The oil market plays a significant role in the global economy, and its impact on foreign exchange (forex) markets is evident. This article will explore the relationship between oil prices and exchange rates, the drivers of this relationship, and the potential implications for global finance.

The Relationship Between Oil Prices and Exchange Rates

Oil prices and exchange rates have been found to be interconnected, with a long-term equilibrium between the two. The co-movement of higher oil prices and currency appreciation, particularly the US dollar, can exert unprecedented pressures on oil importers, especially in emerging market economies (EMEs) . The transition of the US from an oil importer to an oil exporter, thanks to the shale revolution, has created a new dimension of fiscal risk that is currently not fully priced in financial markets.

Drivers of the Oil-Dollar Relationship

Several factors contribute to the relationship between oil prices and exchange rates:

- Direct and indirect channels: Oil prices can have a direct impact on exchange rates through trade balances and capital flows. Additionally, oil prices can indirectly influence exchange rates by affecting other financial assets and commodity prices.

- Bilateral and multilateral interactions: The relationship between oil prices and exchange rates is not limited to direct bilateral interactions. Instead, it involves complex multilateral interactions involving various financial and commodity markets.

- Short-term and long-term effects: The impact of oil prices on exchange rates can be short-term or long-term, depending on the specific market conditions and the strength of the transmission channels.

Implications for Global Finance

The shifting oil-dollar relationship has several potential economic, policy, and portfolio implications:

- Increased fiscal risk: The transition of the US from an oil importer to an oil exporter creates a new dimension of fiscal risk that is currently not fully priced in financial markets.

- Exchange rate pressures: The co-movement of oil prices and currency appreciation can exert unprecedented pressures on oil importers, particularly in EMEs.

- Financial market implications: The increased use of oil as a financial asset has intensified the link between oil and other assets, with a sizeable difference in the strength of transmission between direct and indirect channels.

- Policy challenges: Policymakers in oil-dependent countries need to navigate the complexities of the oil-dollar relationship and develop strategies to manage the potential impact of oil price volatility on their economies.

In conclusion, the relationship between oil prices and exchange rates is complex and multifaceted, with significant implications for global finance. As the oil market continues to evolve, policymakers and financial market participants must closely monitor the shifting oil-dollar relationship and develop strategies to manage the associated risks and opportunities.

Q&A

Q: How has the shale revolution affected the oil-dollar relationship?

A: The shale revolution has significantly impacted the oil-dollar relationship by transforming the US from an oil importer to an oil exporter. This shift has created a new dimension of fiscal risk that is currently not fully priced in financial markets. The increased production capacity and geopolitical considerations have led to a more complex and interconnected relationship between oil prices and exchange rates.

Q: Can you provide examples of countries that have been affected by the oil-dollar relationship?

A: Countries that rely heavily on oil exports, such as those in the Middle East and Africa, have been significantly affected by the oil-dollar relationship. For instance, the economic and financial conditions of countries like Saudi Arabia, the United Arab Emirates, and Iran are closely tied to the global oil market. On the other hand, countries with weaker currencies, such as those in Latin America and the Caribbean, have experienced fluctuations in exchange rates due to the co-movement of oil prices and currency appreciation.

Q: How can policymakers navigate the complexities of the oil-dollar relationship?

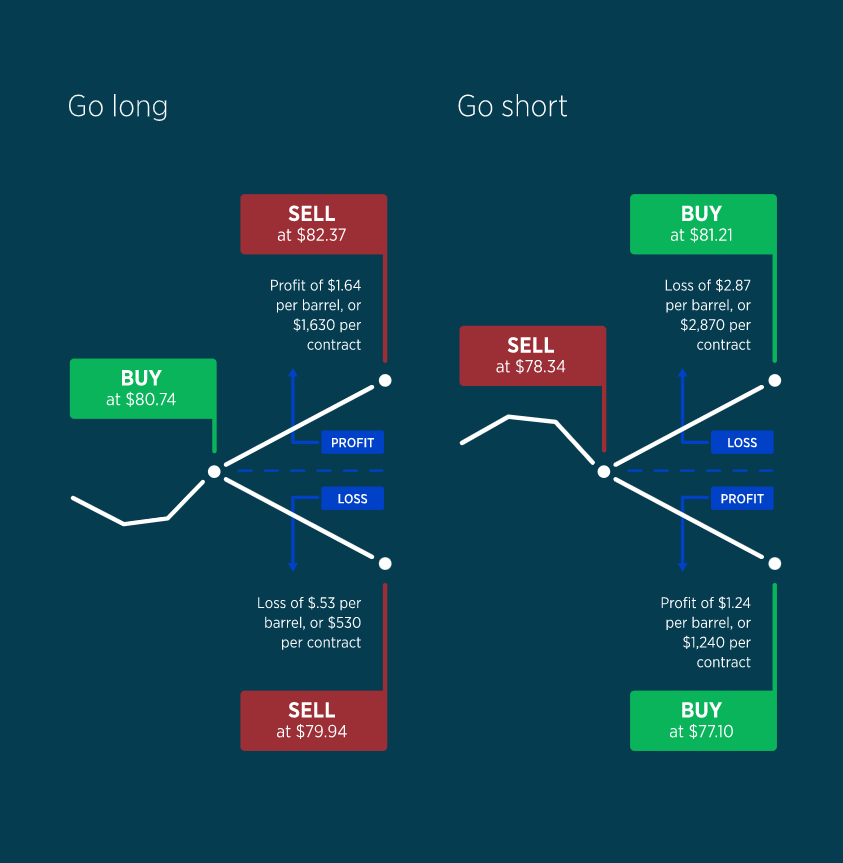

A: Policymakers in oil-dependent countries can navigate the complexities of the oil-dollar relationship by implementing prudent macroeconomic policies, diversifying their economies, and managing exchange rates through targeted interventions or flexible exchange rate regimes. They should also consider the use of financial instruments, such as forward contracts, futures, and options, to hedge against oil price volatility and mitigate the impact on their economies.