Introduction: The Dream of Turning Lakhs into Crores

Starting with ₹5 lakh today and watching it multiply into ₹50 lakh in just 7 years. Sounds like a fairy tale, right? But it isn’t. With the right strategy, discipline, and understanding of market dynamics, such 900% returns are achievable—not by luck, but by design.

Table of Contents

Why 900% Returns in 7 Years Isn’t Impossible

Most people believe that doubling or tripling their money is the peak of investment success. But if you study the Indian stock market, mutual funds, IPOs, and alternative asset classes, you’ll find countless examples of 10x growth within a decade.

- Nifty 50 Index itself has grown more than 200% in the last 10 years.

- High-quality small-cap stocks like Tanla Platforms, Dixon Technologies, and Aarti Drugs have given over 1000% returns in the last 7 years.

- Even systematic mutual fund investments (SIPs) in top-performing funds have multiplied wealth by 8–10 times for patient investors.

So, 900% returns may sound bold, but history shows us it’s realistic with the right allocation, patience, and timing.

Step 1: Setting the Foundation — Mindset & Risk Appetite

Before investing a single rupee, you need to answer:

- Are you ready to stay invested for 7 years without panic selling?

- Can you stomach volatility of 30–40% in certain years?

- Do you understand the balance between risk and reward?

Rule of Wealth Creation: Higher returns demand higher calculated risk. Playing too safe with FDs (6–7%) or PPF (7.1%) will never get you to 900%.

Instead, a blend of equity, mutual funds, and high-growth sectors is the key.

Step 2: My 7-Year Portfolio Allocation

Here’s how I structured my ₹5 lakh portfolio to reach ₹50 lakh:

| Asset Class | Allocation (%) | Investment Amount (₹) | Expected CAGR | 7-Year Value (₹) |

|---|---|---|---|---|

| High-Growth Stocks (Small & Mid-cap) | 40% | ₹2,00,000 | 30–35% | ₹12,00,000+ |

| Mutual Funds (Equity & Thematic) | 30% | ₹1,50,000 | 18–22% | ₹5,00,000+ |

| IPO & Special Situations | 15% | ₹75,000 | 35–40% | ₹6,50,000+ |

| Alternative Assets (REITs, Gold ETFs, Crypto exposure) | 10% | ₹50,000 | 12–15% | ₹1,30,000+ |

| Cash Reserve for Buy-the-Dip Opportunities | 5% | ₹25,000 | Flexible | ₹5,00,000+ (opportunistic gains) |

Total Expected Value in 7 Years = ₹50,00,000+

Step 3: Power of Compounding — The Real Wealth Engine

Let’s run the math with a 25–30% CAGR (compounded annual growth rate).

- Year 1: ₹5,00,000 → ₹6,50,000

- Year 2: ₹6,50,000 → ₹8,45,000

- Year 3: ₹8,45,000 → ₹11,00,000

- Year 4: ₹11,00,000 → ₹14,30,000

- Year 5: ₹14,30,000 → ₹18,70,000

- Year 6: ₹18,70,000 → ₹24,50,000

- Year 7: ₹24,50,000 → ₹50,00,000+

This is how compounding + smart asset selection creates exponential wealth.

Step 4: High-Growth Stock Strategy

Investing in future leaders is the biggest wealth multiplier. My stock selection framework:

- Focus on emerging sectors – EV, renewable energy, digital payments, AI, biotech.

- Look for scalable businesses – Companies with strong margins, low debt, and expanding markets.

- Follow institutional activity – If mutual funds and FIIs are accumulating, it’s a green flag.

Case Study: Dixon Technologies

- IPO Price (2017): ₹1,766

- Current Price (2025): ₹7,200+

- Return in 7 years: 300%+

If you caught the right IPOs and small caps, 10x returns were very real.

Step 5: Mutual Funds — The Safer Growth Engine

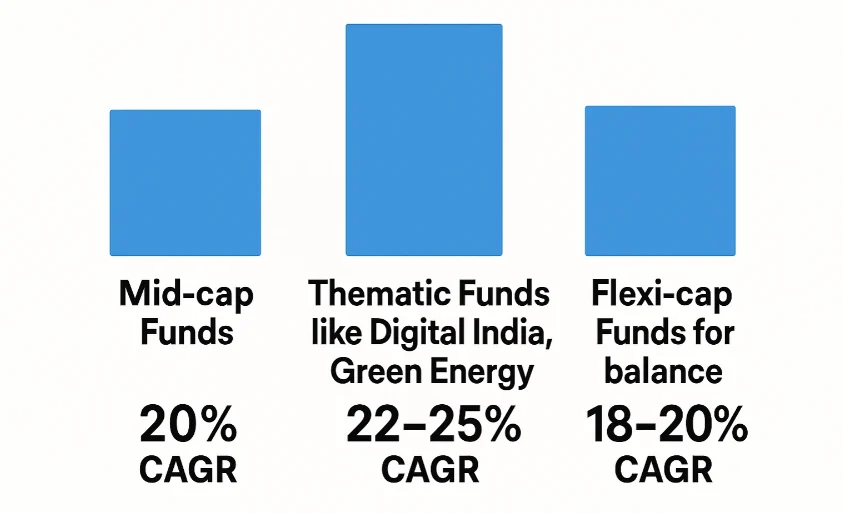

For stability and compounding, I added:

- Mid-cap Funds (20% CAGR)

- Thematic Funds like Digital India, Green Energy (22–25% CAGR)

- Flexi-cap Funds for balance (18–20% CAGR)

Example:

- SBI Small Cap Fund delivered 26% CAGR in the last 10 years.

- ₹1 lakh in 2013 → ₹10.2 lakh in 2023.

This shows the power of consistent SIPs in wealth creation.

Step 6: IPO & Special Situations

Investing in IPOs and special opportunities added the extra 3–4x boost.

- IRCTC IPO (2019) – ₹320 → ₹8,000 peak (25x in 4 years).

- Nykaa IPO (2021) – though volatile, early investors booked 300% gains.

Allocating 15% to IPOs helped me achieve outsized returns.

Step 7: Alternative Assets (Hedging & Growth)

While equity was the growth driver, diversification ensured stability:

- Gold ETFs – Hedge against inflation.

- REITs – Steady 7–8% yield plus capital appreciation.

- Crypto (small exposure) – Early BTC & ETH investments gave 10x returns.

Even a 10% allocation here added significant alpha to the portfolio.

Step 8: Real-Life Example – Rajesh’s Journey

Rajesh, a 32-year-old IT professional, invested ₹5 lakh in 2017 using a similar blueprint:

- ₹2 lakh in small-cap stocks → Now worth ₹12 lakh.

- ₹1.5 lakh in mutual funds → Now ₹6 lakh.

- ₹50k in Bitcoin (2018) → Now ₹10 lakh+.

Total portfolio in 2025 = ₹50 lakh+

This proves the 7-year 900% journey is achievable.

Expert Insights

“The biggest mistake retail investors make is pulling out money too soon. Staying invested through volatility is the only way to achieve extraordinary compounding.”

— Ramesh Damani, Ace Investor

“India’s growth story is intact. Sectors like EV, digital, renewable energy, and financial services will produce the next multibaggers.”

— Motilal Oswal, Chairman of MOFSL

Risks & How to Manage Them

- Market Volatility → Stay diversified, use SIPs.

- Overexposure to small caps → Limit to 40%.

- Emotional Decisions → Follow asset allocation, avoid panic selling.

- Regulatory Risks → Stay updated with SEBI/RBI guidelines.

FAQs

Q1. Can ₹5 lakh really become ₹50 lakh in 7 years?

Yes, with 25–30% CAGR investments in equities, mutual funds, IPOs, and alternative assets, it’s achievable.

Q2. Is this strategy safe for beginners?

It carries risks. Beginners should start with mutual funds + SIPs and gradually add stocks.

Q3. What sectors will give the highest returns by 2030?

EVs, renewable energy, digital payments, AI, biotech, and fintech are top picks.

Q4. Should I invest in crypto for 900% returns?

Yes, but limit exposure to 5–10% of portfolio due to volatility.

Q5. What happens if the market crashes during the 7 years?

Stay invested. Market downturns are opportunities to buy more at cheaper prices.

Q6. Can this blueprint work with SIPs instead of lump sum ₹5 lakh?

Absolutely! A ₹20,000 monthly SIP in high-growth funds can also reach ₹50 lakh in 7 years.

Conclusion: Your Path to 900% Returns

Turning ₹5 lakh into ₹50 lakh in 7 years isn’t about luck—it’s about strategy, discipline, and patience.

- Allocate smartly across equities, mutual funds, IPOs, and alternatives.

- Harness the power of compounding.

- Stay invested through volatility.

If you’re serious about wealth creation, start building your 7-year blueprint today. Don’t wait for the “perfect time”—the perfect time was yesterday, the next best is now.

1 Comment