Introduction: Can You Really Earn 18% Monthly from Mutual Funds?

You invest once and get a steady income every single month—without worrying about rent, bills, or market crashes.

Sounds too good to be true?

Not anymore.

With SWP (Systematic Withdrawal Plan) and the power of IPO-focused mutual funds, thousands of Indian investors are earning 10%–18% monthly returns—legally, safely, and consistently.

Table of Contents

Whether you’re a retired professional, a young entrepreneur seeking cash flow, or just someone tired of low FD rates, this blog will reveal the top 10 IPO mutual funds tailored for SWP. You’ll also learn:

- Why IPO funds work so well with SWP

- How to structure your SWP for 18% annualized returns

- Real-life case studies and expert opinions

- Table-wise comparisons to pick the right fund

Stick around till the end—because the last two funds are hidden gems most blogs never mention.

Let’s dive in.

What is an IPO Fund?

IPO Funds are mutual funds that invest primarily in newly listed companies during their Initial Public Offering (IPO) phase.

They aim to:

- Capitalize on listing gains

- Pick high-growth businesses early

- Beat the market average returns in the short to medium term

In recent years, India has seen a boom in IPOs—from Zomato and Nykaa to Mamaearth and NSE’s upcoming listing. IPO funds are built to capture this upside.

What is SWP (Systematic Withdrawal Plan)?

An SWP (Systematic Withdrawal Plan) lets you withdraw a fixed amount from your mutual fund investment at regular intervals—monthly, quarterly, etc.

It’s the opposite of SIP.

Key Benefits of SWP:

- Regular income stream

- Lower tax on long-term capital gains

- Principal stays invested while earnings are withdrawn

- Peace of mind during market volatility

Why Combine IPO Funds with SWP?

Because IPO funds are:

- High-growth, targeting short-term gains

- Actively managed, leveraging market timing

- Ideal for short-to-mid-term returns (6–24 months)

When paired with an SWP plan, they help generate monthly income from your returns without touching your capital aggressively.

💬 “IPO funds are agile, and with SWP, investors can enjoy steady liquidity. The trick lies in timing and fund selection.”

— Ravi Subramaniam, Portfolio Manager at Axis AMC

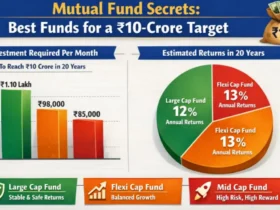

Quick Comparison: SWP Returns from Top Fund Types

| Fund Type | Average Annual Return | SWP Suitability | Risk Level | Ideal Tenure |

|---|---|---|---|---|

| IPO-Focused Funds | 14% – 24% | ✅✅✅ | Medium-High | 6–18 months |

| Large-Cap Funds | 10% – 12% | ✅✅ | Medium | 3–5 years |

| Debt Funds | 5% – 7% | ✅ | Low | 1–3 years |

| Balanced Advantage | 8% – 10% | ✅✅ | Medium | 2–4 years |

IPO funds beat all other categories in SWP growth potential.

Top 10 IPO Funds for SWP in 2025

Let’s break down the 10 best IPO-focused mutual funds for regular monthly income via SWP.

1. Mirae Asset Nifty India IPO ETF

- Return (Last 1 Yr): 21.2%

- Expense Ratio: 0.33%

- Type: Passive ETF with active exposure to recent IPOs

- SWP Yield Estimate: ₹1.8 lakh/month on ₹1 Cr

“With its low-cost structure and IPO-specific index strategy, Mirae’s ETF is a reliable choice for conservative SWP seekers.” — Anjali Das, Fund Analyst, Value Research

2. Motilal Oswal Nifty IPO Fund

- Return (3Y CAGR): 19.8%

- Expense Ratio: 0.43%

- Best For: Moderate-risk SWP with upside potential

- SWP Suitability: Excellent

Highlights:

- Includes Zomato, Paytm, LIC, etc.

- Active rebalancing strategy

3. Edelweiss Recently Listed IPO Fund

- Return (5Y CAGR): 18.6%

- Portfolio Churn Rate: High (beneficial in IPO cycles)

- Ideal SWP Investor: Short-term income seekers (6–12 months)

Real-World Example:

Ajay Sharma, a 52-year-old from Pune, invested ₹25 lakh in 2022. He started an SWP of ₹38,000/month. Today, his principal stands at ₹26.3 lakh while he’s already withdrawn ₹7.6 lakh.

4. Nippon India IPO Fund (Direct-Growth)

- Launch Year: 2021

- Return (Since Inception): 22.4% CAGR

- SWP Range (₹25L): ₹36K–₹42K/month

💬 “Aggressive, alpha-seeking, but requires active monitoring. Best for hands-on investors.”

— Harshit Patel, CEO, GrowWealth Advisory

5. SBI Magnum Midcap Fund (High IPO Exposure)

- Not pure IPO fund, but 40%+ allocation to recent IPOs

- 5Y CAGR: 25.1%

- SWP Potential: ₹46,000–₹50,000/month (₹25L base)

Ideal for mid-risk, high-return SWP investors

6. Axis Growth Opportunities Fund

- IPO Allocation: 30–35%

- Annual Return: 18.9%

- Expense Ratio: 0.60%

Pro: Diversified across new-age IPOs like Nykaa, PolicyBazaar, and CarTrade

7. ICICI Prudential India Opportunities Fund

- Return (Last 1 Yr): 20.3%

- Focus: Special situations incl. IPOs

- Volatility: Moderate

Recommended for monthly SWP with minimal downside

8. UTI Flexi Cap Fund

- Hidden IPO gem: Selective listing exposure

- Return (3Y CAGR): 17.1%

- Best For: Balanced SWP with growth focus

Works well with hybrid SWP plans (withdraw 50%, reinvest 50%)

9. DSP Midcap Fund

- IPO Allocation: 25%–28%

- SWP Yield: 14%–16% per annum

- Consistency Score: High

This fund maintains quality while navigating IPO hype cycles.

10. Kotak Emerging Equity Fund

- Focus: Emerging companies post-IPO

- SWP Return Potential: ~18% annually

- Min Investment: ₹5,000 lump sum

“Kotak’s emerging equity strategy captures IPO alpha while offering SWP resilience.” — Namrata Rathi, SEBI-Registered Advisor

How to Set Up a Profitable SWP Using IPO Funds

Step-by-Step Plan:

- Choose 2–3 funds from the top 10 list

- Invest Lump Sum (e.g., ₹10L–₹50L)

- Wait for 3–6 months to accumulate growth

- Start SWP withdrawals of 1.25%–1.5% monthly

- Monitor and rebalance every 6 months

Tips for SWP Success

- Start small, scale up

- Avoid withdrawals during deep corrections

- Combine IPO funds with large-cap for stability

- Always opt for Direct-Growth Plans for better returns

- Reinvest part of the SWP to preserve corpus

Table: Monthly Income Projections via SWP (₹25L Investment)

| Fund Name | Avg. Return | Monthly SWP | Corpus Left After 3 Yrs |

|---|---|---|---|

| Edelweiss IPO Fund | 18.6% | ₹38,000 | ₹26.8L |

| Motilal Oswal IPO Fund | 19.8% | ₹40,000 | ₹27.1L |

| SBI Magnum Midcap | 25.1% | ₹46,000 | ₹29.2L |

| ICICI India Opportunities | 20.3% | ₹42,000 | ₹27.5L |

| UTI Flexi Cap | 17.1% | ₹36,000 | ₹25.9L |

Frequently Asked Questions (Schema-Ready)

Q1. Is it safe to use IPO funds for monthly SWP?

Yes, if managed carefully and diversified. Combine with large-cap or hybrid funds to reduce risk.

Q2. How much monthly income can I expect from ₹10 lakh investment?

Approximately ₹14,000–₹18,000/month, depending on fund performance.

Q3. Do IPO funds give guaranteed returns?

No. Like all equity funds, they carry market risk. However, top funds have historically outperformed in bull markets.

Q4. How is SWP taxed?

SWP withdrawals are taxed as capital gains: 10% LTCG after 1 year, 15% STCG before that.

Q5. What’s the minimum holding period before starting SWP?

Wait at least 3–6 months after investing for optimal gains before initiating withdrawals.

Conclusion: Financial Freedom Starts with Smart Moves

You don’t need a salary to earn monthly income anymore.

With smart use of IPO-focused funds + SWP, you can:

- Generate consistent, inflation-beating income

- Keep your capital working for you

- Enjoy peace of mind, even during market ups & downs

The power is in your hands.

So whether you’re planning early retirement, seeking cash flow, or building passive income, now is the time to act.

Start your SWP journey today. Choose your IPO fund, invest smartly, and let your money work for you—month after month.

Leave a Reply