Visa stock forecast, Visa stock price prediction, Visa stock analysis

Visa (NYSE:V) is a leading global payments processor with a strong position in the digital finance market. The company’s stock has been setting up for another solid year, and there are discussions about Visa potentially becoming a $1 trillion company in the next five years or by 2030. In this article, we will analyze Visa’s growth prospects, market position, and potential for reaching a $1 trillion market cap.

Table of Contents

What are the potential benefits of visa achieving a $1 trillion market cap

Achieving a $1 trillion market cap would have several potential benefits for Visa, including:

- Increased market recognition: Achieving a $1 trillion market cap would further solidify Visa’s position as a leading global payments processor and increase its market recognition.

- Enhanced financial strength: A larger market cap would provide Visa with increased financial strength, allowing the company to pursue growth opportunities and invest in new technologies.

- Increased shareholder value: Achieving a $1 trillion market cap would likely lead to increased shareholder value, as the company’s stock price would likely rise, benefiting long-term investors.

- Attracting top talent: Achieving a $1 trillion market cap would make Visa an even more attractive employer, allowing the company to attract top talent in the industry.

- Expanded growth opportunities: A larger market cap would provide Visa with more resources to expand its operations and enter new markets, further fueling its growth.

- Increased bargaining power: Achieving a $1 trillion market cap would give Visa increased bargaining power in negotiations with partners, regulators, and other stakeholders.

- Diversification: Achieving a $1 trillion market cap would allow Visa to diversify its business and explore new opportunities beyond payment processing, further driving its growth.

Visa’s Market Position and Growth

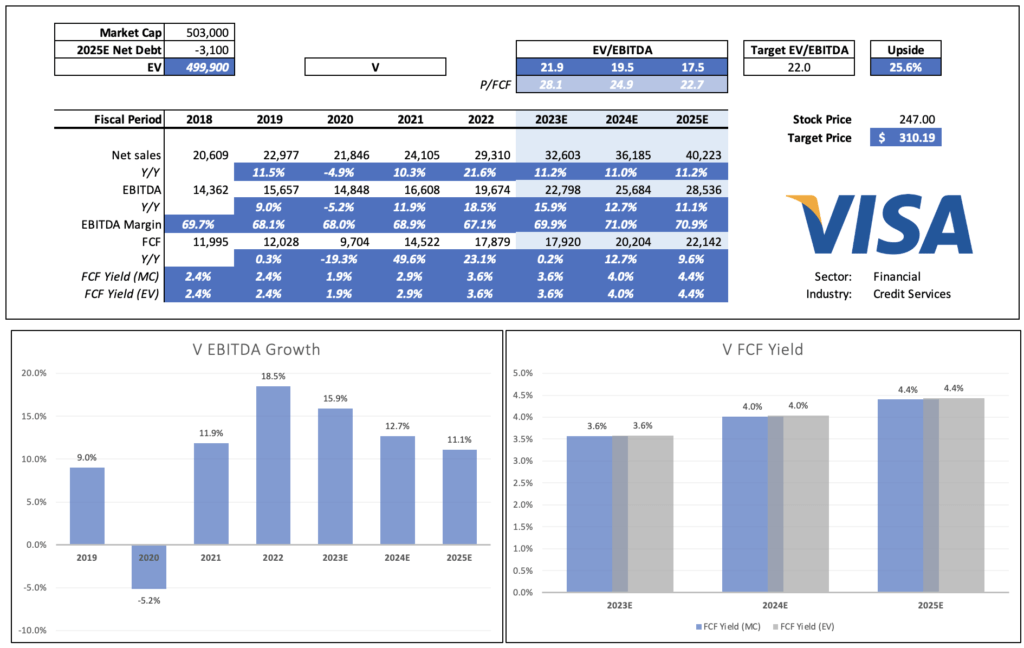

Visa is currently the most valuable digital finance brand globally, with a market cap of over $300 billion. The company’s focus on payment processing, which shields it from non-payment or credit defaults, has contributed to its strong market position. Visa’s growth prospects are supported by its position as the largest payments processor, with over 4.3 billion Visa cards in circulation and generated $250 billion in revenue in 2022. The company’s earnings are expected to expand by 14% annually, which is slightly greater than its growth over the past five years.

Potential for a $1 Trillion Market Cap

To achieve a $1 trillion market cap, Visa would need to grow at a 13% compounded annual rate. This growth rate is achievable, as the company has demonstrated strong growth in the past and is expected to continue expanding its earnings. Visa’s opportunity for expansion is enormous, as most global transactions are still being conducted in cash, allowing the company to expand organically into underbanked regions or lean on acquisitions to grow.

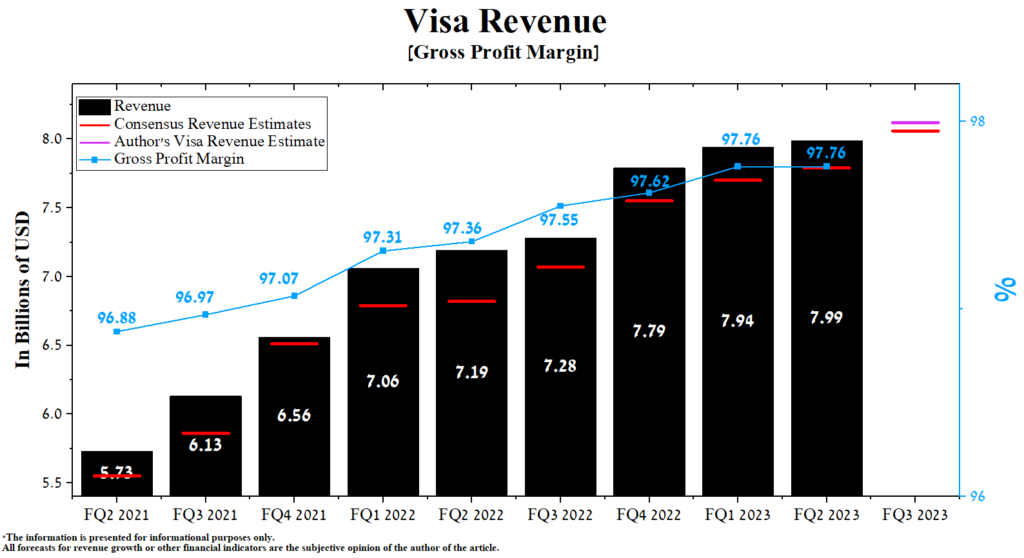

How has visa’s financial performance been in recent years

Visa’s financial performance in recent years has been strong, with the company demonstrating consistent growth in revenue and earnings. Between 2015 and 2022, Visa’s total revenues in Europe increased from about 1.5 billion euros to over 5.2 billion euros. In the first quarter of fiscal year 2024, Visa reported GAAP net income of $4.9 billion or $2.39 per share, an increase of 17% and 20%, respectively, over the prior year’s results. The company’s net revenues for the quarter were $8.6 billion, an increase of 9% on a nominal and constant-dollar basis. Payments volume growth and processed transaction growth were relatively stable, and cross-border growth remained strong.

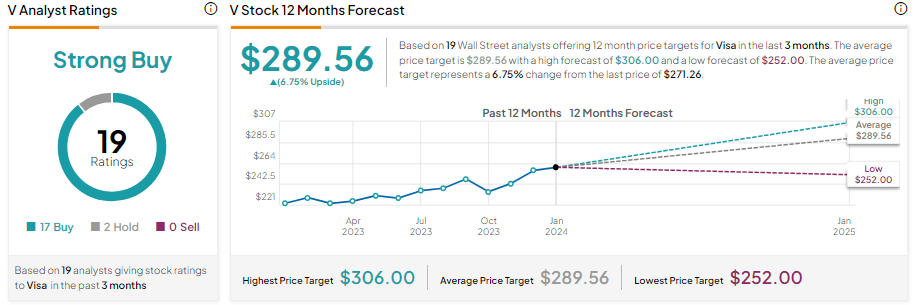

Visa’s earnings are expected to expand by 14% annually, which is slightly greater than its growth over the past five years. Analysts project Visa’s earnings to show year-over-year and sequential improvement in the first quarter of fiscal year 2024, with Wall Street expecting Visa to report earnings of $2.34 per share, up from $2.18 in the prior-year quarter. Visa’s top-line growth rate is expected to improve as the year progresses, with Wall Street expecting Visa to post revenue of $8.56 billion, up about 7.8% year-over-year.

While Visa’s financial performance has been strong, there are also risks and challenges that the company may face. Visa’s record-high margins pose a risk for its share price in 2024, and the need for sustained growth to achieve a $1 trillion market cap is significant. Additionally, the ongoing shift towards cashless transactions presents both an opportunity and a challenge for Visa, as the company must continue to innovate and adapt to remain competitive in the market.

Visa’s Stock Price Prediction

Visa’s stock price in 2030 is projected to range between $410 and $600, averaging near $505. This growth is supported by the company’s strong market position, growth prospects, and potential for sustained growth.

What is visa’s outlook for the next few years

Visa’s outlook for the next few years is generally positive, with the company expected to continue its growth trajectory. Key factors contributing to this optimistic outlook include:

- Rising payments volume: Visa’s payments volume is expected to keep rising over the next five years, driven by the ongoing shift towards cashless transactions and the expansion of its network.

- Competitive advantage: Visa’s wide competitive moat, network effects, and strong brand recognition provide the company with a sustainable advantage, allowing it to produce impressive financial performance.

- Innovation and technology: Visa is expected to continue investing in new technologies and innovative payment experiences, such as biometric authorization, digital identity, tokenized access, and integrated mobility ecosystems.

- Global growth: The company’s expansion into emerging markets and its focus on enabling next-gen payment experiences are expected to contribute to its growth in the coming years.

- Strong financial performance: Visa’s earnings are projected to expand by 14% annually, and the company’s top-line growth rate is expected to improve as the year progresses.

However, there are also potential challenges and risks that Visa may face in the coming years, such as increased competition from fintech companies, the need for sustained growth to achieve a $1 trillion market cap, and the potential limitations of a focus on payment processing compared to companies offering a wider range of financial services.

Risks and Challenges

While Visa’s growth prospects are promising, there are also risks and challenges that the company may face. The company’s record-high margins pose a risk for its share price in 2024, and the need for sustained growth to achieve a $1 trillion market cap is significant. Additionally, the company’s focus on payment processing may limit its potential for growth compared to other companies that offer a wider range of financial services.

Conclusion

Visa’s strong position in the global payments market and its potential for sustained growth make it an interesting prospect for investors. The company’s upcoming earnings release and its long-term growth prospects are key factors to monitor for those interested in Visa’s stock. While achieving a $1 trillion market cap is a challenging goal, Visa’s growth prospects and market position suggest that it is a viable possibility in the next decade.