Introduction: Turning Your Investments into a Steady ₹25,000 Monthly Income

Imagine this: you retire or want to take a short break from work — yet, every month, ₹25,000 lands quietly in your bank account. No tension, no calls from brokers, and no sleepless nights over market swings. Sounds like a dream?

Well, it’s completely achievable through something called an SWP — Systematic Withdrawal Plan.

If you’ve already invested in mutual funds and now wish to enjoy a steady monthly income, the SWP strategy can help you turn your investment corpus into a consistent cash flow — without disturbing your long-term goals.

In this guide, we’ll explain how an SWP works, how much you need to invest for ₹25,000 monthly income, and which funds suit this goal best — all in simple, human terms.

What Is an SWP (Systematic Withdrawal Plan)?

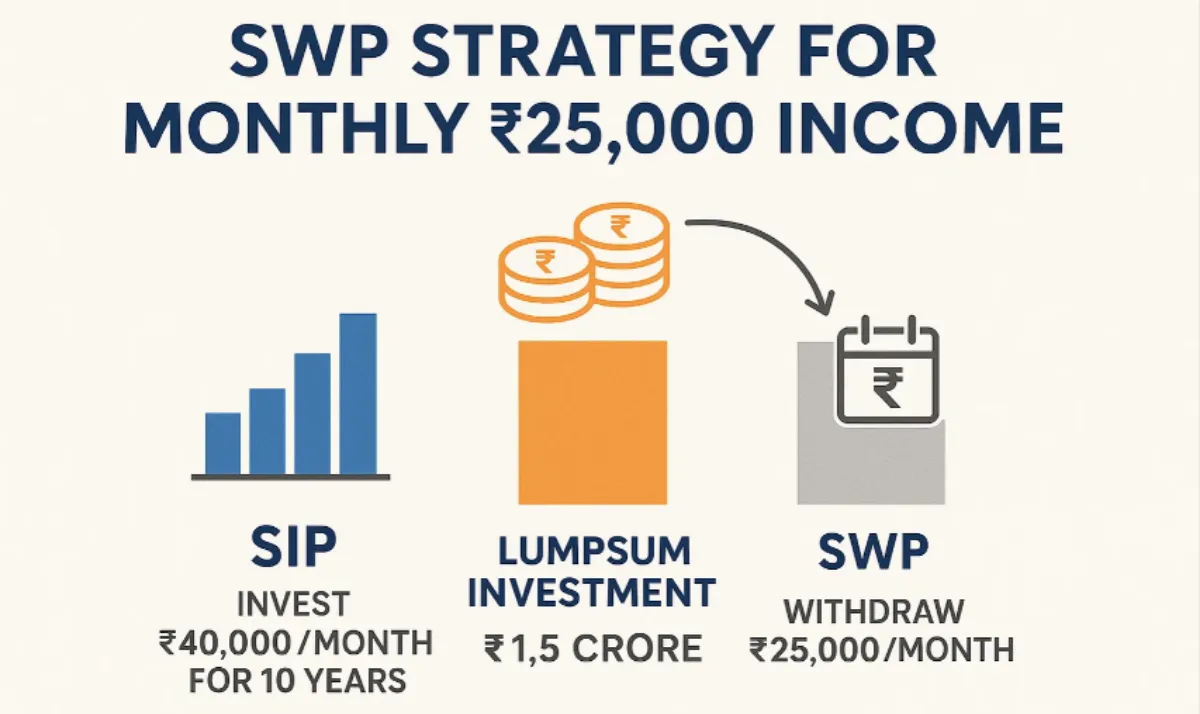

An SWP (Systematic Withdrawal Plan) is a smart mutual fund feature that lets you withdraw a fixed amount regularly — monthly, quarterly, or annually — from your mutual fund investment.

Think of it as the opposite of SIP (Systematic Investment Plan).

- In SIP, you invest regularly into a fund.

- In SWP, you withdraw regularly from your fund.

It’s like setting up a personal monthly salary from your mutual fund corpus.

So, instead of redeeming your entire investment at once, you withdraw only what you need — letting the rest of your money continue to grow through compounding.

How Does SWP Work in Real Life?

Let’s understand with a simple example:

| Scenario | Details |

|---|---|

| Investment Corpus | ₹30 lakh |

| Fund Type | Balanced Advantage Fund |

| Expected Annual Return | 10% |

| SWP Amount | ₹25,000 per month |

| Annual Withdrawal | ₹3 lakh |

| Net Growth (approx.) | ₹30 lakh × (10% – 3%) = ₹2.1 lakh growth yearly |

So even after withdrawing ₹3 lakh annually, your remaining corpus continues to grow due to the 10% annual return.

This balance between income generation and capital preservation is what makes SWP so powerful for investors — especially retirees or those seeking passive income.

How Much Corpus Do You Need for ₹25,000 Monthly SWP?

The most common question investors ask is:

“How much should I invest to earn ₹25,000 per month through SWP?”

Let’s calculate using realistic assumptions.

Scenario 1: Moderate 8% Return Fund

| Monthly SWP Goal | Expected Annual Return | Safe Withdrawal Rate (6%) | Required Corpus |

|---|---|---|---|

| ₹25,000/month | 8% | 6% | ₹50 lakh |

In this scenario, if you invest ₹50 lakh, you can comfortably withdraw ₹25,000 every month for several years, assuming the fund grows around 8% annually.

Also Read: ₹11,480 Crore Created by Top Performing SWP Mutual Funds

Scenario 2: Aggressive 10% Return Fund

| Monthly SWP Goal | Expected Annual Return | Safe Withdrawal Rate (8%) | Required Corpus |

|---|---|---|---|

| ₹25,000/month | 10% | 8% | ₹37.5 lakh |

Here, with a slightly higher return expectation (10%), you need around ₹37.5 lakh corpus to generate the same ₹25,000 monthly income.

Scenario 3: Conservative 6% Return Fund

| Monthly SWP Goal | Expected Annual Return | Safe Withdrawal Rate (5%) | Required Corpus |

|---|---|---|---|

| ₹25,000/month | 6% | 5% | ₹60 lakh |

If you prefer safer funds like debt or hybrid funds, you’ll need ₹60 lakh to generate ₹25,000 monthly with minimum risk.

The “4%–6% Rule” for Sustainable SWP Income

Experts often suggest a 4%–6% annual withdrawal rate for SWPs.

Here’s what that means:

- If your corpus earns around 8–10% yearly, withdrawing 4%–6% per year helps preserve your principal for long-term use.

- For example, with ₹50 lakh corpus, withdrawing ₹2–3 lakh per year (₹16,000–₹25,000/month) is safe and sustainable.

In short:

Withdraw too little = you underutilize your money.

Withdraw too much = you risk exhausting your corpus early.

Balance is the key.

Why SWP Is Better Than Bank FD or Monthly Income Schemes

Let’s compare SWP with traditional income options:

| Feature | SWP (Mutual Funds) | Bank FD | Post Office MIS |

|---|---|---|---|

| Return Potential | 8–12% (equity-oriented) | 6–7% | 6.6% |

| Tax Efficiency | Capital Gains Tax (lower) | Interest taxed as income | Interest taxed as income |

| Liquidity | High | Moderate | Limited |

| Flexibility | Fully customizable | Fixed term | Fixed term |

| Inflation Protection | Yes (if equity-based) | No | No |

Verdict: SWP offers better post-tax returns, flexibility, and inflation protection, making it ideal for long-term monthly income planning.

How to Set Up an SWP for ₹25,000/Month

Follow these 5 simple steps:

Step 1: Choose the Right Mutual Fund

Prefer funds with consistent returns, moderate volatility, and low expense ratios.

Top categories include:

- Balanced Advantage Funds

- Conservative Hybrid Funds

- Equity Savings Funds

- Short-duration Debt Funds (for low risk)

Step 2: Calculate Required Corpus

Use the 6% rule:

Corpus = (Desired Monthly Income × 12) ÷ 0.06

Corpus = (₹25,000 × 12) ÷ 0.06 = ₹50 lakh approx.

Step 3: Start SWP After 1-Year Holding

Avoid starting withdrawals immediately after investment.

Let your corpus grow for at least 12 months before activating SWP.

Step 4: Set SWP Frequency

Choose monthly payouts to mimic a salary-like income.

Step 5: Review Performance Every 6–12 Months

Adjust withdrawal amounts if market returns change significantly.

Best SWP-Friendly Mutual Funds (as of 2025)

| Category | Fund Name | 5-Year CAGR | Risk Level | Best For |

|---|---|---|---|---|

| Balanced Advantage | HDFC Balanced Advantage Fund | 12.3% | Moderate | Long-term SWP |

| Conservative Hybrid | ICICI Pru Regular Savings Fund | 8.9% | Low | Retirees |

| Equity Savings | Kotak Equity Savings Fund | 9.5% | Moderate | Regular Income |

| Debt Fund | Axis Short Term Fund | 7.2% | Low | Conservative investors |

| Dynamic Asset Allocation | Edelweiss Balanced Advantage Fund | 11.8% | Moderate | Growth + Income |

(Data Source: AMFI, Value Research, 2025)

Expert Insights: How to Maximize Your SWP Returns

1. Choose Growth Option, Not Dividend

Always select the Growth option in mutual funds — SWP will withdraw from your capital gains, not depend on fund house declarations.

2. Diversify Your Portfolio

Split your corpus:

- 60% in hybrid or balanced funds

- 40% in short-duration debt funds

This ensures steady growth plus stability.

3. Avoid Starting SWP in Bear Markets

If markets are falling, delay SWP activation by a few months to protect your corpus.

4. Reinvest Surplus Income

If you don’t need all ₹25,000 monthly, reinvest part of it in low-risk funds to maintain compounding.

Also Read: SWP mutual fund plans for ₹1 crore investment

Taxation of SWP Withdrawals (Simple Explanation)

Unlike bank interest, SWP withdrawals are not fully taxed.

Only the gains portion of each withdrawal is taxable.

For Example:

You invested ₹10 lakh in a balanced fund.

After a year, your investment grows to ₹11 lakh.

You withdraw ₹1 lakh through SWP.

Here’s how it works:

- ₹90,909 = principal (no tax)

- ₹9,091 = gain (taxable)

So, you pay tax only on ₹9,091, not the entire ₹1 lakh.

Tax Rates (as of FY 2025–26):

| Fund Type | Holding Period | Tax Rate |

|---|---|---|

| Equity-Oriented | < 1 year | 15% (STCG) |

| Equity-Oriented | > 1 year | 10% (LTCG above ₹1 lakh) |

| Debt-Oriented | < 3 years | As per income slab |

| Debt-Oriented | > 3 years | 20% with indexation |

Tip: Prefer hybrid or equity savings funds for better post-tax income.

SWP vs Dividend Option — Which Is Better?

| Aspect | SWP (Growth Option) | Dividend Option |

|---|---|---|

| Flexibility | You choose withdrawal amount | Fund decides payout |

| Taxation | Only capital gains taxed | Dividend taxed at your slab |

| Corpus Control | Full control | Limited |

| Reliability | Guaranteed withdrawal | Uncertain payout frequency |

Verdict: SWP (Growth Option) is more flexible and tax-efficient.

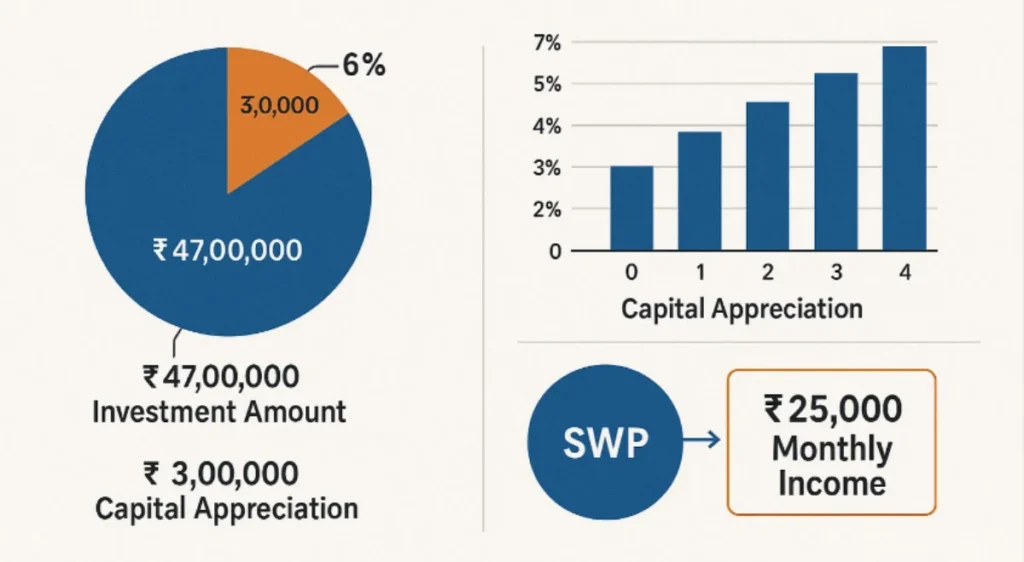

Real-Life Example: ₹50 Lakh Corpus SWP Plan

Let’s simulate a real investor case:

| Details | Values |

|---|---|

| Initial Corpus | ₹50,00,000 |

| Fund Type | Balanced Advantage Fund |

| Expected Return | 9% per annum |

| Monthly Withdrawal | ₹25,000 |

| Tenure | 10 years |

After 10 years:

- Total withdrawal = ₹30 lakh

- Corpus value (approx.) = ₹58–60 lakh

You received ₹25,000/month for 10 years and still retained most of your principal.

Table: SWP Monthly Income for Different Corpus Levels

| Corpus Amount | Expected Return (8%) | Safe SWP/Month |

|---|---|---|

| ₹20 lakh | Moderate | ₹10,000 |

| ₹30 lakh | Moderate | ₹15,000 |

| ₹40 lakh | Moderate | ₹20,000 |

| ₹50 lakh | Moderate | ₹25,000 |

| ₹60 lakh | Moderate | ₹30,000 |

(Assuming 6% annual withdrawal rate)

Common Mistakes to Avoid in SWP

- Starting SWP immediately after investment

- Choosing 100% equity fund for income generation

- Ignoring tax implications

- Not reviewing performance annually

- Withdrawing higher than 8% annually (unsustainable)

“A well-planned SWP strategy ensures steady income, tax efficiency, and longevity of your portfolio. Treat it like a personal pension, not an ATM.”

— Raghav Choudhary, Certified Financial Planner (CFP)

Tools to Calculate Your SWP

You can use:

- Groww SWP Calculator

- ET Money SWP Planner

- SBI Mutual Fund SWP Tool

These help estimate how much corpus is needed for your desired monthly income.

Summary: Key Takeaways

| Aspect | Key Insight |

|---|---|

| Target Income | ₹25,000/month |

| Ideal Corpus | ₹37–50 lakh |

| Safe Withdrawal Rate | 4%–6% annually |

| Best Fund Type | Balanced Advantage / Hybrid |

| Tax Advantage | Only on gains, not full amount |

| Goal | Steady, inflation-beating income |

Conclusion: Make Your Money Work Like a Monthly Salary

SWP isn’t just a withdrawal plan — it’s a financial lifestyle strategy.

It gives you the freedom to enjoy your money without killing the compounding effect of mutual funds.

Whether you’re planning retirement, aiming for part-time work, or simply want steady ₹25,000/month passive income, the SWP route makes it possible — smartly and sustainably.

Start small, diversify, review regularly, and let your money work for you, month after month.

CTA

Want to explore which mutual funds can generate ₹25,000 monthly income for you?

Visit SmartBlog91.com for in-depth fund comparisons, SWP calculators, and expert guides designed for Indian investors.

Leave a Reply