Introduction

In this section, we will introduce the concept of price action patterns and their significance in trading. We will highlight how price action patterns allow traders to read the market and make informed decisions based on the observed patterns.

Table of Contents

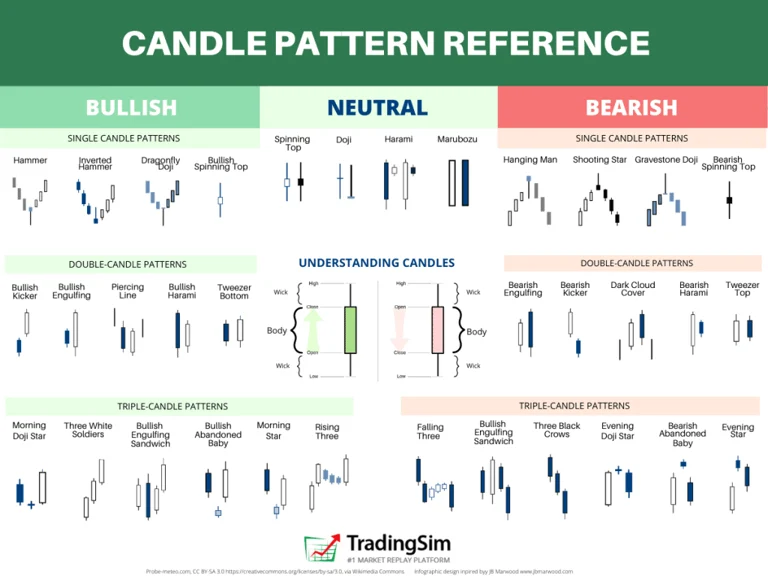

Basics of Price Action Patterns

Here, we will delve into the fundamental concepts of price action patterns, including support and resistance, trend lines, and candlestick patterns. We will provide clear examples and explanations to help readers understand these concepts.

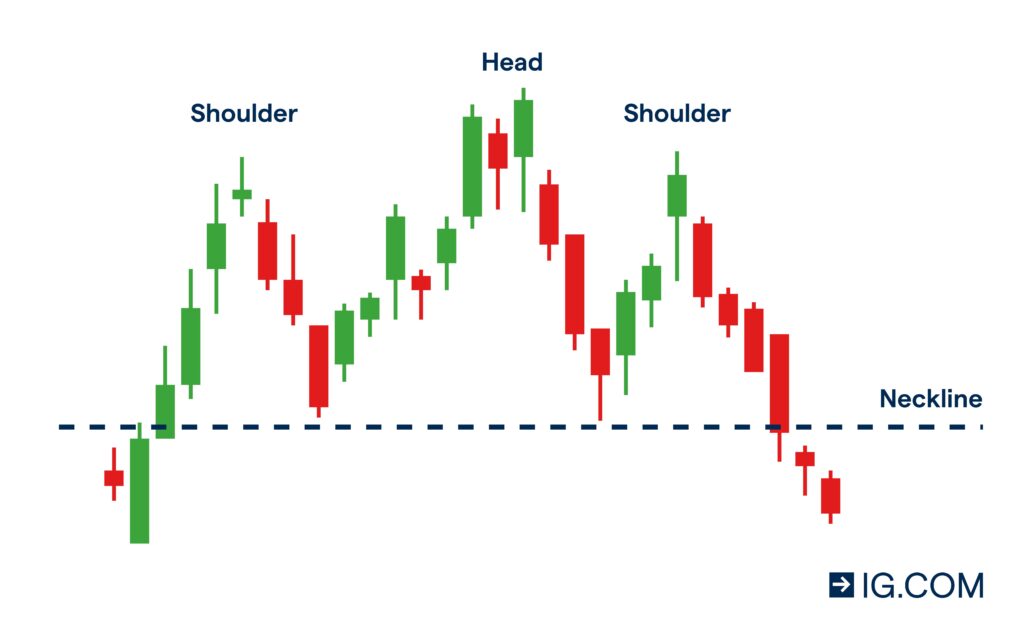

Popular Price Action Patterns

This section will discuss some of the most widely observed price action patterns, such as head and shoulders, double top and double bottom, triangles, and flags. For each pattern, we will explain how it is formed, its potential implications, and how traders can use it to anticipate market movements.

Significance in Trading

We will highlight the significance of recognizing price action patterns in trading, discussing how these patterns can help in identifying potential entry and exit points, setting price targets, and managing risk. Real-world examples of how these patterns have played out in the markets will be included.

Tips for Trading Price Action Patterns

Practical tips for traders who want to incorporate price action patterns into their strategies will be provided in this section. This can include advice on combining multiple patterns, using other technical indicators for confirmation, and the importance of risk management.

what is the difference between price action and technical analysis

The difference between price action and technical analysis lies in their focus, complexity, and use of tools. Price action analysis primarily relies on the observation of price patterns and levels, focusing on understanding basic price movements and patterns. On the other hand, technical analysis incorporates a broader range of technical indicators and oscillators, making it more complex due to the multitude of tools used. Price action analysis can be more subjective, relying on a trader’s interpretation of patterns and levels, while technical analysis is more objective, incorporating computerized systems and mathematical analysis[1].

Price action is solely based on using past price movements to provide information about market trends, while technical analysis involves the use of charts, indicators, and other technical tools to analyze the market. Price action is the movement of an asset’s price on a chart, focusing on actual price movements and patterns without necessarily relying on specific tools, while technical analysis includes a wider range of tools and methods beyond just price movements[2].

Price action is the movement of a security’s price plotted over time and forms the basis for all technical analyses of a stock, commodity, or other asset charts. Many short-term traders rely exclusively on price action and the formations and trends extrapolated. Technical analysis, on the other hand, is a derivative of price action since it uses past prices in calculations that can then be used to inform trading decisions[5].

In summary, price action analysis is a simpler and more intuitive approach that focuses on understanding basic price movements and patterns, while technical analysis is a more complex and objective approach that incorporates a broader range of technical indicators and tools to analyze the market. Both approaches have their advocates and detractors, and the debate over which method is more effective is a long-standing one in the world of trading[1].

Conclusion

In the conclusion, we will summarize the key points discussed in the article and emphasize the value of understanding price action patterns in the context of trading. We will encourage readers to continue learning and practicing to enhance their ability to spot these patterns in the market.

By following this outline and delving into each section with detailed explanations and relevant examples, the article will provide a comprehensive understanding of price action patterns and their relevance in trading.

To add an FAQ section to the article about price action patterns, you can include common questions that traders might have about this topic. Here’s a sample FAQ section that you can incorporate into the article:

Frequently Asked Questions

Q: What are price action patterns?

A: Price action patterns are formations or movements in the price of a security that can be visually identified on a price chart. These patterns are used by traders to analyze and predict future price movements based on historical data.

Q: Why are price action patterns important in trading?

A: Price action patterns are important in trading as they provide valuable insights into market sentiment and potential future price movements. By understanding these patterns, traders can make more informed decisions about when to enter or exit a trade.

Q: How can I effectively use price action patterns in my trading strategy?

A: To effectively use price action patterns, it’s essential to combine them with other technical analysis tools and indicators to confirm signals. Additionally, risk management and trade timing are crucial when incorporating these patterns into a trading strategy.

Q: Are price action patterns suitable for all types of trading instruments?

A: Price action patterns can be applied to various trading instruments, including stocks, forex, commodities, and cryptocurrencies. However, it’s important to consider the specific characteristics of each market when analyzing price action patterns.

Q: Do price action patterns guarantee successful trades?

A: No, price action patterns do not guarantee successful trades. While they can provide valuable insights, trading always involves risk, and it’s essential to combine price action analysis with other forms of analysis and risk management strategies.