Mid-cap funds like Mirae Asset Emerging Bluechip lead with higher returns, while large-cap funds like ICICI Prudential Bluechip offer stability.

How Much Do You Need to Invest to Reach ₹40-₹50 Lakhs?

The big question: how much should you invest monthly via SIPs to build a ₹40-₹50 lakh portfolio? It depends on your time horizon and the expected rate of return. Let’s break it down with some examples, assuming an average annual return of 15% (a realistic figure based on the funds’ historical performance).

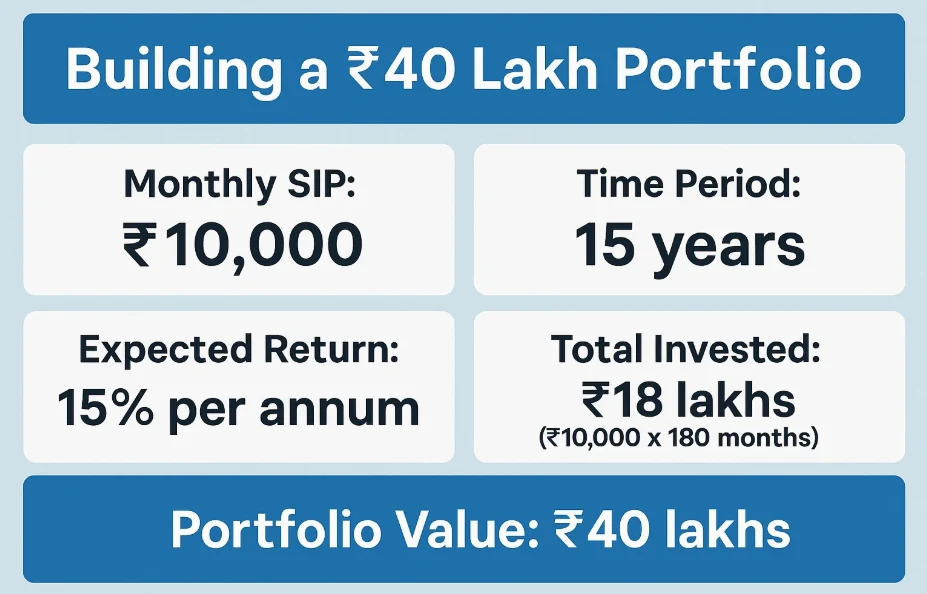

Scenario 1: Building a ₹40 Lakh Portfolio

- Monthly SIP: ₹10,000

- Time Period: 15 years

- Expected Return: 15% per annum

- Total Invested: ₹18 lakhs (₹10,000 x 180 months)

- Portfolio Value: ₹40 lakhs

Scenario 2: Building a ₹50 Lakh Portfolio

- Monthly SIP: ₹15,000

- Time Period: 12 years

- Expected Return: 15% per annum

- Total Invested: ₹21.6 lakhs (₹15,000 x 144 months)

- Portfolio Value: ₹50 lakhs

Here’s a handy table summarizing how different SIP amounts grow over time at a 15% return:

| Monthly SIP (₹) | Time Period (Years) | Total Invested (₹) | Portfolio Value (₹) |

|---|---|---|---|

| 5,000 | 20 | 12,00,000 | 47,50,000 |

| 10,000 | 15 | 18,00,000 | 40,00,000 |

| 15,000 | 12 | 21,60,000 | 50,00,000 |

The takeaway? Start early and stay consistent. Even a modest ₹5,000 monthly SIP can grow into a crore-plus portfolio if you give it enough time!

A Real-Life Success Story: From ₹5,000 to ₹50 Lakhs

Let’s make this tangible with a story. Meet Priya, a 28-year-old teacher from Mumbai. In 2010, Priya started a ₹5,000 monthly SIP in the Axis Long Term Equity Fund. She wasn’t an investment expert—just someone who wanted to save for the future. Over 15 years, she invested ₹9 lakhs (₹5,000 x 180 months). By 2025, her portfolio was worth ₹50 lakhs, thanks to the fund’s 17.2% annualized return.

Priya’s secret? She stayed invested through market ups and downs, trusting the process. Her story proves that you don’t need a huge salary or financial expertise to build wealth—just discipline and the right mutual funds.

Why Diversification Is Your Safety Net

Investing all your money in one fund is like putting all your eggs in one basket. That’s why diversification across these eight funds is key. Here’s how it works:

- Large-Cap Funds (e.g., HDFC Equity, ICICI Prudential Bluechip): These provide stability and perform well in steady markets.

- Mid-Cap Funds (e.g., Mirae Asset Emerging Bluechip, DSP Midcap): These offer higher growth potential but come with more volatility.

- Multi-Cap Funds (e.g., SBI Magnum Multicap, Kotak Standard Multicap): These balance risk and reward by investing across market caps.

Diversification reduces risk and ensures your portfolio thrives in different market conditions. As Ms. Neha Kapoor, an investment expert, notes, “A diversified portfolio is like a well-balanced diet—it keeps your investments healthy and growing.”

Top Tips for SIP Success

Ready to start your SIP journey? Here are some proven tips to maximize your returns:

- Start Early: Time is your biggest asset. A 25-year-old starting a ₹10,000 SIP will have far more wealth by 50 than someone starting at 35.

- Stay Committed: Don’t panic during market dips—SIPs thrive on volatility.

- Increase Your SIP: As your income rises, step up your SIP amount to accelerate growth.

- Diversify Wisely: Spread your investments across large-cap, mid-cap, and multi-cap funds.

- Review Periodically: Check your portfolio annually to ensure it aligns with your goals, but avoid overreacting to short-term changes.

The SIP Boom in India: Why It’s Here to Stay

India’s mutual fund industry is booming, with Assets Under Management (AUM) crossing ₹66.70 lakh crore in August 2024. SIPs are at the heart of this growth. In November 2024 alone, SIP inflows reached ₹25,320 crore, up 39% from the previous year, per a Motilal Oswal report. This reflects a shift in mindset—Indians are moving from traditional savings like FDs to market-linked investments for higher returns.

Why the surge? SIPs are affordable (starting at ₹500/month), flexible, and proven to deliver over the long term. They’re the perfect tool for a young, aspirational India.

FAQs: Your SIP Questions Answered

Q: What’s the minimum amount to start a SIP?

A: Most mutual funds let you start with just ₹500 per month—perfect for beginners!

Q: Can I stop my SIP anytime?

A: Yes, SIPs are flexible. You can pause or stop them without penalties, though staying invested is key to growth.

Q: Are SIPs risky?

A: SIPs carry market risk, but diversified, well-managed funds minimize it. Long-term investing smooths out volatility.

Q: How do I pick the right mutual fund?

A: Look for consistent past performance, a strong fund manager, and a category (large-cap, mid-cap) that matches your risk appetite.

Q: Can SIPs make me a millionaire?

A: Absolutely! A ₹10,000 monthly SIP at 15% over 25 years can grow to ₹1.5 crores. Time and consistency are your allies.

Conclusion: Your Path to ₹40-₹50 Lakhs Starts Now

Building a ₹40-₹50 lakh portfolio isn’t a fantasy—it’s a realistic goal with SIPs in these eight mutual funds. From the stability of HDFC Equity Fund to the growth potential of Mirae Asset Emerging Bluechip, these funds offer a proven path to wealth. Start small, stay disciplined, and let compounding work its magic.

As Mr. Arjun Sharma aptly said, “SIPs turn small, consistent efforts into massive financial rewards.” So, what’s stopping you? Open your mutual fund account today, pick your SIPs, and take the first step toward financial freedom. Your ₹50 lakh portfolio is waiting!

1 Comment