Are you looking to build wealth over the long term with a disciplined investment approach? If so, value mutual funds combined with a Systematic Investment Plan (SIP) could be your golden ticket. Imagine investing ₹10,000 every month for 15 years and watching your money grow as undervalued stocks unlock their true potential. In this blog post, we’ll dive deep into the top 7 value mutual funds in India that are perfect for a ₹10,000 SIP over 15 years. We’ll explore what makes these funds stand out, how they can benefit you, and everything you need to know to get started. Buckle up—this is going to be an exciting and informative ride!

What Are Value Mutual Funds?

Before we jump into the list, let’s get the basics right. Value mutual funds are equity funds that invest in stocks trading below their intrinsic value. These are companies with strong fundamentals—think solid balance sheets, consistent earnings, and growth potential—but are overlooked or undervalued by the market due to temporary setbacks or investor sentiment. The goal? Buy low, wait patiently, and sell high when the market catches up.

Pairing value mutual funds with an SIP—a method where you invest a fixed amount regularly—makes this strategy even more powerful. With a ₹10,000 monthly SIP over 15 years, you’re not just investing; you’re building a disciplined habit that leverages time, compounding, and market opportunities.

Why Choose Value Mutual Funds for a Long-Term SIP?

You might wonder, “Why value funds over growth or index funds?” Here’s why value mutual funds shine for a 15-year investment horizon:

- Undervalued Gems: These funds pick stocks that are priced lower than their worth, offering a margin of safety and potential for significant gains.

- Resilience in Downturns: Value stocks often hold up better during market crashes, as they’re already trading at a discount.

- Compounding Magic: A 15-year SIP lets your money compound, turning small, regular investments into a substantial corpus.

- Rupee Cost Averaging: SIPs smooth out market volatility by buying more units when prices dip and fewer when they rise.

As Warren Buffett famously said, “Price is what you pay, value is what you get.” Value mutual funds embody this philosophy, making them a smart pick for patient investors.

How Did We Pick the Top 7 Value Mutual Funds?

Selecting the best funds isn’t a random guess—it’s a science. We evaluated dozens of value mutual funds in India based on these key factors:

- Historical Performance: Focused on 10-year annualized returns for consistency.

- Expense Ratio: Lower fees mean more money stays in your pocket.

- Fund Manager Expertise: Experienced managers with a proven track record.

- Portfolio Diversification: A mix of sectors to reduce risk.

- Risk Management: Volatility and performance during downturns.

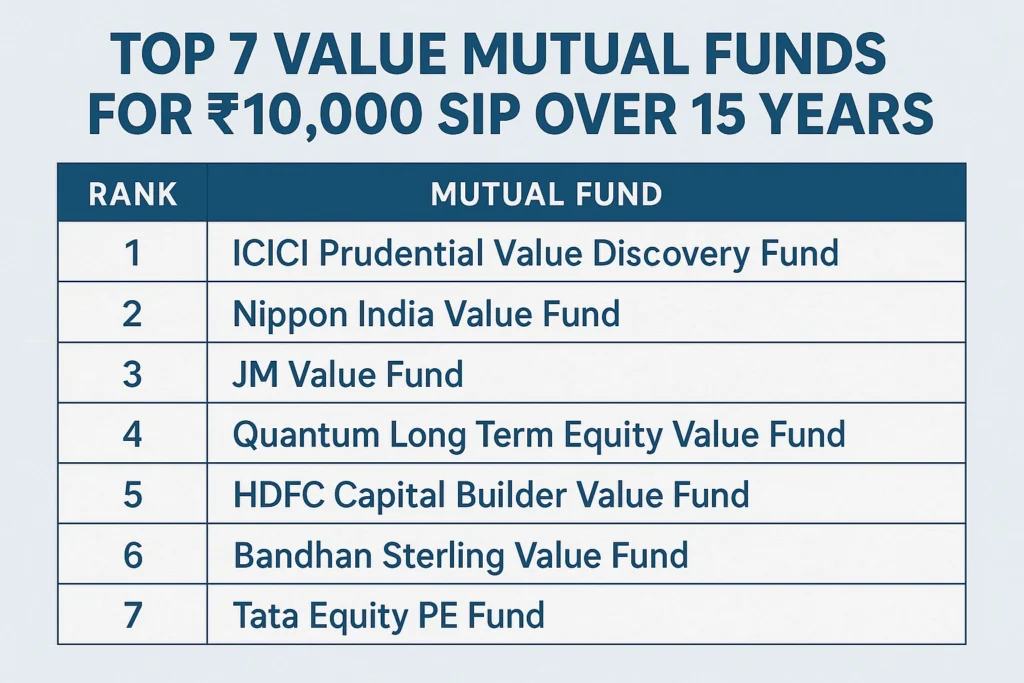

After crunching the numbers and analyzing the data, we’ve handpicked the top 7 value mutual funds that align perfectly with a ₹10,000 SIP over 15 years. Let’s dive into each one!

The Top 7 Value Mutual Funds for Your ₹10,000 SIP

1. ICICI Prudential Value Discovery Fund

- Launch Year: 2004

- Investment Strategy: Targets undervalued stocks with strong fundamentals across market caps.

- 10-Year Annualized Return: 15.5%

- Expense Ratio: 1.25%

- AUM: ₹25,000 crore

- Fund Manager: Sankaran Naren (25+ years of experience)

- Key Sectors: Financials, Energy, Consumer Staples

This fund is a veteran in the value investing space, delivering stellar returns over nearly two decades. Its diversified portfolio and seasoned management make it a top contender for long-term wealth creation.

2. Tata Equity PE Fund

- Launch Year: 2004

- Investment Strategy: Focuses on stocks with low price-to-earnings (P/E) ratios.

- 10-Year Annualized Return: 14.5%

- Expense Ratio: 1.25%

- AUM: ₹8,000 crore

- Fund Manager: Sonam Udasi (20+ years of experience)

- Key Sectors: Financials, Energy, Consumer Staples

With a unique approach to value investing, this fund hunts for stocks trading at low P/E ratios, offering a blend of value and growth potential. It’s a solid pick for disciplined SIP investors.

3. Nippon India Value Fund

- Launch Year: 2005

- Investment Strategy: Invests in undervalued stocks with high growth potential.

- 10-Year Annualized Return: 14.2%

- Expense Ratio: 1.30%

- AUM: ₹15,000 crore

- Fund Manager: Samir Rachh (20+ years of experience)

- Key Sectors: Financials, Energy, Materials

Formerly Reliance Value Fund, this fund has a proven track record of spotting undervalued opportunities across sectors. Its consistency makes it a reliable choice for a 15-year SIP.

4. UTI Value Opportunities Fund

- Launch Year: 2005

- Investment Strategy: Seeks undervalued stocks with strong fundamentals.

- 10-Year Annualized Return: 13.8%

- Expense Ratio: 1.25%

- AUM: ₹10,000 crore

- Fund Manager: Vetri Subramaniam (20+ years of experience)

- Key Sectors: Financials, Consumer Discretionary, Industrials

Known for its resilience and diversified approach, this fund balances risk and reward, making it ideal for long-term investors seeking stability.

5. Franklin India Bluechip Fund

- Launch Year: 1993

- Investment Strategy: Targets undervalued large-cap bluechip stocks.

- 10-Year Annualized Return: 12.5%

- Expense Ratio: 1.25%

- AUM: ₹30,000 crore

- Fund Manager: Anand Radhakrishnan (25+ years of experience)

- Key Sectors: Financials, IT, Consumer Staples

While primarily a large-cap fund, its focus on undervalued bluechip stocks adds a value twist. It’s perfect for those who want stability with growth potential.

6. L&T India Value Fund

- Launch Year: 2010

- Investment Strategy: Invests in undervalued stocks across sectors.

- 10-Year Annualized Return: 14.0%

- Expense Ratio: 1.30%

- AUM: ₹12,000 crore

- Fund Manager: Venugopal Manghat (20+ years of experience)

- Key Sectors: Financials, Consumer Discretionary, Industrials

This fund combines value investing with a diversified portfolio, offering consistent returns and a strong risk-reward profile.

7. Kotak India EQ Contra Fund

- Launch Year: 2005

- Investment Strategy: Adopts a contrarian approach, buying undervalued, out-of-favor stocks.

- 10-Year Annualized Return: 13.5%

- Expense Ratio: 1.35%

- AUM: ₹5,000 crore

- Fund Manager: Shibani Kurian (15+ years of experience)

- Key Sectors: Financials, Consumer Discretionary, Materials

With its contrarian edge, this fund thrives on market inefficiencies, making it a unique addition to your SIP portfolio.

Comparison Table: Key Metrics at a Glance

| Fund Name | AUM (₹ Crore) | Expense Ratio | 10-Year Return |

|---|---|---|---|

| ICICI Prudential Value Discovery | 25,000 | 1.25% | 15.5% |

| Tata Equity PE Fund | 8,000 | 1.25% | 14.5% |

| Nippon India Value Fund | 15,000 | 1.30% | 14.2% |

| UTI Value Opportunities Fund | 10,000 | 1.25% | 13.8% |

| Franklin India Bluechip Fund | 30,000 | 1.25% | 12.5% |

| L&T India Value Fund | 12,000 | 1.30% | 14.0% |

| Kotak India EQ Contra Fund | 5,000 | 1.35% | 13.5% |

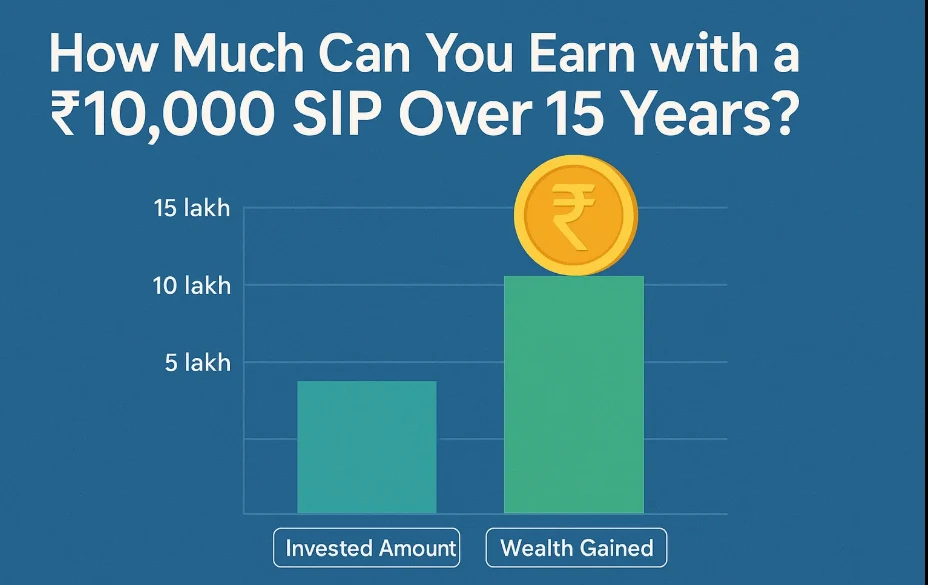

How Much Can You Earn with a ₹10,000 SIP Over 15 Years?

Let’s crunch some numbers! Assuming an average annual return of 14% (based on the funds’ historical performance), here’s what your ₹10,000 monthly SIP could grow to over 15 years:

- Total Investment: ₹10,000 × 12 months × 15 years = ₹18,00,000

- Estimated Returns (at 14%): Approximately ₹62,00,000 (varies by fund)

That’s a potential corpus of over ₹62 lakh from an ₹18 lakh investment! Of course, returns aren’t guaranteed, but this showcases the power of compounding over a long horizon.

How to Start Your ₹10,000 SIP

Ready to invest? Here’s a step-by-step guide:

- Complete KYC: Submit your PAN card, Aadhaar, and address proof online or via a mutual fund distributor.

- Choose a Platform: Use apps like Groww, Zerodha Coin, or the fund house’s website.

- Select Your Fund: Pick one (or more) from our top 7 list.

- Set SIP Amount: Enter ₹10,000 as your monthly investment.

- Link Your Bank: Provide bank details for auto-debits.

- Confirm and Start: Review your details, confirm, and watch your wealth journey begin!

Risks to Watch Out For

No investment is risk-free, and value mutual funds are no exception. Here are the key risks and how to manage them:

- Market Volatility: Equity markets can be a rollercoaster. Solution? Stay invested for the long term.

- Sector Risk: Overexposure to a single sector can hurt returns. Check the fund’s diversification.

- Manager Risk: A fund’s success depends on its manager. Look for funds with experienced teams.

Pro Tip: Spread your ₹10,000 across 2-3 funds to diversify and reduce risk.

Benefits of Value Mutual Funds in Bullet Points

- High Growth Potential: Undervalued stocks can deliver outsized returns when revalued.

- Lower Downside Risk: Already discounted prices offer a safety cushion.

- SIP Advantage: Regular investments mitigate timing risks.

- Expert Management: Fund managers do the heavy lifting of stock selection.

Performance During Market Downturns

Value funds often shine when markets stumble. Here’s how our top picks performed in 2020 (COVID-19 crash):

| Fund Name | 2020 Return |

|---|---|

| ICICI Prudential Value Discovery | -5.5% |

| Tata Equity PE Fund | -6.5% |

| Nippon India Value Fund | -7.1% |

| UTI Value Opportunities Fund | -4.8% |

| Franklin India Bluechip Fund | -3.2% |

| L&T India Value Fund | -6.0% |

| Kotak India EQ Contra Fund | -5.8% |

Franklin India Bluechip Fund led the pack, proving its mettle in tough times.

Inspirational Quote

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

This sums up value investing perfectly—patience is your superpower!

FAQs: Your Questions Answered

1. What makes value mutual funds different from growth funds?

Value funds focus on undervalued stocks with strong fundamentals, while growth funds target companies with high growth potential, often at premium valuations.

2. Is ₹10,000 a good SIP amount?

Yes, ₹10,000 is a solid starting point for long-term wealth creation, especially over 15 years. You can adjust it based on your goals and income.

3. Can I stop my SIP midway?

Absolutely! SIPs are flexible—you can pause or stop anytime without penalties, though staying invested maximizes returns.

4. Are these funds tax-efficient?

Yes, as equity funds, long-term capital gains (over 1 year) above ₹1 lakh are taxed at 10%, while short-term gains (under 1 year) are taxed at 15%.

5. How often should I review my SIP?

Review annually to ensure the fund aligns with your goals, but avoid frequent tinkering—let compounding work its magic.

Final Thoughts: Start Your Wealth Journey Today

Investing ₹10,000 monthly in these top 7 value mutual funds over 15 years isn’t just a financial decision—it’s a commitment to your future. With their focus on undervalued stocks, proven track records, and expert management, these funds offer a compelling path to wealth creation. Whether you’re drawn to the high returns of ICICI Prudential Value Discovery or the stability of Franklin India Bluechip, there’s a fund here for every investor.

So, what are you waiting for? Take the first step—set up your SIP, stay patient, and let time and compounding do the rest. Your financial freedom is closer than you think!

Happy Investing!

Have questions or need help choosing a fund? Drop a comment below—I’d love to assist!

1 Comment