Are you dreaming of growing your wealth at a rapid pace? Imagine turning a modest investment into a substantial nest egg in just five years. With the right strategy, investments offering 18% to 25% returns are within reach. But here’s the catch: high rewards come with high risks. In this blog, we’ll explore seven investment options that have the potential to deliver these impressive gains over the next half-decade. From the stock market to cryptocurrencies, we’ll break down each option, highlight the opportunities, and flag the risks—so you can make informed decisions.

Whether you’re a seasoned investor or just starting out, this guide will arm you with the knowledge to chase those big returns. Let’s dive into these exciting opportunities and see how you can put your money to work!

Table of Contents

Introduction: Why Aim for High Returns?

Investing is one of the most effective ways to build wealth, but not all investments are created equal. If you’re targeting 18% to 25% annual returns, you’re looking at opportunities that go beyond the safety of savings accounts or government bonds, which typically yield 2% to 5%. High-return investments can accelerate your financial goals—whether it’s buying a home, funding retirement, or achieving financial independence. However, they require a willingness to embrace risk and a commitment to research.

In this blog, we’ll cover seven investment options with the potential to hit that 18%-25% sweet spot over the next five years. We’ll provide actionable insights, expert quotes, and data to guide you. Ready to explore? Let’s get started!

1. High-Growth Stocks: Riding the Wave of Innovation

Stocks have long been a go-to for investors seeking substantial returns, especially high-growth companies in sectors like technology, biotech, and renewable energy. These are businesses poised for rapid expansion, often fueled by innovation or market disruption.

Why High-Growth Stocks?

- Explosive Potential: Companies like Amazon and Tesla have delivered triple-digit returns over short periods.

- Liquidity: Stocks can be bought and sold quickly, giving you flexibility.

- Diversification: Spread your investment across industries to balance risk.

How to Invest

- Target Innovators: Look for companies with cutting-edge products or services, like NVIDIA (AI chips) or Shopify (e-commerce).

- Check Metrics: Focus on firms with revenue growth exceeding 20% annually and strong leadership.

- Use Tools: Platforms like WallStreetZen or Yahoo Finance can help identify top performers.

Expert Quote: “Growth stocks are the rocket fuel of a portfolio, but you need a steady hand to navigate their volatility.” – Peter Lynch, legendary investor.

Historical Performance

Over the past decade, the FAANG stocks (Facebook, Amazon, Apple, Netflix, Google) have averaged annual returns exceeding 20%, according to Yahoo Finance data.

Risks

- Volatility: Prices can swing wildly, especially during market corrections.

- Overvaluation: High expectations can lead to bubbles that burst.

2. Real Estate: Building Wealth Brick by Brick

Real estate offers a dual promise: steady income from rentals and long-term appreciation. With the right market and strategy, it’s a solid contender for high returns.

Why Real Estate?

- Income Stream: Rental properties generate cash flow month after month.

- Appreciation: Property values in growing areas can soar over five years.

- Tax Perks: Deductions for mortgage interest and depreciation boost net returns.

How to Invest

- Rental Properties: Buy in high-demand cities like Austin, TX, or Raleigh, NC.

- REITs: Invest in Real Estate Investment Trusts via the stock market—think Vanguard REIT ETF (VNQ).

- Crowdfunding: Platforms like Fundrise let you start with as little as $10.

Example

A $200,000 rental property with 5% annual appreciation and $1,000 monthly rent (after expenses) could yield a 20%+ annualized return over five years, factoring in equity growth and income.

Risks

- Illiquidity: Selling property takes time and effort.

- Upkeep Costs: Repairs and vacancies can erode profits.

Expert Quote: “Real estate is about location, timing, and leverage—get those right, and the returns will follow.” – Barbara Corcoran, real estate mogul.

3. Cryptocurrencies: The Wild Card of Wealth

Cryptocurrencies have redefined high-risk, high-reward investing. Bitcoin and Ethereum have posted jaw-dropping gains, and their underlying blockchain technology hints at more growth to come.

Why Cryptocurrencies?

- Skyrocketing Gains: Bitcoin jumped from $1,000 to $69,000 between 2017 and 2021.

- Future Potential: Blockchain adoption in finance and tech is accelerating.

- Accessibility: You can start with small amounts on exchanges like Coinbase.

How to Invest

- Buy and Hold: Purchase Bitcoin or Ethereum and wait for growth.

- Diversify: Explore altcoins like Solana or Cardano for higher upside (and risk).

- Stake: Earn rewards by locking up coins on platforms like Kraken.

Historical Performance

Bitcoin’s annualized return from 2016 to 2021 was over 100%, though it’s cooled since. Ethereum has followed a similar trajectory.

Risks

- Volatility: Prices can drop 30% in a day.

- Regulation: Government crackdowns could cap growth.

Expert Quote: “Crypto is a rollercoaster—strap in, but don’t bet the farm.” – Vitalik Buterin, Ethereum co-founder.

4. Peer-to-Peer Lending: Be the Bank

P2P lending platforms connect investors with borrowers, offering returns that outpace traditional fixed-income options. It’s a way to earn interest without a middleman.

Why P2P Lending?

- Solid Returns: Platforms like LendingClub advertise returns up to 14%-18%.

- Passive Income: Monthly payments roll in as borrowers repay.

- Control: Choose loans based on risk and return profiles.

How to Invest

- Pick a Platform: Try LendingClub, Prosper, or Percent.

- Diversify: Spread your money across dozens of loans to mitigate defaults.

- Start Small: Invest $25 per loan to test the waters.

Example

Investing $10,000 across 400 loans at 15% average interest could net $1,500 annually, compounding to a 20%+ return over five years.

Risks

- Defaults: Borrowers might not repay.

- Platform Risk: If the site fails, your funds could be at risk.

5. Venture Capital: Betting on the Next Big Thing

Venture capital lets you invest in startups with unicorn potential. It’s high-stakes, but the payoffs can be astronomical.

Why Venture Capital?

- Massive Upside: Early investors in Airbnb or Uber saw 100x returns.

- Innovation: Back groundbreaking ideas before they hit the mainstream.

- Excitement: Be part of the entrepreneurial journey.

How to Invest

- Angel Investing: Use AngelList to fund startups directly.

- Venture Funds: Join pooled investments for broader exposure.

- Equity Crowdfunding: Platforms like SeedInvest open doors to smaller investors.

Example

A $10,000 investment in a startup that grows 10x in five years could turn into $100,000—a 58% annualized return.

Risks

- Failure Rate: 90% of startups flop.

- Illiquidity: Your money is tied up for years.

Expert Quote: “Venture capital is about finding the one winner that pays for all the losers.” – Marc Andreessen, VC pioneer.

6. Commodities: Profiting from Raw Materials

Commodities like gold, silver, and oil can spike in value during economic shifts, offering a hedge and a shot at big gains.

Why Commodities?

- Inflation Hedge: Gold often rises when currencies weaken.

- Global Demand: Emerging markets drive demand for metals and energy.

- Diversification: Less tied to stock market movements.

How to Invest

- Physical Assets: Buy gold bars or silver coins.

- ETFs: Trade commodity funds like SPDR Gold Shares (GLD).

- Futures: Speculate on price movements (for advanced investors).

Historical Performance

Gold returned 10%-15% annually during inflationary periods like 2008-2012, with potential for higher spikes.

Risks

- Price Swings: Supply and demand can be unpredictable.

- Storage: Physical assets need safekeeping.

7. Options Trading: Leveraging Market Moves

Options trading uses leverage to amplify returns on stock price movements. It’s complex but powerful for skilled investors.

Why Options Trading?

- High Leverage: A small investment can control a big position.

- Flexibility: Profit in up or down markets.

- Income: Sell options for steady premiums.

How to Invest

- Calls: Bet on rising prices.

- Puts: Bet on falling prices.

- Covered Calls: Earn income on stocks you own.

Example

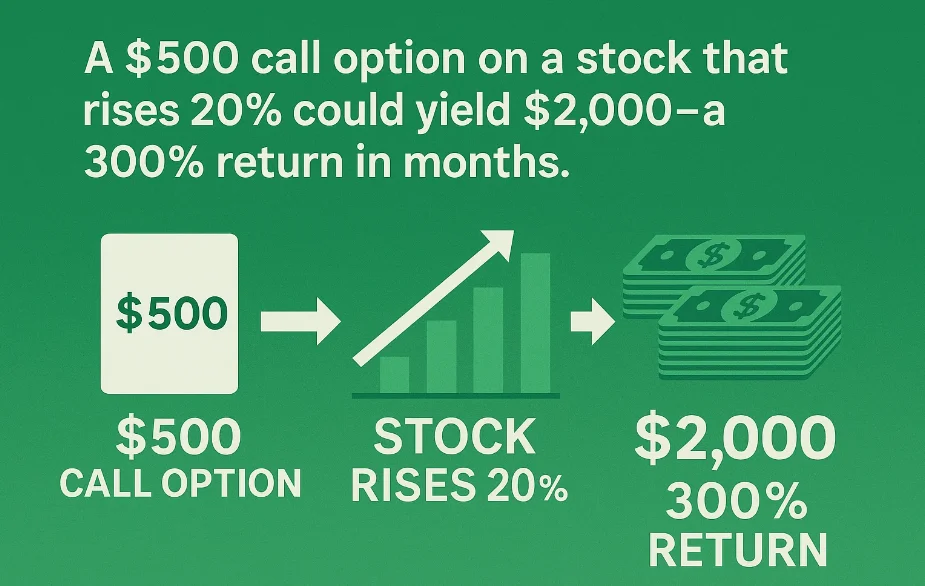

A $500 call option on a stock that rises 20% could yield $2,000—a 300% return in months.

Risks

- Complexity: Requires deep market knowledge.

- Losses: Leverage can magnify losses.

Expert Quote: “Options are tools—learn to use them, or they’ll use you.” – Nassim Taleb, options trader.

Comparison Table: Risk vs. Reward

| Investment | Potential Return | Risk Level | Liquidity | Time Horizon |

|---|---|---|---|---|

| High-Growth Stocks | 20%-30% | High | High | 5+ years |

| Real Estate | 15%-25% | Medium | Low | 5+ years |

| Cryptocurrencies | 25%-100%+ | Very High | High | 1-5 years |

| P2P Lending | 12%-18% | Medium | Medium | 1-3 years |

| Venture Capital | 25%-50%+ | Very High | Low | 5+ years |

| Commodities | 10%-20% | Medium | Medium | 1-5 years |

| Options Trading | 20%-50%+ | High | High | <1-5 years |

Key Tips for Success

- Diversify: Don’t put all your eggs in one basket—mix asset types.

- Research: Stay updated with market trends and expert forecasts.

- Start Small: Test each option with a small investment before scaling.

- Risk Management: Set stop-losses or limits to protect your capital.

The Power of Compound Growth

High returns get even better with compounding. Here’s how $10,000 grows over five years at different rates:

| Year | 18% Return | 20% Return | 25% Return |

|---|---|---|---|

| 1 | $11,800 | $12,000 | $12,500 |

| 2 | $13,924 | $14,400 | $15,625 |

| 3 | $16,430 | $17,280 | $19,531 |

| 4 | $19,387 | $20,736 | $24,414 |

| 5 | $22,876 | $24,883 | $30,517 |

At 20%, your $10,000 becomes nearly $25,000—more than doubling in five years. That’s the magic of high-return investing!

FAQs

Q: How much should I invest in these high-return options?

A: Limit risky investments to 10%-20% of your portfolio, depending on your comfort level.

Q: Are these returns guaranteed?

A: No, high returns come with high risks. Past performance isn’t a promise of future results.

Q: What’s the safest option on this list?

A: Real estate and P2P lending tend to have more predictable returns, though they’re not risk-free.

Q: Can I start with $500?

A: Yes! Try P2P lending, fractional stock shares, or crypto to get started small.

Q: Should I hire a financial advisor?

A: If you’re new to high-risk investing, an advisor can help tailor a plan to your goals.

Conclusion: Your Path to High Returns

Chasing 18%-25% returns over the next five years is an ambitious but achievable goal. Whether you’re drawn to the fast-paced world of cryptocurrencies, the steady growth of real estate, or the leverage of options trading, there’s an option here for you. The key? Balance ambition with caution. Diversify your investments, stay informed, and be patient.

As Warren Buffett famously said, “Risk comes from not knowing what you’re doing.” Equip yourself with knowledge, and these seven investments could be your ticket to financial success. Ready to take the plunge? Start researching today—your future self will thank you!

Leave a Reply