Investing is often considered a complex, risky endeavor. With so many options, strategies, and advice from self-proclaimed experts, it’s easy to become confused. But what if there was an investment option that offered simplicity, low cost, and consistent performance? That’s exactly what index funds provide.

In this comprehensive guide, we’ll dive deep into why index funds are so powerful, how they consistently beat professional fund managers, and how you can harness their benefits to achieve your financial goals. By the end of this article, you’ll have all the information you need to make informed investment decisions and start building wealth for the long term.

Table of Contents

What Are Index Funds and Why Should You Consider Them?

An index fund is a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index. These indices represent large groups of stocks across different industries, and the fund’s objective is to track the performance of the stocks within that index.

Some of the most popular indices include:

- S&P 500: A list of the 500 largest publicly traded companies in the U.S.

- NASDAQ-100: Focuses on 100 of the largest non-financial technology companies.

- Dow Jones Industrial Average (DJIA): Comprises 30 large U.S. companies, often considered blue-chip stocks.

Unlike actively managed funds, where professional managers pick stocks to “beat the market,” index funds simply replicate the index. This means they are passively managed, offering simplicity and efficiency with lower costs and risks.

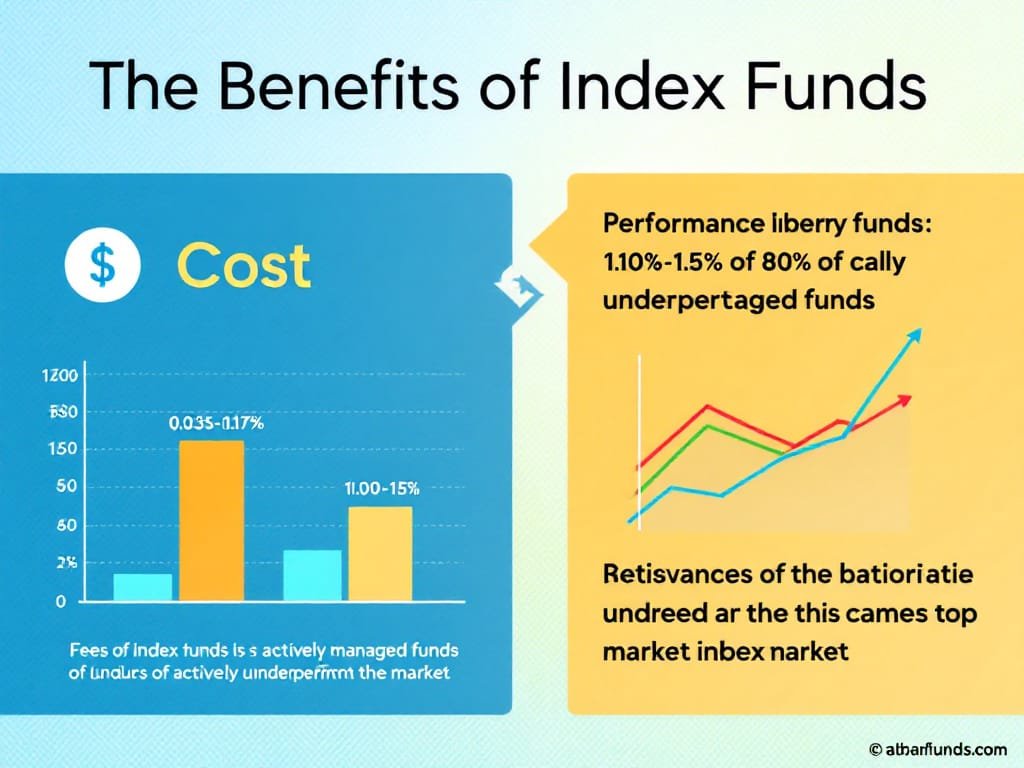

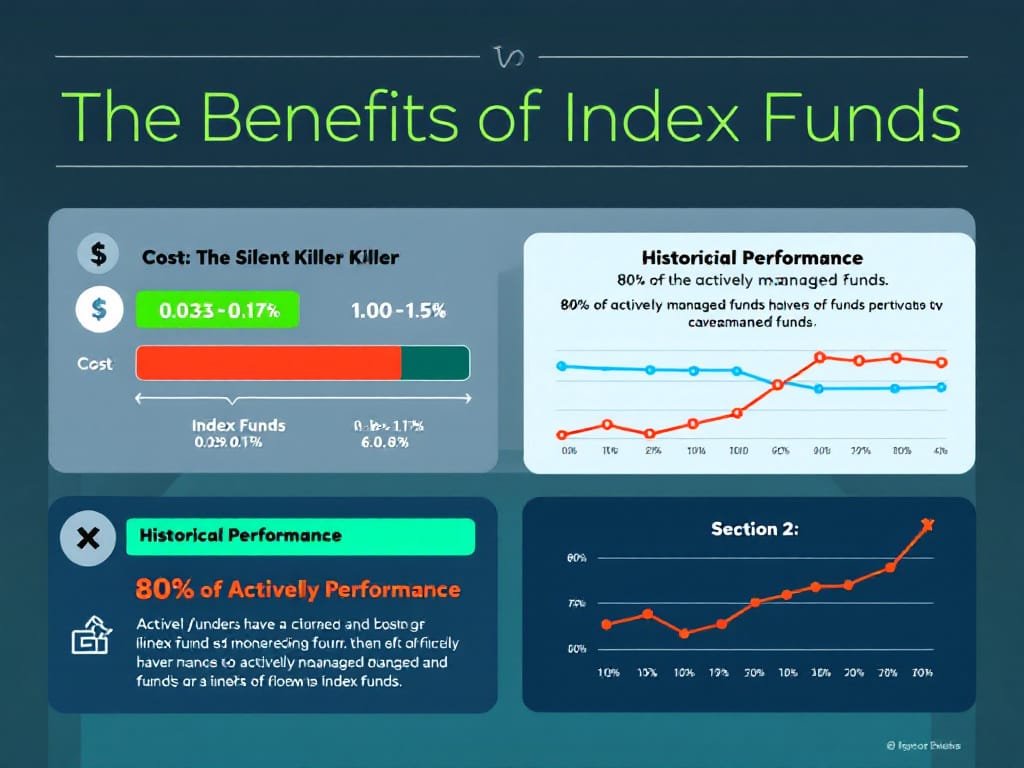

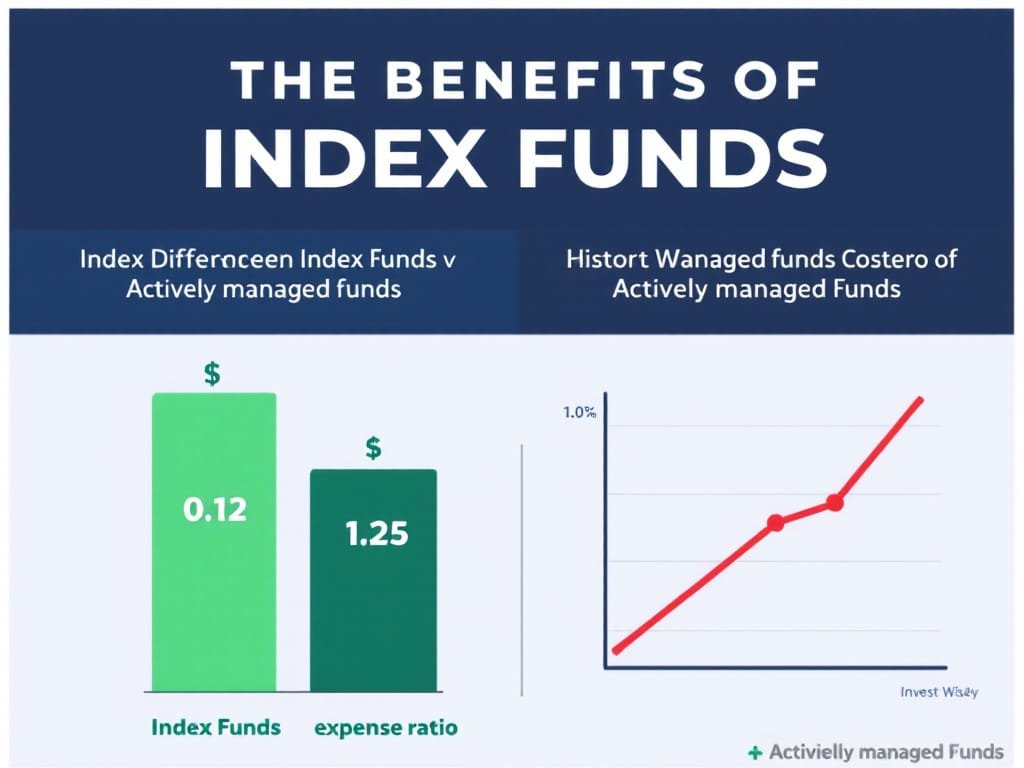

1. Index Funds Are Incredibly Cost-Effective

The Power of Low Fees

One of the key reasons index funds outperform actively managed funds is their low cost. Actively managed funds incur higher management fees due to the need for professional analysts and frequent stock trades.

- Index Funds: Average expense ratio of 0.03% – 0.15%.

- Actively Managed Funds: Average expense ratio of 1.0% – 1.5%.

This difference in fees may seem small, but it can have a massive impact on long-term returns.

Real-Life Example:

Let’s assume an investment of $100,000 with an 8% annual return over 30 years:

| Fund Type | Expense Ratio | Portfolio Value After 30 Years |

|---|---|---|

| Index Fund | 0.15% | $1,040,000 |

| Actively Managed Fund | 1.5% | $774,000 |

Difference: $266,000, simply due to lower fees.

Why Low Fees Matter:

Over time, small fees compound and erode your returns. With index funds, the lower the fees, the more of your money stays invested and grows.

2. Historical Performance: Index Funds vs. Professional Fund Managers

The Challenge of Beating the Market

Many investors believe they can outperform the market by picking the right stocks. However, studies have shown that over 80% of actively managed funds fail to beat their benchmark indices over a 10-year period, and over 90% underperform over 15 years.

Why Do Active Fund Managers Struggle?

- High Fees: Even if a fund manager succeeds in beating the market, the fees can offset the outperformance.

- Market Efficiency: In today’s market, information is disseminated rapidly, making it difficult to consistently pick stocks that will outperform.

- Human Error: Emotional decisions and market timing often result in buying high and selling low.

Quote from Warren Buffett:

“The investor of today does not profit from yesterday’s growth.” – Warren Buffett

Example: Warren Buffett’s Bet

In 2008, Warren Buffett bet $1 million that an S&P 500 index fund would outperform a group of hedge funds over a 10-year period. The result?

- S&P 500 Index Fund: 125% return

- Hedge Funds: 36% average return

This bet highlighted the effectiveness of index funds, as even professional hedge fund managers couldn’t outperform a simple, low-cost index fund.

3. Built-in Diversification: Reducing Risk Automatically

The Importance of Diversification

Diversification is a key principle of investing. It involves spreading investments across different assets to reduce risk. Index funds provide this diversification automatically by investing in hundreds, or even thousands, of stocks within a single fund.

How Index Funds Achieve Diversification

- S&P 500 Index Fund: Includes 500 companies from various industries, such as tech, healthcare, and finance.

- NASDAQ-100: Primarily technology-focused, but still offers broad exposure to some of the largest firms in the world.

Diversification Example in Action

| Sector | S&P 500 Weightage |

|---|---|

| Technology | 28.5% |

| Healthcare | 13.8% |

| Consumer Discretionary | 12.2% |

| Financials | 11.2% |

| Industrials | 8.1% |

Benefit: If one sector underperforms, the others balance out the performance, reducing the impact of any individual company or industry. This is much more efficient than selecting a few individual stocks.

4. Emotion-Free Investing: The Key to Long-Term Success

Behavioral Biases and the Downfall of Active Investing

Most professional fund managers and individual investors fall prey to behavioral biases, such as fear and greed, which can lead to poor decision-making. For example:

- Fear: Selling off investments during market downturns to “cut losses.”

- Greed: FOMO (Fear of Missing Out) on hot stocks or market trends, often resulting in buying at overvalued prices.

How Index Funds Help You Avoid Emotional Traps

Index funds are passive, meaning they follow a set strategy without reacting to market fluctuations or trends. This approach removes emotional decision-making from the process, helping investors stay focused on the long-term objective.

5. Tax Efficiency: Keeping More of What You Earn

Active Funds vs. Index Funds for Taxation

Active funds tend to trade stocks frequently, leading to capital gains taxes. The more a fund buys and sells, the more taxable events occur. In contrast, index funds generally have lower turnover rates, resulting in fewer taxable events and higher tax efficiency.

Example:

- Active Fund: 50–100% turnover, leading to high taxes on capital gains.

- Index Fund: 5–10% turnover, leading to fewer taxes and better long-term returns.

For long-term investors, this tax efficiency can lead to more money in your pocket.

6. The Magic of Compounding

How Low Fees and Long-Term Growth Lead to Exponential Wealth

Compounding is one of the most powerful concepts in investing. By reinvesting earnings, you earn returns on your returns. Index funds are perfect for compounding because they provide steady, long-term growth with minimal fees.

Illustration of Compounding:

| Investment Amount | Index Fund (0.15% fee) | Active Fund (1.5% fee) |

|---|---|---|

| $10,000 | $99,400 | $76,120 |

| $50,000 | $497,000 | $380,600 |

| $100,000 | $1,040,000 | $774,000 |

The difference becomes substantial over time, and you can see how low fees make a big difference to long-term wealth accumulation.

7. Transparency and Simplicity

The Simple Appeal of Index Funds

One of the most attractive features of index funds is their transparency. Investors know exactly what they’re investing in, as index funds publicly disclose their holdings. Additionally, the objective is clear: to replicate the performance of an index.

In contrast, actively managed funds may use complex strategies or be subject to changes in manager philosophy, making it harder for investors to follow along.

8. Accessibility for All Investors

Index Funds for Everyone

Whether you are a beginner or an experienced investor, index funds offer something for everyone:

- Beginners: No need to research individual stocks or time the market.

- Experienced Investors: Index funds provide a low-cost foundation for building a diversified portfolio.

Furthermore, many index funds have low minimum investment amounts, making them accessible to investors of all sizes.

9. Resilience During Market Crashes

How Index Funds Weather Volatility

Active fund managers may panic during market downturns and sell assets at the wrong time, locking in losses. Index funds, however, simply track the performance of the broader market and continue to recover once the market rebounds.

Historical Evidence:

- 2008 Financial Crisis: The S&P 500 index lost nearly 38% in 2008, but it fully recovered by 2013, rewarding long-term investors who stayed the course.

Quote from Jack Bogle (Founder of Vanguard and Creator of the Index Fund):

“The stock market is a giant distraction to the business of investing.”

10. Proven Strategies for Index Fund Investing

Getting Started with Index Funds

Now that we’ve covered the benefits of index funds, here’s how you can start building your portfolio with them.

- Choose the Right Index Fund

- S&P 500 Index Fund: Great for exposure to the U.S. stock market.

- Total Stock Market Index Fund: Provides exposure to large-cap, mid-cap, and small-cap stocks.

- International Index Funds: Expand your portfolio globally with international exposure.

- Invest Regularly

Use dollar-cost averaging by investing a fixed amount each month, no matter the market conditions. This strategy can help reduce the impact of market volatility. - Stick to a Long-Term Strategy

Avoid emotional decisions and short-term thinking. Trust in the long-term growth potential of the market. - Monitor Costs

Stick to index funds with low expense ratios to maximize your returns over time.

Conclusion: The Smarter Way to Build Wealth

Index funds are a low-cost, highly effective, and straightforward way to build wealth over the long term. They consistently outperform most professional fund managers due to their low fees, broad diversification, tax efficiency, and simplicity. By investing in index funds, you avoid the pitfalls of emotional investing, high fees, and market timing mistakes.

FAQ 1: What is the difference between an index fund and an actively managed fund?

Answer:

The primary difference between an index fund and an actively managed fund is the management style.

- Index Funds: These are passively managed and aim to replicate the performance of a specific market index (e.g., S&P 500, NASDAQ-100). They do not require a fund manager to pick stocks.

- Actively Managed Funds: These funds are managed by professional fund managers who actively select stocks and make decisions based on research and market forecasts in an attempt to outperform the market.

The key advantage of index funds is their lower costs and consistent performance, while actively managed funds have higher fees and often underperform over the long term.

FAQ 2: Can I lose money in an index fund?

Answer:

Yes, it is possible to lose money in an index fund, especially in the short term. Index funds track the performance of market indices, which means they reflect the ups and downs of the overall market. In times of market downturns, such as during recessions or financial crises, the value of your index fund may decrease.

However, index funds are designed for long-term investing. Historically, markets have recovered from downturns over time, so staying invested for the long haul typically leads to growth. Diversification also helps reduce the risk of significant losses.

FAQ 3: How do I choose the best index fund?

Answer:

When choosing the best index fund for your needs, consider the following factors:

- Expense Ratio: Look for funds with low expense ratios (typically under 0.15%) to maximize your returns.

- Track Record: Choose funds that consistently replicate the performance of their benchmark index.

- Fund Size: Larger funds tend to be more stable, with more assets under management.

- Index Focus: Choose an index that aligns with your investment goals (e.g., S&P 500 for U.S. market exposure or a total stock market index for broader diversification).

- Tax Efficiency: If you’re investing in a taxable account, consider funds with low turnover rates to minimize capital gains taxes.

FAQ 4: Are index funds a good choice for beginners?

Answer:

Yes, index funds are an excellent choice for beginners. They are simple to understand, require minimal management, and provide broad market exposure, reducing the risk of individual stock picking. Since they track well-known indices like the S&P 500, you don’t need to be an expert to get started. Index funds also have lower fees compared to actively managed funds, meaning more of your money stays invested and works for you.

They are particularly suited for long-term goals, such as retirement, and help beginners build a diversified portfolio without the need for frequent decision-making or market timing.

FAQ 5: How often should I invest in index funds?

Answer:

The best approach is to invest in index funds regularly through a strategy known as dollar-cost averaging. This means investing a fixed amount of money at regular intervals (e.g., monthly or quarterly), regardless of the market’s ups and downs.

By doing so, you reduce the impact of market volatility and avoid trying to time the market, which can be difficult. Regular investments help you take advantage of compounding over time and accumulate wealth steadily without worrying about short-term market fluctuations.

These FAQs address common questions that investors often have about index funds and can help provide clarity and further educate your readers.

1 Comment