Introduction

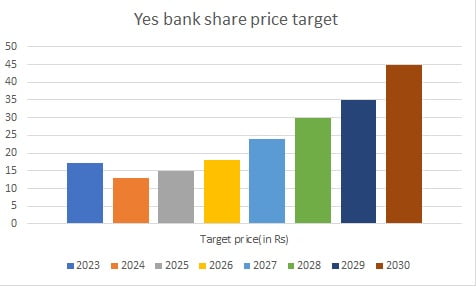

Yes Bank is a private sector bank in India that was founded in 2004. The bank has faced several challenges in recent years, including a financial crisis in 2020 that led to a government-led rescue plan. As of January 2024, the share price of Yes Bank is around INR 15.

Factors Affecting Yes Bank Share Price in 2030

Several factors could affect the share price of Yes Bank in 2030. These include:

Table of Contents

- Economic conditions in India: The Indian economy is expected to grow at a steady pace in the coming years, which could have a positive impact on the banking sector. However, any adverse economic conditions could negatively affect the share price of Yes Bank.

- Regulatory environment: The Reserve Bank of India (RBI) has been taking steps to strengthen the banking sector in India, including stricter regulations for banks. Any changes in the regulatory environment could affect the share price of Yes Bank.

- Financial performance: Yes Bank’s financial performance will be a key factor in determining its share price in 2030. The bank will need to demonstrate sustained profitability and growth to attract investors.

Expert Opinion

There are no specific predictions available for Yes Bank’s share price in 2030. However, according to a report by Deutsche Bank Research[2], the Indian banking sector is expected to grow significantly in the coming years, driven by factors such as rising incomes, increasing financial inclusion, and a growing middle class. This could have a positive impact on the share price of Yes Bank.

Sure, here are some additional points to consider:

- Competition: Yes Bank operates in a highly competitive banking sector in India, with both public and private sector banks vying for market share. The bank will need to differentiate itself and offer unique products and services to remain competitive and attract investors.

- Technology: The banking sector in India is rapidly adopting new technologies such as digital banking, mobile payments, and blockchain. Yes Bank will need to keep pace with these developments and invest in technology to remain relevant and competitive.

- Government policies: The Indian government has been taking steps to promote financial inclusion and increase access to banking services, which could benefit Yes Bank. However, any changes in government policies could also affect the bank’s share price.

- Investor sentiment: The overall sentiment of investors towards the banking sector and the stock market in general will also play a role in determining Yes Bank’s share price in 2030. Any major global or domestic events that affect investor sentiment could impact the bank’s share price.

- Mergers and acquisitions: Yes Bank has been involved in several mergers and acquisitions in recent years, including the acquisition of Reliance Mutual Fund’s assets in 2020. Any future mergers or acquisitions could also affect the bank’s share price.

Overall, the share price of Yes Bank in 2030 will depend on a complex interplay of various factors, and it is difficult to make accurate predictions. However, by focusing on factors such as financial performance, technology, and competition, the bank can position itself for long-term growth and success.

FAQs about Yes Bank Share Price:

1. What factors can influence the share price of Yes Bank?

- Several factors can influence the share price of Yes Bank, including economic conditions, regulatory environment, the bank’s financial performance, competition, technological advancements, government policies, and investor sentiment.

2. Is it possible to predict the exact share price of Yes Bank in 2030?

- It is difficult to predict the exact share price of Yes Bank in 2030 due to the complex and dynamic nature of the stock market. Various factors, both internal and external, can impact the share price, making it challenging to provide an accurate prediction.

3. Where can I find reliable forecasts for Yes Bank’s share price?

- Reliable forecasts for Yes Bank’s share price can be found from financial institutions, market analysts, and investment research firms. It’s important to consider multiple sources and factors before making any investment decisions.

4. How has Yes Bank’s share price performed in the past?

- Yes Bank has experienced significant fluctuations in its share price in the past, especially after the financial crisis in 2020. The bank’s share price history reflects the impact of various internal and external factors on its valuation.

5. What should investors consider when evaluating Yes Bank’s share price?

- Investors should consider the bank’s financial health, growth prospects, competitive position, regulatory environment, and overall market conditions when evaluating Yes Bank’s share price. Conducting thorough research and seeking advice from financial experts is advisable before making any investment decisions.

Conclusion

The share price of Yes Bank in 2030 will depend on several factors, including economic conditions, regulatory environment, and the bank’s financial performance. While there are no specific predictions available, the growth potential of the Indian banking sector could have a positive impact on the share price of Yes Bank.

1 thought on “Yes Bank Share Price in 2030”