Introduction: “How I Discovered the True Power of Passive Income Through Dividends”

A few years ago, I found myself staring at my bank statement after yet another exhausting work month. Despite working 50+ hours weekly, I barely made ends meet. That night, I stumbled upon a video about dividend investing — regular people earning money while they sleep. That curiosity sparked a journey that changed my life.

Table of Contents

What if your money could work for you 24/7 — without selling anything, clocking in, or taking risks like day trading?

That’s exactly what a dividend portfolio does: it creates a steady, growing stream of passive income. But building one isn’t just about picking random high-yield stocks. It’s a strategy, a mindset, and a commitment to long-term wealth.

What Is a Dividend Portfolio?

A dividend portfolio is a collection of income-generating stocks, ETFs, or funds that regularly pay out a portion of their earnings to shareholders. These payments, called dividends, can be quarterly, monthly, or annually.

Why Focus on Dividends?

- Reliable Income Stream

- Lower Volatility than Growth Stocks

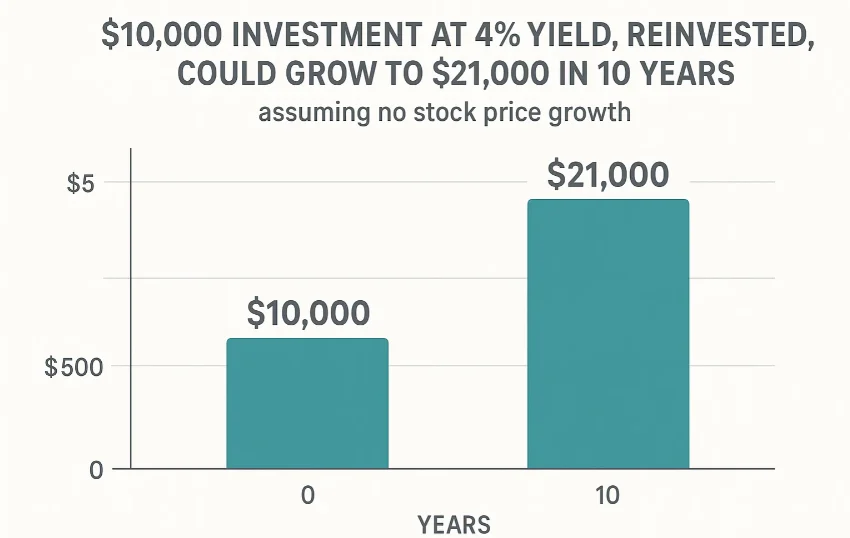

- Compounding Power via Reinvestment

- Tax Advantages (in some jurisdictions)

1. Start With Dividend Aristocrats

Dividend Aristocrats are companies in the S&P 500 that have increased their dividends for 25+ consecutive years.

Why Start Here?

- Proven track record of stability

- Strong fundamentals

- Shareholder-friendly policies

Examples:

| Company | Years of Dividend Growth | Current Yield |

|---|---|---|

| Coca-Cola (KO) | 61 years | 3.1% |

| Johnson & Johnson (JNJ) | 62 years | 2.9% |

| Procter & Gamble (PG) | 68 years | 2.6% |

Pro Tip: These are core holdings to build around. Don’t expect sky-high returns, but count on consistency.

2. Use the Dividend Yield + Dividend Growth Formula

Don’t chase yield blindly. A 9% yield may look tempting, but is it sustainable?

The Sweet Spot Formula:

Dividend Yield + Dividend Growth Rate ≥ 8%

Example Table:

| Stock | Yield (%) | Growth Rate (%) | Total Return Potential (%) |

|---|---|---|---|

| PepsiCo | 2.8 | 6.2 | 9.0 |

| Realty Income | 5.2 | 2.9 | 8.1 |

| Verizon | 6.5 | 0.8 | 7.3 |

3. Diversify Across Sectors

One of the most common beginner mistakes? Overloading on a single sector like REITs or utilities.

Recommended Sector Allocation (Example Table):

| Sector | % Allocation |

|---|---|

| Consumer Staples | 20% |

| Healthcare | 15% |

| Utilities | 15% |

| Financials | 15% |

| REITs | 15% |

| Industrials | 10% |

| Tech (Div-Paying) | 10% |

sector diversification, dividend diversification, income spread

4. Use Dividend Reinvestment Plans (DRIPs)

DRIPs allow you to automatically reinvest dividends to buy more shares.

Benefits:

- Compound faster

- Dollar-cost averaging

- No emotional decision-making

Real-Life Example:

Sanjay, a 33-year-old investor from Pune, started investing in ITC and HDFC Bank using DRIPs in 2017. With just ₹5000/month, his portfolio now generates over ₹22,000/year in passive income, and his original investment has doubled.

5. Screen for Dividend Safety Using Payout Ratio

The payout ratio is the percentage of earnings paid as dividends. A high payout ratio means the dividend may be at risk during downturns.

General Rule of Thumb:

- Below 60% for most sectors

- Below 80% for REITs and Utilities

Expert Insight:

“Look for companies with a low payout ratio and a history of earnings stability. It’s the best way to ensure your dividends won’t vanish in a recession.” — Rohit Mehra, Equity Strategist at Axis Securities

6. Include High-Quality REITs for Monthly Income

Real Estate Investment Trusts (REITs) are legally required to pay 90% of income as dividends.

Popular Monthly REITs:

- Realty Income (O)

- STAG Industrial (STAG)

- LTC Properties (LTC)

Tip: Choose REITs with low debt, diverse tenant base, and consistent FFO growth.

7. Use ETFs to Access Global Dividend Opportunities

Don’t want to pick individual stocks? ETFs offer easy access.

Best Dividend ETFs:

| ETF Name | Yield | Expense Ratio | Region |

|---|---|---|---|

| Vanguard Dividend Appreciation (VIG) | 2.1% | 0.06% | US |

| Schwab Int’l Div Equity (SCHY) | 4.2% | 0.14% | International |

| iShares Select Dividend (DVY) | 3.8% | 0.39% | US |

8. Review and Rebalance Every 6 Months

Dividend investing is not set-and-forget. Sectors change. Companies cut dividends.

Checklist:

- Recheck payout ratios

- Watch earnings reports

- Reinvest gains in undervalued sectors

Quote:

“A semi-annual portfolio health check keeps your income flowing and future secure.” — Meenal Jain, CFA, NISM Faculty

9. Focus on Tax-Efficient Accounts (If Available)

Depending on your country, consider holding dividend payers in tax-advantaged accounts like:

- Roth IRA / PPF / EPF (India)

- NPS / 401(k)

- TFSA (Canada)

This helps you maximize your net returns.

10. Set a Monthly Passive Income Goal & Automate

Finally, make it personal.

Step-by-Step:

- Decide your income goal (e.g., ₹50,000/month)

- Use average dividend yield (say, 4%)

- Calculate portfolio size needed: ₹50,000 x 12 / 0.04 = ₹15 lakh

- Automate SIPs or regular contributions

Motivational Insight:

“Every rupee invested is a seed. Plant enough of them, and you’ll grow a money tree that feeds you forever.” — Ankur Warikoo, Entrepreneur & Investor

Final Thoughts: The Quiet Power of Dividend Freedom

Passive income from dividends doesn’t happen overnight, but every step you take today builds a future where your money earns while you rest. Whether it’s your first stock or your 50th, the key is to start — and stay consistent.

Remember:

- Stick to high-quality dividend stocks

- Reinvest consistently

- Review and adjust

Your financial freedom isn’t a dream. It’s a plan. And it starts now.

FAQs: Dividend Portfolio Building

1. How much money do I need to start a dividend portfolio?

You can start with as little as ₹500. Use fractional shares or mutual funds to begin.

2. Are dividend stocks safe?

Dividend stocks from well-established companies tend to be more stable, but nothing is 100% safe. Always diversify.

3. Should I go for high dividend yield stocks?

Not always. Check if the yield is sustainable. A 10% yield may indicate underlying issues.

4. How often will I receive dividends?

Most companies pay quarterly. Some REITs and ETFs pay monthly.

5. What are DRIPs and should I use them?

Dividend Reinvestment Plans (DRIPs) automatically reinvest your dividends. Yes, they help compound your growth.

Explore dividend-friendly stocks and ETFs today and begin your journey toward financial independence.

Leave a Reply