Of ₹40,000 flowing into your bank account every month without lifting a finger. Sounds like a dream, right? Well, it’s not just a fantasy—it’s a reality you can achieve with a Systematic Withdrawal Plan (SWP). Whether you’re a retiree looking to enjoy your golden years or someone seeking a passive income stream, SWPs can turn your mutual fund investments into a reliable paycheck. But here’s the million-rupee question: should you use debt funds or equity funds to make this happen?

Table of Contents

What is a Systematic Withdrawal Plan (SWP)?

A Systematic Withdrawal Plan (SWP) is like a reverse Systematic Investment Plan (SIP). Instead of putting money into a mutual fund, you take money out at regular intervals—monthly, quarterly, or even annually. It’s a disciplined way to generate income while keeping your investment working for you in the market.

Here’s why SWPs are gaining popularity in India:

- Steady Cash Flow: Withdraw a fixed amount (like ₹40,000) every month to cover your expenses.

- Flexibility: Customize the amount, frequency, and duration to suit your needs.

- Tax Benefits: Withdrawals are treated as capital gains, often taxed at lower rates than interest income from fixed deposits.

- Growth Potential: The remaining corpus stays invested, potentially growing over time.

“SWPs are a game-changer for anyone seeking financial independence. They blend income generation with the power of compounding.” — Priya Sharma, Financial Planner at WealthGrow Advisors

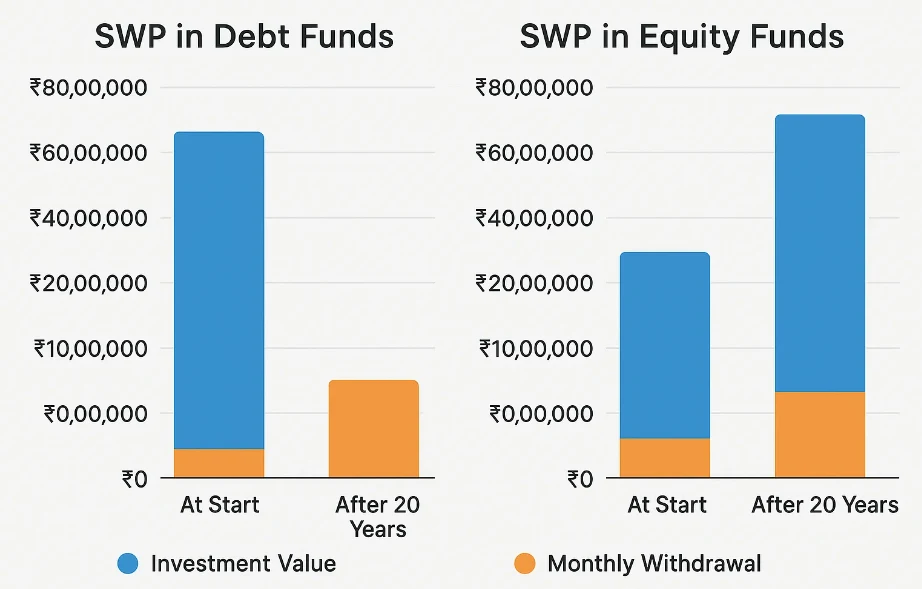

Let’s explore how debt funds and equity funds stack up when you use them for an SWP.

Why Choose Debt Funds for SWP?

Debt funds invest in fixed-income securities like government bonds, corporate bonds, and money market instruments. They’re the tortoises of the investment world—slow, steady, and reliable. If you’re someone who values peace of mind over rollercoaster returns, debt funds might be your SWP soulmate.

Advantages of SWP in Debt Funds

- Low Volatility: Debt funds don’t swing wildly like equity funds, making your monthly ₹40,000 predictable.

- Capital Preservation: With lower risk, your principal is safer, even as you withdraw regularly.

- Consistent Returns: Expect annual returns of 6-8%, driven by interest from bonds, which supports steady withdrawals.

- Perfect for Short-Term Needs: Ideal if you need income for 3-5 years without worrying about market crashes.

Top Debt Funds for SWP in 2025

Here’s a quick look at some top-performing debt funds you might consider:

| Fund Name | 5-Year CAGR | Expense Ratio | Risk Level |

|---|---|---|---|

| ICICI Prudential Corporate Bond Fund | 7.5% | 0.45% | Low |

| HDFC Short Term Debt Fund | 7.2% | 0.40% | Low |

| SBI Magnum Medium Duration Fund | 7.8% | 0.55% | Moderate |

“Debt funds are the backbone of a stable SWP strategy, especially for retirees who can’t afford to gamble with their savings.” — Anil Gupta, Fund Manager at SBI Mutual Fund

Real-Life Example

Meet Rajesh, a 60-year-old retiree from Mumbai. He invested ₹1 crore in a debt fund with a 7% annual return. By setting up an SWP for ₹40,000 per month, he enjoys a steady income while his corpus continues to grow modestly. For Rajesh, stability trumps everything else.

Why Choose Equity Funds for SWP?

Equity funds, on the other hand, are the hares—fast, thrilling, and a bit risky. They invest in stocks, offering the potential for higher returns but with more ups and downs. If you’re willing to ride the market waves, equity funds could supercharge your SWP.

Advantages of SWP in Equity Funds

- Higher Returns: Historically, equity funds deliver 12-15% annually, outpacing inflation and debt funds over the long term.

- Long-Term Growth: Your corpus can grow significantly, making your ₹40,000 withdrawals sustainable for decades.

- Inflation Protection: Equity returns often beat inflation, preserving your purchasing power.

Challenges of SWP in Equity Funds

- Volatility: Market dips can shrink your corpus, forcing you to sell more units to get ₹40,000.

- Risk of Depletion: A prolonged bear market could eat into your principal faster than planned.

- Not for Short-Term: If you need income for just a few years, equity funds might be too unpredictable.

Top Equity Funds for SWP in 2025

Check out these high-performing equity funds:

| Fund Name | 5-Year CAGR | Expense Ratio | Risk Level |

|---|---|---|---|

| Parag Parikh Flexi Cap Fund | 18.5% | 0.75% | High |

| Mirae Asset Large Cap Fund | 15.2% | 0.60% | High |

| SBI Bluechip Fund | 14.8% | 0.85% | High |

“Equity funds can turbocharge your SWP if you’ve got the stomach for risk and time on your side.” — Neha Kapoor, Equity Analyst at Mirae Asset

Real-Life Example

Take Priya, a 45-year-old IT professional from Bangalore. She invested ₹80 lakh in an equity fund averaging 12% returns. Her ₹40,000 monthly SWP not only meets her side hustle needs but also grows her corpus over 15 years, thanks to equity’s compounding magic.

Debt Funds vs Equity Funds: A Side-by-Side Comparison

Let’s break it down with a handy table to see how debt and equity funds compare for your SWP:

| Factor | Debt Funds | Equity Funds |

|---|---|---|

| Risk Level | Low to Moderate | High |

| Return Potential | 6-8% p.a. | 12-15% p.a. |

| Volatility | Low | High |

| Investor Profile | Conservative, short-term goals | Aggressive, long-term goals |

| Taxation | LTCG at 20% with indexation (3+ years) | LTCG at 10% above ₹1 lakh (1+ year) |

| Withdrawal Stability | Highly predictable | Varies with market conditions |

Key Insight: Debt funds win for stability, while equity funds shine for growth. Your choice depends on whether you prioritize safety or long-term wealth.

How to Set Up an SWP for ₹40,000 Monthly Income

Ready to make ₹40,000 a month? Here’s a step-by-step guide to set up your SWP:

Step 1: Calculate Your Corpus

To figure out how much you need to invest, consider your expected return and withdrawal rate. Let’s assume:

- Debt Fund: 7% annual return, 5% withdrawal rate.

- Equity Fund: 12% annual return, 5% withdrawal rate.

Formula:

[ \text{Corpus} = \frac{\text{Annual Withdrawal}}{\text{Withdrawal Rate}} ]

Annual withdrawal = ₹40,000 × 12 = ₹4,80,000.

- Debt Fund: ₹4,80,000 ÷ 0.05 = ₹96 lakh.

- Equity Fund: ₹4,80,000 ÷ 0.05 = ₹96 lakh.

But here’s the catch: equity funds need a buffer for volatility, so you might aim for ₹1-1.2 crore to be safe.

Step 2: Pick the Right Fund

- Debt Fund: Go for ICICI Prudential Corporate Bond Fund if you want low risk.

- Equity Fund: Choose Parag Parikh Flexi Cap Fund for growth potential.

- Hybrid Option: Consider HDFC Balanced Advantage Fund for a mix of both.

Step 3: Set Up the SWP

- Amount: ₹40,000.

- Frequency: Monthly.

- Platform: Use apps like Groww, Zerodha Coin, or your fund house’s website.

“An SWP calculator is your best friend here. It helps you tweak your plan so your money lasts.” — Rohit Jain, Financial Advisor at ClearTax

Tax Implications: Debt Funds vs Equity Funds

Taxes can nibble away at your SWP income, so let’s decode them:

Debt Funds

- Short-Term Capital Gains (STCG): Withdrawals within 3 years are taxed at your income slab rate (e.g., 30% for high earners).

- Long-Term Capital Gains (LTCG): After 3 years, taxed at 20% with indexation, reducing your tax burden.

Equity Funds

- Short-Term Capital Gains (STCG): Withdrawals within 1 year are taxed at 15%.

- Long-Term Capital Gains (LTCG): After 1 year, gains above ₹1 lakh are taxed at 10% without indexation.

Tax Hack: Stagger withdrawals over years to stay under the ₹1 lakh LTCG exemption for equity funds.

Risks and Considerations

SWPs aren’t foolproof. Here’s what to watch out for:

- Capital Depletion: If withdrawals outpace returns (e.g., in a market crash), your corpus shrinks.

- Market Swings: Equity funds can be a wild ride—think 2020’s COVID crash.

- Inflation: ₹40,000 today won’t buy as much in 10 years. Equity funds help counter this better than debt.

- Over-Withdrawal: A 6% withdrawal rate on a 7% return fund leaves little room for growth.

“Monitor your SWP like a hawk. Adjust withdrawals if markets tank or inflation spikes.” — Vikram Mehra, Wealth Coach at Angel One

Conclusion: Debt or Equity for Your ₹40,000 SWP?

So, which is better for your ₹40,000 monthly income plan?

- Debt Funds: Pick these if you’re risk-averse or need income for 3-5 years. Your money stays safe, and withdrawals are steady.

- Equity Funds: Choose these if you’re in it for the long haul (10+ years) and can handle market dips. The growth potential is unmatched.

- Hybrid Approach: Split your corpus—say, 60% in debt, 40% in equity—for a balance of stability and growth.

Ultimately, it’s about your goals and comfort zone. Run the numbers, consult a financial advisor, and start your SWP journey today!

“There’s no one-size-fits-all in SWP. Match it to your life stage and risk appetite for the best results.” — Sneha Patel, Investment Strategist at PaisaBazaar

FAQs

Q1: Can I adjust my SWP amount later?

Yes, most funds let you tweak the amount or frequency anytime.

Q2: Is SWP better than a fixed deposit?

SWP offers tax efficiency and growth potential, but FDs guarantee your principal—your call!

Q3: How long will my SWP last?

It depends on your corpus, withdrawal rate, and fund returns. Use an online SWP calculator for clarity.

Q4: Are there fees for SWP?

Usually no, but watch for exit loads if you redeem early.

Q5: Can I use multiple funds for SWP?

Absolutely! Diversify across debt and equity for a balanced income stream.

Leave a Reply