Unveiling the Mystery: Why Bitcoin is Capped at 21 Million

There is a hard cap of 21 million bitcoins that can ever be created on the Bitcoin network. Satoshi Nakamoto, the person who created Bitcoin, set this supply limit as an “educated guess” to make prices comparable to those of other currencies.

Key rationales for the 21 million ceilings include:

Nakamoto placed great attention on the eventual scarcity of Bitcoin’s supply because he wanted to be sure that no more could be released beyond the predetermined limit.

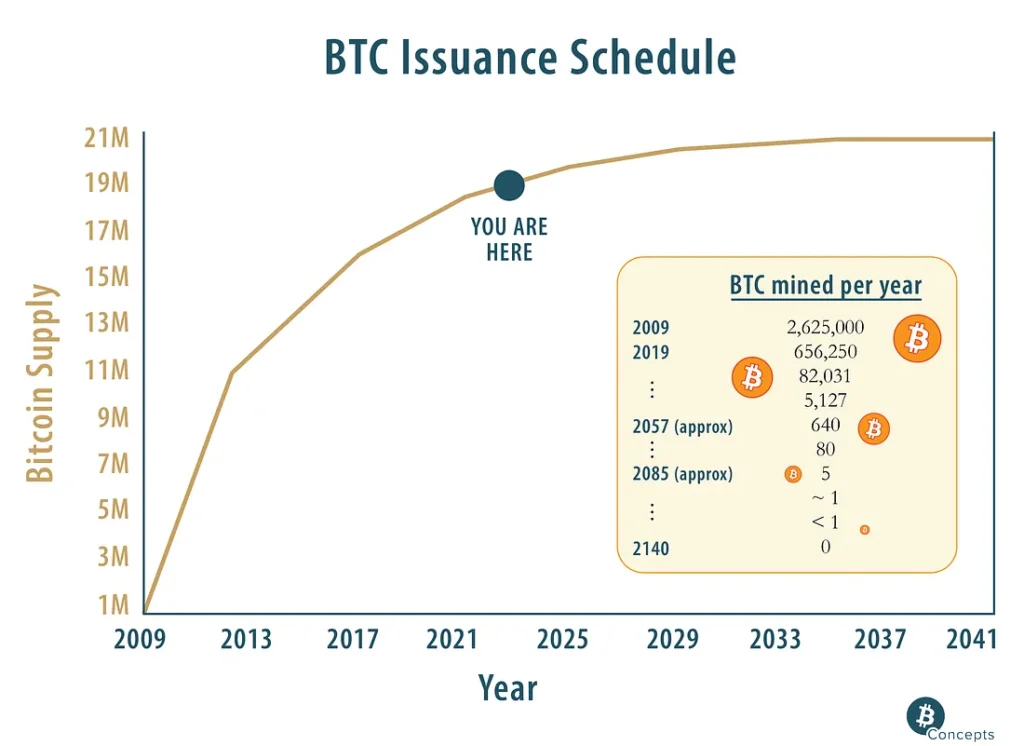

- The goal of the declining block rewards system was to eventually accelerate the rate of Bitcoin adoption by reducing the number of new bitcoins created every block by 50%, roughly every four years.

21 Million: Strategic Scarcity for Digital Gold

In order to establish gold and Bitcoin as valuable assets with a finite quantity, the idea of scarcity is essential. The stock-to-flow ratio of gold, which shows that it would take 62 years to reach existing gold reserves at the current production rate, determines how scarce people believe the metal to be. Conversely, the 21 million coin cap on Bitcoin’s scarcity model aligns with the actual scarcity experienced in strategic sourcing and provides insights for overcoming scarcity-related obstacles in diverse settings. Due to its current stock-to-flow ratio of 55.92, which is only below that of gold, bitcoin’s scarcity plays a significant role in its value proposition. After its next halving, which is anticipated to occur in 2024, it may become the “most scarce” asset worldwide.

Whether considering Bitcoin or gold, the strategic ramifications of scarcity emphasize how crucial it is to strike a balance between perceived and actual scarcity. This knowledge is crucial for making wise choices in a variety of areas, such as sourcing procedures and investment plans, where scarcity can have a big impact on value and competitive advantage.

Bitcoin’s Finite Echo: The 21 Million Limit Impact

One of the main components of Bitcoin’s monetary policy, which aims to create scarcity and stop inflation, is the 21 million limit on the total number of bitcoins that can ever be created.

Some salient details regarding the 21 million bitcoin cap:

Satoshi Nakamoto, the person who created Bitcoin, set the cap as an “educated guess” to make the price of the cryptocurrency comparable to other currencies. Nakamoto thought it wouldn’t really matter how many bitcoins were actually issued, so long as it was divisible.

The intention of the diminishing block rewards is to support the gradual development in the popularity of Bitcoin by reducing the number of new bitcoins created per block by 50% about every four years.

But because some bitcoins are lost or unavailable, it is doubtful that the total quantity in circulation will ever reach precisely 21 million. 3.89 million to 4.87 million bitcoins are thought to have been lost forever, bringing the total supply down to about 17.11 million.

Since the hard maximum of 21 million on Bitcoin is ingrained in the protocol and upheld by the network, changing it would be very challenging. A controversial fork would probably ensue from any attempt to alter it, with the original Bitcoin network maintaining the 21 million limit.

Like the scarcity of gold, a major component of Bitcoin’s value proposition as a store of value is the scarcity brought about by the 21 million limit. Because of its divisibility and scarcity, Bitcoin is useful at many economic scales.

Mapping the Endgame: What Happens When All Bitcoins Are Mined

Once all 21 million bitcoins are mined, the network will undergo significant changes concerning miner incentives and the overall Bitcoin economy.

– End of Mining Rewards: The block reward, which incentivizes miners, will disappear, leaving transaction fees as the sole reward for miners.

– New Economic Dynamics: These changes will usher in a new era for Bitcoin’s economy, potentially heightening its deflationary aspect.

This transition raises important points for discussion:

– How will Bitcoin’s network security fare when mining rewards cease to exist?

– Will transaction fees be sufficient to encourage miners to continue validating transactions?

Answering these concerns requires a deeper dive:

– Post-Mining Security: Transaction fees need to be substantial enough to incentivize miners to maintain network integrity.

– Stable Value Proposition: With a fixed supply, Bitcoin could become a more stable store of value over time.

Takeaways for the post-mining landscape are as follows:

– The shift to transaction fees might impact the dynamics of the Bitcoin mining industry.

– Economic theories speculate on the possible effects of a finite Bitcoin supply on its valuation and adoption.

The Invisible Bitcoin: The Reality of Lost Coins

An estimated 20% of all bitcoins are out of circulation, stuck in digitally locked vaults because of lost access keys or forgotten passwords, akin to sunken treasures never to be recovered.

– Human Error: Losses due to human error continue to shave off the total number of accessible bitcoins.

– Technical Malfunctions: Hardware malfunctions also contribute to the tally of lost bitcoins.

Elaborating on this phenomenon yields important insights:

– Inadvertent Contraction: Losses due to errors and accidents effectively make Bitcoin even scarcer than its 21 million cap suggests.

Here are concrete examples of how bitcoins become lost:

– Misplaced hardware wallets or backup phrases leading to unrecoverable coins.

– System failures or data corruption causing permanent loss of wallet contents.

– Disposal of storage devices without proper extraction of contained bitcoins.

And these are the consequences of such loss scenarios:

– Accidental loss heightens scarcity and may influence Bitcoin’s market price positively.

– The actual number of bitcoins in circulation is lower than the maximum cap, affecting supply-and-demand dynamics.

Deciphering the Code: Why Exactly 21 Million?

The 21 million Bitcoin limit is a result of the block reward halving schedule built into the Bitcoin protocol. Here are the key reasons for this specific number:

- The block reward is initially set at 50 BTC and is halved about every 4 years, or every 210,000 blocks. This halving keeps happening until the block reward hits zero.

- There are roughly 6.9 million blocks that can be mined in total (210,000 blocks x 33 halvings).

- This means that there will be a total supply of about 20.9 million BTC after the first 50 BTC block reward (50 BTC x 6.9 million blocks).

Rounding issues cause the real total supply to come in at just under 21 million Bitcoin.

The Countdown Continues: Mining Till the Last Bitcoin

The next Bitcoin halving event is slated for sometime in 2028, thus the countdown to the final Bitcoin is still ongoing. The salient features are as follows:

The second halving of the Bitcoin block reward is expected to happen at block 1,050,000, where it will be halved from 3.125 BTC to 1.5625 BTC.

The daily pace of Bitcoin generation will decrease from 450 BTC to 225 BTC following this halving.

Before the block reward falls below one satoshi, the smallest unit of Bitcoin, and eventually reaches zero, there will be 33 halvings in all. It is anticipated that this will occur around 2140.

The halvings are intended to maintain Bitcoin’s scarcity, which is a major factor in its appeal as a store of value, and to manage inflation.

Significant price increases have historically followed Bitcoin halvings, but historical performance does not guarantee future outcomes. The effects are felt more immediately by miners, whose earnings are halved while expenses either stay the same or go up.

The average block production time will determine the precise date of the 2028 halving and is subject to variation based on hash rate and mining difficulty. However, current projections place it sometime in 2028; as of May 2024, the countdown clock was 2.56% complete.

Nearing the Finish Line: The Remaining Unmined Bitcoins

Out of the 21 million Bitcoins that will ever exist, there will be about 1.5 million left to be mined as of May 2024. Thus, more than 92% of all Bitcoins have already been produced through mining.

Through a process called mining, wherein participants validate transactions and produce new blocks, the remaining Bitcoins are released. New Bitcoins are created as a reward for each block that miners successfully mine.

The Bitcoin protocol regulates the rate at which new Bitcoins are created. The block reward is halved approximately every 4 years or every 210,000 blocks. The Bitcoin halving is the term for this procedure.

The block reward was most recently halved in May 2020, going from 12.5 BTC to 6.25 BTC. The block reward will drop to 3.125 BTC per block after the next halving, which is anticipated to happen in April 2028.

The last Bitcoin is predicted to be mined around the year 2140, based on the current rate of mining, which is about 900 per day. However, if Bitcoin’s price rises considerably, more miners would be encouraged to join the network, which might speed up this timetable.

Satoshi’s Foresight: 21 Million by Design

The total quantity of Bitcoin, set by Satoshi Nakamoto at 21, million, was not chosen at random but rather as a result of careful consideration during design. The main justifications are as follows:

- The block reward halving schedule, which starts at 50 BTC and halves every 210,000 blocks (or roughly every 4 years) is what led to the 21 million total. This halving keeps going until the block reward hits zero, which is anticipated to occur somewhere in 2140.

- The total number of blocks that can be mined is roughly 6.9 million (210,000 blocks x 33 halvings), with the initial 50 BTC block reward and 210,000 blocks per halving cycle. As a result, there are about 20.9 million BTC in total supply (50 BTC x 6.9 million blocks).

- Rounding issues cause the real total supply to come in at just under 21 million Bitcoin.

This plan was probably selected by Satoshi in order to maintain a reasonably stable supply curve and prevent the block reward from falling to zero too soon. - The 21 million limits has psychological benefits even though it has little economic significance considering how divisible Bitcoin is. It guarantees that the value of Bitcoin as a whole—which most people consider to be more valuable—remains high.

The Capstone of Cryptocurrency: Why 21 Million Matters

A well-crafted component of the Bitcoin protocol, the 21 million Bitcoin supply cap has a big impact on the coin’s value, scarcity, and long-term sustainability. Why it matters is as follows:

Managed Increase in Supply

The 21 million limit is the outcome of the block reward halving schedule that is incorporated into the Bitcoin code, not a random figure. Beginning at 50 BTC, the block reward is expected to be half every 210,000 blocks, or roughly every 4 years, until it reaches zero in the year 2140. This regulated increase in supply guarantees that Bitcoin’s inflation rate will eventually decline.

Value and Scarcity

Bitcoin imitates the scarcity of actual goods like gold by limiting the overall supply. One of the main factors supporting Bitcoin’s appeal as a store of value is its scarcity. The 21 million limit also has psychological benefits because it guarantees that the value of Bitcoin as a whole, which people often view as having a higher exchange rate, will continue to be high.

Rewards for Miners

Miners are encouraged to keep protecting the network even when the block subsidy decreases per the block reward halves schedule. In due course, transaction fees will be the only source of income for miners—not the newly created Bitcoins. This guarantees the network’s long-term security.

Unchangeability and Confidence

The nodes in the network uphold the 21 million supply cap, which is ingrained in the source code of Bitcoin. A majority of nodes would need to concur to change this cap, which is extremely improbable given the incentives to uphold the protocol’s regulations. Because of its immutability, Bitcoin is seen as a trustworthy store of value.

Likeness to Fiat Currency

The quantity of Bitcoin is set and predictable, in contrast to fiat currencies, wherein central banks can generate money indefinitely. Because of this, it is a more trustworthy store of value than fiat, which is subject to inflationary devaluation.

In conclusion, the enigma of why only 21 million bitcoins exist boils down to the concepts of scarcity, economic incentives, and a departure from the inflationary tendencies of fiat currencies. This limit not only safeguards Bitcoin’s value but also ensures its longevity as a decentralized currency. As the cryptocurrency landscape evolves, it becomes increasingly clear that Bitcoin’s fixed supply is a cornerstone of its identity, offering a sturdy foundation for its sustained relevance and appeal in an unpredictable financial world. The scarcity of Bitcoin, much like that of gold, has become an intrinsic part of its allure, potentially shaping the future of money as we know it