Introduction: The Wake-Up Call for Your Retirement

Waking up one morning, years from now, knowing your monthly expenses are covered—no stress, just freedom. That’s what sound retirement planning can do. Yet, too many of us put it off, thinking we have “plenty of time.” I’ve seen close friends realize, at 50, that their savings might dry up in a decade. The numbers? As per a recent survey, only one in three Indians feels “fully prepared” for retirement.

Table of Contents

Now, here’s the kicker: Just one shift—choosing high-performing funds with 14%+ long-term returns—can multiply your retirement corpus exponentially. In this guide, you’ll learn how ordinary investors are securing extraordinary retirements. Let’s explore the exact funds, strategies, and expert insights that could turn your financial worries into a peaceful, abundant, and independent life.

Stay with me—what you discover next could mean the difference between working in your 60s or relaxing by the beach, with nothing but choices ahead.

Why 14% Returns Matter for Your Retirement

Ever wonder what a small percentage can do over decades? Returns aren’t just numbers—they’re the fuel that powers a comfortable retired life. Here’s why aiming for 14% long-term annual returns is a game-changer for savvy investors like you.

- Beating Inflation: Inflation eats up around 6-7% yearly in India. Anything below that, and you’re just treading water.

- Doubling Faster: At 14%, your money doubles in approximately 5 years (using the Rule of 72).

- Compound Growth: Over 25-30 years, compounding transforms even modest SIPs into massive nests.

Let’s break down the math.

| Investment Period (Years) | Monthly SIP (₹) | 8% Returns | 14% Returns |

|---|---|---|---|

| 15 | ₹10,000 | ₹28.5 lakh | ₹48 lakh |

| 25 | ₹10,000 | ₹77 lakh | ₹2+ crore |

| 30 | ₹10,000 | ₹1.5 crore | ₹4.7 crore |

A mere 6% difference in returns can make the difference between an ordinary and an extraordinary retirement.

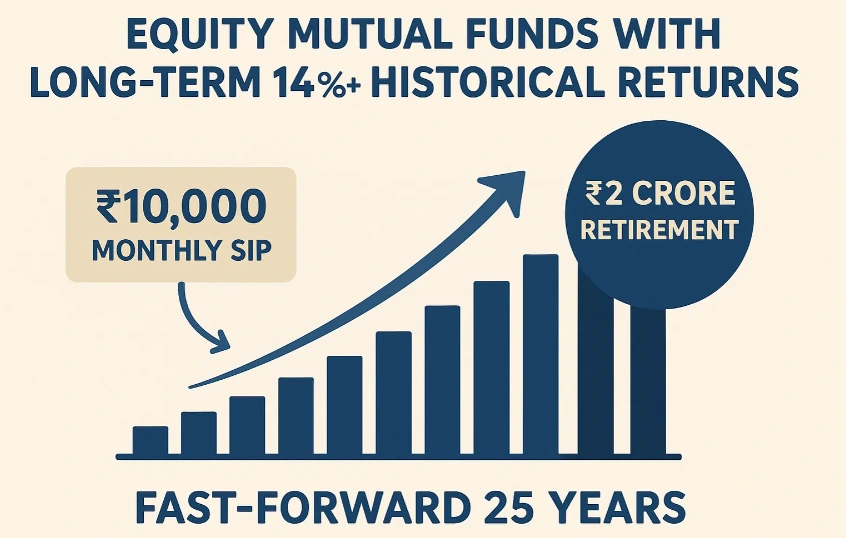

The Power of Starting Early—and Staying Consistent

You don’t need to be a market wizard. What matters more is discipline and an early start. Consider Kavita, an IT engineer who started her SIP at 27. She picked a combination of equity mutual funds with long-term 14%+ historical returns. Fast-forward 25 years, and her ₹10,000 monthly SIP is now a ₹2-crore retirement safety net.

“It wasn’t complicated. I just stuck to quality funds—and never paused my SIP,” she says. It’s real stories like this that prove the process works.

7 Funds with a Track Record of 14% Long-Term Returns

It’s time to reveal the very funds that have consistently helped investors build wealth for retirement in India. Note: these are direct, growth options where available, and all data reflects long-term (10 yrs+) CAGR as of July 2025.

| Fund Name | 10 Yr CAGR (%) | Category | Min. SIP (₹) | Min. Lumpsum (₹) |

|---|---|---|---|---|

| Axis Growth Opportunities Fund | 16.3 | Flexi Cap | ₹500 | ₹5,000 |

| Mirae Asset Emerging Bluechip Fund | 17.1 | Large & Mid Cap | ₹500 | ₹5,000 |

| SBI Small Cap Fund | 19.2 | Small Cap | ₹500 | ₹5,000 |

| Parag Parikh Flexi Cap Fund | 16.7 | Flexi Cap | ₹1,000 | ₹1,000 |

| Kotak Emerging Equity Scheme | 17.8 | Mid Cap | ₹500 | ₹5,000 |

| HDFC Flexi Cap Fund | 15.6 | Flexi Cap | ₹500 | ₹5,000 |

| Nippon India Growth Fund | 15.2 | Mid Cap | ₹500 | ₹5,000 |

Note: Past performance is not a guarantee of future results. Always review updated factsheets or consult a financial advisor.

Fund 1: Axis Growth Opportunities Fund

- Category: Flexi Cap

- Performance: 16.3% CAGR over ten years

- USP: Strong diversification, managed by a consistent team, exposure to both domestic and international equities.

- Ideal For: Investors seeking a balance of growth and stability.

Fund 2: Mirae Asset Emerging Bluechip Fund

- Category: Large & Mid Cap

- Performance: 17.1% CAGR over ten years

- USP: Impressive stock-picking—often rates among top in its segment.

- Ideal For: Moderately aggressive investors with a 7+ year horizon.

Fund 3: SBI Small Cap Fund

- Category: Small Cap

- Performance: 19.2% CAGR over ten years

- USP: Stellar returns, but expect higher volatility. Works best for those starting young.

- Ideal For: Aggressive investors targeting higher long-term growth.

Fund 4: Parag Parikh Flexi Cap Fund

- Category: Flexi Cap

- Performance: 16.7% CAGR over ten years

- USP: Unique global allocation—invests in Indian and select US stocks for true diversification.

- Ideal For: Investors wanting overseas exposure.

Fund 5: Kotak Emerging Equity Scheme

- Category: Mid Cap

- Performance: 17.8% CAGR over ten years

- USP: Consistent mid-cap picker, robust risk management.

- Ideal For: Those who can stomach volatility for better rewards.

Fund 6: HDFC Flexi Cap Fund

- Category: Flexi Cap

- Performance: 15.6% CAGR over ten years

- USP: Legacy fund with long market experience behind its picks.

- Ideal For: Conservative to moderate investors.

Fund 7: Nippon India Growth Fund

- Category: Mid Cap

- Performance: 15.2% CAGR over ten years

- USP: Steady outperformance in bull runs, avoids micro-cap excess risk.

- Ideal For: Diversification within mid-cap space.

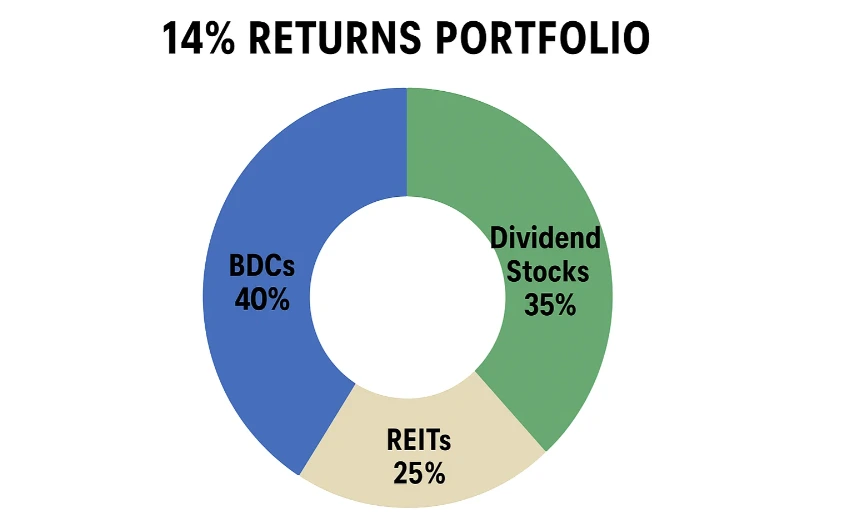

How to Build a 14% Returns Portfolio: Step-by-Step Guide

Step 1: Set Your Retirement Goal

Know your target corpus. Use online calculators with inflation factored in.

Step 2: Diversify Across 4-5 Funds

Choose a mix from the list above: one mid-cap, one large & mid-cap, one flexi-cap, and optionally, a small cap for added growth.

Step 3: Opt for the Direct Plan—Growth Option

This helps you save on expenses and maximize compounding.

Step 4: Invest via SIPs

Automate monthly investments. Even ₹5,000–₹10,000/month compounded at 14% for 25 years is transformational.

Step 5: Review Annually—Not Daily

Performance fluctuates in the short term. Focus on the long-term trend.

| Asset Mix | Expected 14%+ Returns Probability |

|---|---|

| 60% Flexi, 20% Small, 20% Mid | High |

| 40% Flexi, 30% Mid, 30% Large | High |

| 50% Flexi, 25% Small, 25% Large & Mid | Moderate to High |

Real Life Case Study: How Ramesh Beat Retirement Anxiety

Ramesh, a 35-year-old manager, always feared outliving his money. Five years ago, he consulted a fee-only advisor:

- Identified Target: ₹4 crore corpus by age 60

- Started SIPs: ₹20,000/month split between four funds from this list

- Stuck with It: Despite COVID-19 market crash, didn’t halt SIP

- Result: Portfolio value today: ₹27 lakh, CAGR: 18.1%

Ramesh says, “It was hard to ignore the market panic, but I stuck to my plan. My returns beat all my expectations—now I sleep better at night.”

Expert Quotes for Inspiration

“The earlier you start, the easier it is to create enough wealth for a comfortable retirement. Time, not timing, delivers the miracle of compounding.”

— Radhika Gupta, CEO, Edelweiss AMC

“Building a retirement fund isn’t about chasing the highest returns. It’s about consistency and discipline—let compounding work silently for you.”

— Swarup Mohanty, CEO, Mirae Asset Investment Managers

“Equity funds with strong, proven track records have the power to transform anyone’s financial destiny—provided you stay invested through cycles.”

— Dhirendra Kumar, CEO, Value Research

Am I Too Late for High Returns? (And Other Common Questions)

Absolutely not! The best time was yesterday; the next-best is today. Even starting at 40 gives you two decades of compounding. Your portfolio mix might change—tilting away from small-cap to more flexi-cap and large-cap funds—but double-digit returns are still achievable.

Table: SIP Returns Comparison

| SIP Duration (Years) | Monthly SIP (₹) | 14% Returns Corpus (₹) | 10% Returns Corpus (₹) | Difference (₹) |

|---|---|---|---|---|

| 10 | ₹15,000 | ₹33 lakh | ₹30 lakh | ₹3 lakh |

| 20 | ₹15,000 | ₹1.18 crore | ₹82 lakh | ₹36 lakh |

| 25 | ₹15,000 | ₹2.2 crore | ₹1.44 crore | ₹76 lakh |

Frequently Asked Questions (FAQ)

Q1. Can mutual funds consistently give 14% returns for retirement?

Some top-performing equity funds have delivered over 14% CAGR for the last 10–15 years, but returns can fluctuate. Consistency in SIPs and diversification lowers your risk.

Q2. What is the ideal SIP amount to retire rich?

It depends on your lifestyle goals, age, and inflation. Use a retirement calculator—but even ₹10,000/month at 14% for 25 years can create a Multi-Crore corpus.

Q3. Should I invest only in small-cap funds for higher returns?

No. Small caps boost returns but increase risk. A balanced mix (flexi, mid, small, large) is safer and more effective in the long run.

Q4. How do I check if my funds are still “high-return” performers?

Review rolling returns over 5–10 years, check fund manager history, expense ratio, and use trusted sources like Value Research or Morningstar.

Q5. How often should I rebalance my retirement portfolio?

Review annually—reallocating only if a fund consistently underperforms its category or your life goals change.

Conclusion: Secure Your Tomorrow by Acting Today

Retirement planning is less about luck and more about smart choices and steady action. The difference between a worrisome retirement and a worry-free one comes down to one thing: starting your journey toward high-performing funds now.

You’ve seen real-life examples, powerful data, expert advice, and actionable steps. The rest is in your hands. Remember:

- The earlier you start, the more you benefit from compounding

- Consistency and patience trump chasing quick gains

- Diversification is your safety net

Don’t let another day slip by. Picture your dream retirement—and then take the steps, today, to make it real.

Start your SIP today. Your future self will thank you.

(This article is for educational purposes only. Please consult a SEBI-registered financial advisor before making investment decisions.)

Leave a Reply