Waking up one day with a ₹2 crore portfolio—a financial milestone that offers security, freedom, and the ability to chase your dreams. Sounds like a fantasy? It doesn’t have to be. With the right equity funds, a disciplined approach, and a sprinkle of patience, this dream can become your reality. we’re diving deep into the top 7 equity funds that can help you build a ₹2 crore portfolio over time. Whether you’re a newbie investor or a seasoned pro, this guide is packed with insights, actionable tips, and expert advice to supercharge your investment journey.

Table of Contents

What Are Equity Funds?

Before we jump into the good stuff, let’s get the basics down. Equity funds are mutual funds that pool money from investors like you and me to buy stocks in companies. Managed by expert fund managers, these funds aim for capital appreciation—aka growing your money over time. They’re a fantastic option if you’re looking to build wealth, but they do come with some volatility. Think of them as a rollercoaster: thrilling highs, occasional dips, but a rewarding ride if you stay on long enough.

Why Equity Funds Are Perfect for a ₹2 Crore Goal

- High Returns: Over the long term, equity funds often outpace fixed deposits, bonds, and even inflation.

- Expert Management: No need to pick stocks yourself—fund managers do the heavy lifting.

- Diversification: Your money spreads across multiple companies and sectors, reducing risk.

- Flexibility: Start small with SIPs (Systematic Investment Plans) and scale up as you go.

The catch? You’ll need a long-term mindset—think 7-10 years or more—to smooth out market ups and downs. Ready to see which funds can get you to ₹2 crore? Let’s roll!

How Much Do You Need to Invest?

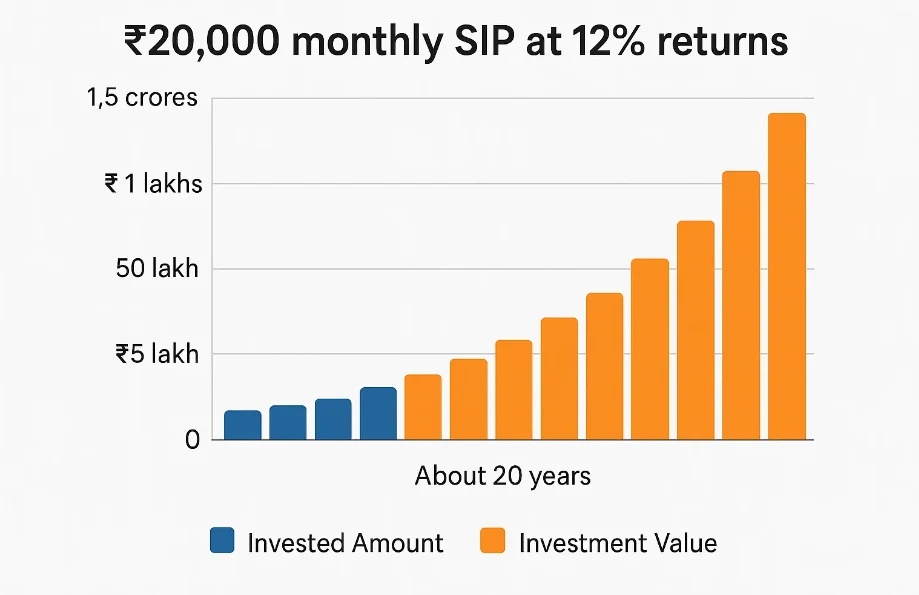

Building a ₹2 crore portfolio sounds daunting, but it’s all about starting smart. Let’s crunch some numbers:

- Assumption: An average annual return of 12% (a reasonable estimate for equity funds in India).

- Monthly SIP: ₹20,000.

- Time Frame: 20 years.

With compounding magic, that ₹20,000 monthly SIP could grow to ₹2 crore in two decades. Want it faster? Bump up your investment or aim for funds with higher returns (and higher risk). We’ll explore both options as we dig into the top 7 funds.

Top 7 Equity Funds to Build Your ₹2 Crore Portfolio

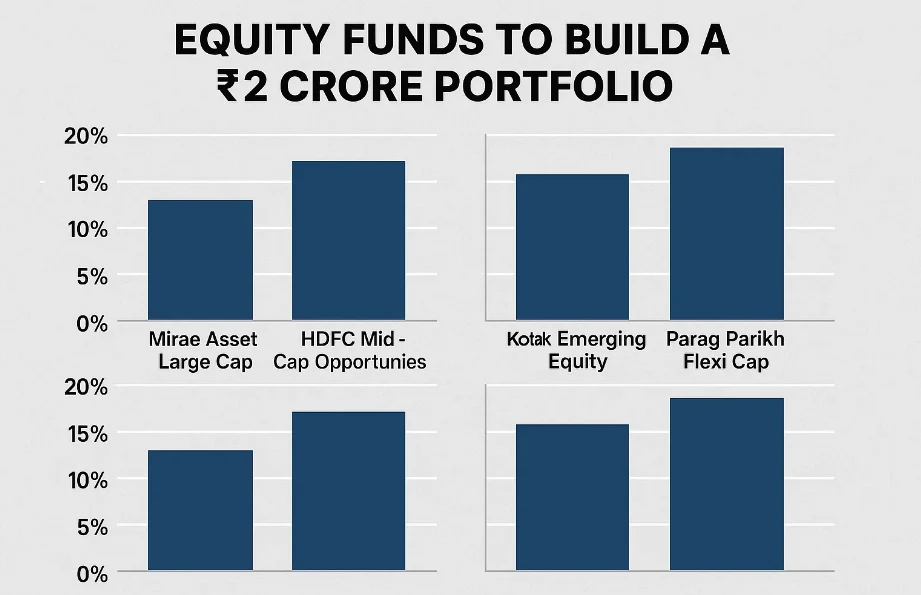

After scouring performance data, fund manager reputations, and investor reviews, here are the top 7 equity funds that stand out for long-term wealth creation. These picks blend stability, growth, and proven track records—perfect for your ₹2 crore mission.

1. HDFC Equity Fund

The HDFC Equity Fund is a large-cap superstar that’s all about steady growth. It invests in big, established companies, making it a solid pick for cautious investors with big goals.

- Investment Objective: Long-term capital appreciation

- Portfolio: Mostly large-cap stocks

- 10-Year Average Return: 15%

- Expense Ratio: 1.5%

- Risk Level: Moderate

Fund Manager Quote:

“We focus on high-quality companies with strong fundamentals and hold them for the long haul. Consistency is our strength.” — Prashant Jain, HDFC Equity Fund Manager

2. ICICI Prudential Bluechip Fund

Love stability with a side of growth? The ICICI Prudential Bluechip Fund targets blue-chip stocks—think industry giants that weather storms and deliver returns.

- Investment Objective: Long-term capital appreciation

- Portfolio: Blue-chip companies

- 10-Year Average Return: 14%

- Expense Ratio: 1.6%

- Risk Level: Moderate

Fund Manager Quote:

“Investing in leaders with competitive edges keeps risks low and returns steady.” — Sankaran Naren, ICICI Prudential Bluechip Fund Manager

3. SBI Bluechip Fund

The SBI Bluechip Fund is another large-cap gem, balancing growth and reliability. It’s perfect if you want a fund that’s been around the block and still shines.

- Investment Objective: Long-term capital appreciation

- Portfolio: Large-cap stocks

- 10-Year Average Return: 13%

- Expense Ratio: 1.7%

- Risk Level: Moderate

Fund Manager Quote:

“We hunt for growth potential and stick with it. Patience pays off.” — Anup Upadhyay, SBI Bluechip Fund Manager

4. Mirae Asset Large Cap Fund

The Mirae Asset Large Cap Fund is a top performer that’s hard to ignore. With stellar returns and a focus on large-cap stocks, it’s a favorite for growth-focused investors.

- Investment Objective: Long-term capital appreciation

- Portfolio: Large-cap stocks

- 10-Year Average Return: 16%

- Expense Ratio: 1.5%

- Risk Level: Moderate

Fund Manager Quote:

“Strong fundamentals and proven performance—that’s our recipe for success.” — Neelesh Surana, Mirae Asset Large Cap Fund Manager

5. Axis Bluechip Fund

The Axis Bluechip Fund zeroes in on blue-chip companies with high growth potential. It’s a sleek, modern option for investors aiming for the top.

- Investment Objective: Long-term capital appreciation

- Portfolio: Blue-chip companies

- 10-Year Average Return: 15%

- Expense Ratio: 1.6%

- Risk Level: Moderate

Fund Manager Quote:

“Growth potential drives us. We pick winners and hold tight.” — Shreyash Devalkar, Axis Bluechip Fund Manager

6. Kotak Standard Multicap Fund

Want a bit more spice? The Kotak Standard Multicap Fund mixes large-cap, mid-cap, and small-cap stocks for higher growth potential (and a tad more risk).

- Investment Objective: Long-term capital appreciation

- Portfolio: Large-cap, mid-cap, small-cap stocks

- 10-Year Average Return: 14%

- Expense Ratio: 1.5%

- Risk Level: High

Fund Manager Quote:

“We chase opportunities across market caps to maximize growth.” — Harsha Upadhyaya, Kotak Standard Multicap Fund Manager

7. Aditya Birla Sun Life Frontline Equity Fund

The Aditya Birla Sun Life Frontline Equity Fund is a large-cap stalwart with a knack for consistency. It’s ideal for those who value reliability.

- Investment Objective: Long-term capital appreciation

- Portfolio: Large-cap stocks

- 10-Year Average Return: 13%

- Expense Ratio: 1.7%

- Risk Level: Moderate

Fund Manager Quote:

“Strong fundamentals and long-term holding—that’s how we build value.” — Mahesh Patil, Aditya Birla Sun Life Frontline Equity Fund Manager

Comparison Table: Top 7 Equity Funds

Here’s a quick snapshot to compare these funds side-by-side:

| Fund Name | Portfolio Composition | 10-Year Avg. Return | Expense Ratio | Risk Level |

|---|---|---|---|---|

| HDFC Equity Fund | Large-cap stocks | 15% | 1.5% | Moderate |

| ICICI Prudential Bluechip Fund | Blue-chip companies | 14% | 1.6% | Moderate |

| SBI Bluechip Fund | Large-cap stocks | 13% | 1.7% | Moderate |

| Mirae Asset Large Cap Fund | Large-cap stocks | 16% | 1.5% | Moderate |

| Axis Bluechip Fund | Blue-chip companies | 15% | 1.6% | Moderate |

| Kotak Standard Multicap Fund | Large, mid, small-cap stocks | 14% | 1.5% | High |

| Aditya Birla Sun Life Frontline Equity Fund | Large-cap stocks | 13% | 1.7% | Moderate |

How to Pick the Right Equity Fund

With seven stellar options, how do you choose? Here’s your checklist:

- Risk Appetite: Prefer safety? Go large-cap (e.g., Mirae Asset). Okay with volatility? Try multi-cap (e.g., Kotak).

- Time Horizon: Got 10+ years? Any of these work. Shorter term? Stick to moderate-risk funds.

- Past Performance: Check 5- and 10-year returns, but don’t obsess—focus on consistency.

- Costs: Lower expense ratios (below 2%) keep more money in your pocket.

- Fund Manager: A seasoned manager can steer the ship through rough waters.

Building Your ₹2 Crore Portfolio: A Step-by-Step Plan

Ready to turn theory into action? Here’s how to build that ₹2 crore portfolio:

1. Define Your Target

Set a clear goal: ₹2 crore. Pick a timeline—say, 15 years.

2. Calculate Your SIP

For ₹2 crore in 15 years at 12% returns, you’d need about ₹30,000 monthly. Use an online SIP calculator to tweak this based on your budget.

3. Diversify Smartly

Split your investments:

- 40% in Mirae Asset Large Cap Fund (high returns, moderate risk)

- 30% in ICICI Prudential Bluechip Fund (stability)

- 20% in Kotak Standard Multicap Fund (growth boost)

- 10% in HDFC Equity Fund (consistency)

4. Automate with SIPs

Set up monthly SIPs. It’s hands-off, disciplined, and leverages rupee cost averaging.

5. Review Annually

Check your funds’ performance yearly. Swap underperformers if needed, but don’t overreact to short-term dips.

Tips to Maximize Your Returns

- Start Early: Even ₹5,000 monthly at age 25 can grow massive by 45.

- Increase SIPs: Boost investments as your income rises.

- Stay Calm: Markets dip. Don’t panic-sell—ride it out.

- Reinvest Dividends: Let your gains compound.

Mistakes to Avoid

- Chasing Hot Funds: Last year’s winner might flop this year. Focus on long-term trends.

- Timing the Market: It’s a fool’s game. Invest regularly instead.

- Overloading on One Fund: Diversify to spread risk.

- Ignoring Fees: High expense ratios erode gains.

Conclusion

Building a ₹2 crore portfolio isn’t a pipe dream—it’s a plan. The top 7 equity funds we’ve covered—HDFC Equity Fund, ICICI Prudential Bluechip Fund, SBI Bluechip Fund, Mirae Asset Large Cap Fund, Axis Bluechip Fund, Kotak Standard Multicap Fund, and Aditya Birla Sun Life Frontline Equity Fund—are your stepping stones. Each offers a unique blend of growth, stability, and expert management to fuel your journey.

Investing in equity funds takes guts and patience, but the rewards are worth it. Do your homework, consult a financial advisor if needed, and start today. Your ₹2 crore future is waiting—go grab it!

FAQs

Q: What are equity funds?

A: Equity funds are mutual funds that invest mostly in stocks, aiming for capital growth over time.

Q: How long does it take to build a ₹2 crore portfolio?

A: With a ₹20,000 monthly SIP at 12% returns, about 20 years. Increase your SIP or returns to shorten the timeline.

Q: Are equity funds risky?

A: Yes, they’re tied to stock market ups and downs. But over 7-10 years, risks often balance out with higher returns.

Q: Can I start with a small amount?

A: Absolutely! Many funds allow SIPs as low as ₹500. Start small, then scale up.

Q: Which fund is best for beginners?

A: Try large-cap funds like Mirae Asset Large Cap Fund or ICICI Prudential Bluechip Fund—they’re less volatile and beginner-friendly.

Leave a Reply