Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

“Is Investing in Bitcoins a Good Idea

Bitcoin, the world’s first decentralized digital currency, has been making headlines since its inception in 2009. Over the years, it has gained immense popularity and has become a hot topic among investors. With its increasing demand and limited supply, many investors are considering investing in bitcoins. But is investing in bitcoins a good idea? In this article, we will explore the world of bitcoin investment and help you make an informed decision.

Table of Contents

What is Bitcoin?

Bitcoin is a digital currency that operates on a decentralized network called the blockchain. It was created by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Unlike traditional currencies, bitcoins are not backed by any government or financial institution. Instead, they are created through a process called mining, where powerful computers solve complex mathematical problems to validate transactions on the blockchain.

Why Invest in Bitcoins?

Bitcoin has several unique features that make it an attractive investment option. Firstly, it is decentralized, which means that it is not controlled by any government or financial institution. This makes it immune to government interference and inflation. Secondly, it has a limited supply of 21 million coins, which makes it a scarce asset. As demand for bitcoins increases, its value is likely to rise. Thirdly, it is highly secure and transparent, thanks to the blockchain technology. Transactions on the blockchain are verified by a network of computers, making it virtually impossible to hack or manipulate.

How to Invest in Bitcoins?

Investing in bitcoins is relatively easy, but it requires some knowledge and preparation. Here are the steps to invest in bitcoins:

Step 1: Choose a Bitcoin Wallet

The first step in investing in bitcoins is to choose a bitcoin wallet. A bitcoin wallet is a digital wallet that stores your bitcoins. There are several types of bitcoin wallets, including desktop wallets, mobile wallets, and hardware wallets. Each type has its own advantages and disadvantages, so it’s important to choose the one that suits your needs.

Step 2: Buy Bitcoins

Once you have a bitcoin wallet, you can buy bitcoins from a bitcoin exchange or a peer-to-peer marketplace. Bitcoin exchanges are online platforms that allow you to buy and sell bitcoins using fiat currencies or other cryptocurrencies. Peer-to-peer marketplaces, on the other hand, connect buyers and sellers directly and allow them to negotiate the price.

Step 3: Store Your Bitcoins

After buying bitcoins, you need to store them in your bitcoin wallet. It’s important to keep your bitcoins safe and secure, as they are valuable assets. Hardware wallets are considered the most secure way to store bitcoins, as they are offline and immune to hacking.

Step 4: Monitor Your Investment

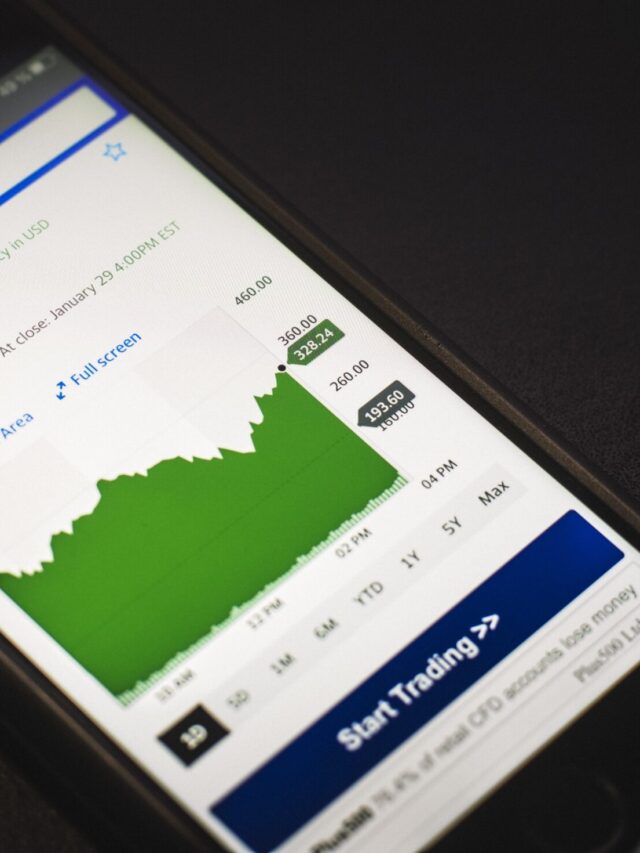

Bitcoin prices are highly volatile and can fluctuate rapidly. It’s important to monitor your investment regularly and be prepared for sudden price changes. You can use various tools and apps to track the price of bitcoins and set alerts for price changes.

Risks of Investing in Bitcoins

While investing in bitcoins has several advantages, it also comes with some risks. Here are some of the risks of investing in bitcoins:

- Volatility: Bitcoin prices are highly volatile and can fluctuate rapidly. This makes it a risky investment option, especially for those who are risk-averse.

- Regulation: Bitcoin is not regulated by any government or financial institution. This makes it vulnerable to government interference and regulation, which can affect its value.

- Security: While the blockchain technology is highly secure, bitcoin exchanges and wallets are vulnerable to hacking and theft. It’s important to choose a reputable exchange and store your bitcoins in a secure wallet.

- Adoption: Bitcoin is still a relatively new technology and is not widely adopted yet. Its success depends on its adoption by businesses and individuals, which is uncertain.

Investing in Bitcoin: Pros and Cons

Bitcoin is a digital currency secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. It is a decentralized currency that operates on a peer-to-peer network, meaning that it is not controlled by any central authority. Bitcoin has attracted a lot of attention from investors due to its high volatility and potential for high returns. However, investing in Bitcoin is not without risks. In this article, we will explore the pros and cons of investing in Bitcoin.

Pros of Investing in Bitcoin

- High Potential for Returns: Bitcoin has seen significant price leaps, with the total market capitalization rising to about $1.2 trillion. Despite the asset’s speculative nature, some have created substantial fortunes by taking on the risk of investing in early-stage.

- Decentralized Currency: Bitcoin is not controlled by any central authority, making it a decentralized currency. This means that it is not subject to government or financial institution regulations, which can be beneficial for investors who are looking for an alternative to traditional investments.

- Hedge Against Inflation: Some bitcoin proponents view the cryptocurrency as a hedge against inflation because the supply is unlike those of fiat currencies, which central banks can expand indefinitely.

Cons of Investing in Bitcoin

- High Volatility: Bitcoin is a risky investment with high volatility, and should only be considered if you have a high risk tolerance. The value of Bitcoin can fluctuate rapidly, and investors can lose a significant amount of money if they do not carefully monitor their investments.

- Lack of Regulation: The lack of oversight has contributed to volatility in the nascent industry, but regulators have begun to catch up. The lack of regulation also means that investors are not protected by government-backed insurance, which can be a significant risk.

- Technical Complexity: The technical complexity of using and storing crypto assets can be a significant hazard to new users. Investors must be familiar with the technology and understand how to store their assets securely to avoid losing their investments.

investing in bitcoins:

- Diversify Your Portfolio

Bitcoin is a high-risk investment option, and it’s important to diversify your portfolio to minimize risk. Don’t put all your eggs in one basket and invest in other assets, such as stocks, bonds, and real estate. This will help you spread your risk and protect your investment.

- Understand the Tax Implications

Investing in bitcoins can have tax implications, and it’s important to understand them before investing. In the United States, bitcoins are treated as property for tax purposes, and any gains or losses are subject to capital gains tax. Make sure to consult a tax professional to understand the tax implications of investing in bitcoins.

- Keep Up with the Latest Developments

Bitcoin is a rapidly evolving technology, and it’s important to keep up with the latest developments. Follow news and updates on bitcoin and blockchain technology to stay informed about the latest trends and developments. This will help you make informed investment decisions and stay ahead of the curve.

- Don’t Invest More Than You Can Afford to Lose

Bitcoin is a high-risk investment option, and it’s important to invest only what you can afford to lose. Don’t invest your life savings or take out loans to invest in bitcoins. This can lead to financial ruin and is not worth the risk.

- Consider Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of the price of bitcoins. This can help you avoid the temptation to buy or sell based on short-term price fluctuations and can help you build a long-term investment strategy.

- Be Prepared for Market Volatility

Bitcoin prices are highly volatile and can fluctuate rapidly. It’s important to be prepared for market volatility and not panic during price drops. Stick to your investment strategy and don’t make impulsive decisions based on short-term price movements.

- Consider the Long-Term Potential

Bitcoin is a relatively new technology, and its long-term potential is still uncertain. However, many experts believe that bitcoin has the potential to revolutionize the financial industry and become a mainstream asset. Consider the long-term potential of bitcoin and its underlying technology when making investment decisions.

Conclusion

Investing in bitcoins can be a lucrative investment option, but it also comes with some risks. It’s important to do your research and understand the risks before investing in bitcoins. Choose a reputable exchange, store your bitcoins in a secure wallet, and monitor your investment regularly. With the right knowledge and preparation, investing in bitcoins can be a good idea.

1 thought on ““Is Investing in Bitcoins a Good Idea? A Comprehensive Guide “”