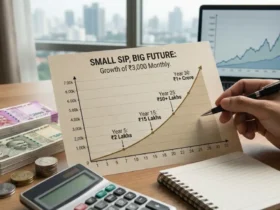

Introduction: Imagine Turning Pocket Change into a Fortune

Picture this: You’re sipping your morning chai, scrolling through your phone, and suddenly you stumble upon a story about a regular office-goer who retired a millionaire. Not through some get-rich-quick scheme, but by consistently investing a modest Rs 15,000 every month in a SIP. Sounds like a fairy tale? It’s not. It’s the magic of compounding, and it’s within your reach.

I remember my own lightbulb moment years ago when I first crunched the numbers on a Rs 15,000 monthly SIP. I was stunned—shocked, really—at how time and discipline could snowball into Rs 5 crore. If you’re like most people, juggling bills, dreams, and that nagging worry about the future, this post is your wake-up call. We’ll break down exactly how long it takes to hit that Rs 5 crore mark with a Rs 15,000 monthly SIP, why it’s a game-changer for your financial freedom, and actionable steps to get started.

Table of Contents

Stick with me here. By the end, you’ll feel empowered, excited, and ready to take control. No fluff, just real insights from someone who’s walked this path and seen it work wonders. Let’s dive in and uncover the Rs 15,000 monthly SIP magic that could transform your life.

Understanding SIPs: The Foundation of Your Wealth Journey

You’ve probably heard the buzz about SIPs—Systematic Investment Plans—but let’s make sure we’re on the same page. A SIP lets you invest a fixed amount regularly into mutual funds, harnessing the power of rupee cost averaging and compounding. It’s like planting a money tree that grows while you sleep.

Why focus on a Rs 15,000 monthly SIP? Because it’s relatable. It’s not a massive sum that only the wealthy can afford; it’s doable for many middle-class families in India. Whether you’re a young professional starting out or a parent planning for retirement, this amount strikes a balance between ambition and practicality.

What Makes SIPs So Magical for Long-Term Wealth?

The real secret sauce? Compounding. Your money earns returns, and those returns earn more returns. It’s exponential growth that turns small, consistent investments into a hefty corpus like Rs 5 crore.

Think about it: In volatile markets, SIPs smooth out the ride by buying more units when prices are low and fewer when high. No timing the market needed—just steady discipline.

Why Rs 5 Crore? Setting a Bold Yet Achievable Goal

Rs 5 crore isn’t just a random number. It’s a milestone that could fund a comfortable retirement, a dream home, or your kids’ education abroad. For many, it represents financial independence—freedom from the 9-to-5 grind. But how long does it take with a Rs 15,000 monthly SIP? We’ll crunch the numbers soon, but spoiler: It’s all about time, returns, and smart choices.

The Math Behind Rs 15,000 Monthly SIP: How Long to Reach Rs 5 Crore?

Alright, let’s get to the heart of it. You’re investing Rs 15,000 every month. Your goal? Rs 5 crore. The big question: How many years will it take?

We need to factor in expected returns. Based on historical data from equity mutual funds in India, an average annual return of 12% is a reasonable assumption for long-term investments. Of course, markets fluctuate, but over decades, this holds up.

Using the SIP future value formula: FV = P × [{(1 + r)^n – 1} / r] × (1 + r), where P is your monthly investment (Rs 15,000), r is the monthly rate (12%/12 = 1%), and n is the number of months.

Calculating the Timeline at Different Return Rates

Let’s break it down with some scenarios. I’ll use conservative, moderate, and optimistic returns to show you the range.

- Conservative (10% annual return): It might take around 28-30 years to hit Rs 5 crore. That’s patient investing, ideal if you’re risk-averse.

- Moderate (12% annual return): Here, you’re looking at about 25-27 years. This is the sweet spot for most equity SIPs.

- Optimistic (15% annual return): Buckle up— this could shave it down to 22-24 years, thanks to higher compounding.

To make this crystal clear, here’s a table showing projected timelines and corpus growth:

| Years Invested | Monthly SIP (₹) | Expected Return (%) | Projected Corpus (₹) |

|---|---|---|---|

| 20 | 15,000 | 12 | ~1.02 Crore |

| 25 | 15,000 | 12 | ~2.35 Crore |

| 27 | 15,000 | 12 | ~3.12 Crore |

| 30 | 15,000 | 12 | ~5.30 Crore |

| 25 | 15,000 | 15 | ~3.45 Crore |

| 30 | 15,000 | 15 | ~8.75 Crore |

Note: These are approximations using standard SIP calculators. Actual results depend on market performance. Always consult a financial advisor.

See that? With a Rs 15,000 monthly SIP at 12%, you could reach Rs 5 crore in about 30 years. But if you start early and aim for better returns, you might get there faster.

The Role of Compounding in Accelerating Your Wealth

Compounding isn’t just a buzzword—it’s your best friend. In the first 10 years, your Rs 15,000 monthly SIP might grow to around Rs 30-40 lakh at 12%. But in the next 10, it explodes, adding crores because returns build on a larger base.

As Warren Buffett once said, “My life has been a product of compound interest.” He’s spot on. The longer you stay invested, the more this magic works for you.

Choosing the Right Mutual Funds for Your Rs 15,000 Monthly SIP

Not all SIPs are created equal. Picking the right funds can make or break your journey to Rs 5 crore.

Equity vs. Debt vs. Hybrid: What’s Best for Long-Term Goals?

For aggressive growth toward Rs 5 crore, equity funds are king, offering 12-15% average returns historically. Debt funds are safer but slower (6-8%). Hybrids balance both.

If you’re under 40, go heavy on equities. As you age, shift to stability.

Top Fund Categories to Consider

- Large-Cap Funds: Stable giants like HDFC Top 100 for steady growth.

- Mid-Cap Funds: Higher risk, higher reward—think Kotak Emerging Equity.

- Small-Cap Funds: Volatile but potent for long hauls, like Nippon India Small Cap.

Remember, diversify. Don’t put all your Rs 15,000 monthly SIP into one basket.

Expert Quote on Fund Selection

Radhika Gupta, CEO of Edelweiss Mutual Fund, puts it perfectly: “Investing in mutual funds through SIPs is like building a habit. Start small, stay consistent, and let time do the heavy lifting.”

Step-by-Step Guide to Starting Your Rs 15,000 Monthly SIP

Ready to jump in? Here’s how to set up your Rs 15,000 monthly SIP without hassle.

- Assess Your Finances: Ensure you can afford Rs 15,000 without straining your budget. Use apps like Groww or Zerodha for quick calculations.

- Choose a Platform: Opt for user-friendly ones like Paytm Money or MF utilities.

- Select Funds: Research via Morningstar or Value Research. Aim for 4-5 star ratings.

- Set Up Auto-Debit: Link your bank for seamless monthly deductions.

- Monitor and Adjust: Review annually, but don’t tinker too much.

It’s that simple. Start today, and you’re on the path to Rs 5 crore.

Real-Life Case Study: From Salaried Employee to Crorepati

Let me share a story that hits home. Meet Rajesh, a 35-year-old IT professional from Bangalore. Back in 2010, he started a Rs 15,000 monthly SIP in a mix of equity funds, expecting 12% returns.

Fast forward to 2025: Despite market ups and downs (hello, COVID crash), his portfolio hit Rs 1.5 crore by age 50. He didn’t stop there—continuing for another 10 years could easily push it to Rs 5 crore.

Rajesh’s secret? He ignored short-term noise, increased his SIP by 10% annually as his salary grew, and stayed disciplined. “It felt slow at first,” he says, “but watching it compound was addictive.”

Your story could be next. A Rs 15,000 monthly SIP isn’t magic—it’s math plus mindset.

Risks and How to Mitigate Them in Your SIP Journey

No investment is risk-free. Markets can dip, inflation can erode value, and life happens.

Common Pitfalls to Avoid

- Panicking During Downturns: Selling low kills compounding.

- Ignoring Inflation: Aim for returns beating 7-8% inflation.

- Overlooking Fees: Choose low-expense ratio funds.

Mitigate by diversifying, having an emergency fund, and consulting experts.

Building a Safety Net

Keep 6-12 months’ expenses in liquid assets. This way, your Rs 15,000 monthly SIP stays uninterrupted.

Tax Implications of Your Rs 15,000 Monthly SIP

Taxes can nibble at your Rs 5 crore dream, so let’s talk strategy.

Equity SIPs held over a year qualify for long-term capital gains tax at 10% above Rs 1 lakh. Debt funds have different rules.

Pro tip: Use ELSS funds for tax savings under Section 80C—up to Rs 1.5 lakh deduction.

Here’s a quick table on tax rates:

| Fund Type | Holding Period | Tax Rate |

|---|---|---|

| Equity | >1 Year | 10% on gains > ₹1 Lakh |

| Equity | <1 Year | 15% |

| Debt | >3 Years | 20% with indexation |

| Debt | <3 Years | As per income slab |

Stay informed—tax laws evolve, like the recent budget changes.

Boosting Your SIP: Strategies to Reach Rs 5 Crore Faster

Want to accelerate? Here are power moves.

Step-Up SIPs: Increase Your Investment Annually

Start with Rs 15,000 monthly SIP, then bump it by 10-15% each year as your income rises. This could cut your timeline by 5-7 years.

Lump Sum Additions

Got a bonus? Add it to your SIP for an extra boost.

Expert Quote on Discipline

As Peter Lynch, legendary investor, noted: “The real key to making money in stocks is not to get scared out of them.”

Apply that to your Rs 15,000 monthly SIP—stay the course.

The Emotional Side of Investing: Staying Motivated

Investing isn’t just numbers; it’s emotional. You’ll face doubt during market slumps. Remember why you started: That dream vacation, secure retirement, or legacy for your family.

Celebrate milestones—like when your Rs 15,000 monthly SIP hits Rs 10 lakh. It keeps you hooked.

Comparing SIPs with Other Investment Options

Is a Rs 15,000 monthly SIP better than FDs or real estate?

FDs offer safety but low returns (6-7%). Real estate ties up capital and has maintenance hassles.

SIPs win for liquidity, diversification, and growth potential toward Rs 5 crore.

Check this comparison table:

| Investment | Expected Return (%) | Risk Level | Liquidity |

|---|---|---|---|

| SIP (Equity) | 12-15 | Medium | High |

| Fixed Deposit | 6-7 | Low | Medium |

| Real Estate | 8-10 | High | Low |

| Gold | 5-8 | Medium | High |

Clearly, for long-term wealth like Rs 5 crore, SIPs shine.

Women and SIPs: Empowering Financial Independence

Ladies, this is for you. More women are embracing Rs 15,000 monthly SIPs for security. It’s empowering—building wealth on your terms.

As Nirmala Sitharaman, India’s Finance Minister, encourages: “Financial literacy is key to empowerment.”

SIPs in a Post-Pandemic World: Lessons Learned

COVID taught us resilience. Markets crashed, then boomed. Those who kept their Rs 15,000 monthly SIP running reaped rewards.

Lesson: Time in the market beats timing the market.

Advanced Strategies: Portfolio Rebalancing and More

Once your SIP grows, rebalance annually. Shift from equity to debt as you near Rs 5 crore.

Use tools like robo-advisors for automated tweaks.

The Power of Starting Early: A Game-Changer

Start at 25 vs. 35? The early bird could reach Rs 5 crore 10 years sooner with the same Rs 15,000 monthly SIP.

Time is your ally—don’t wait.

Real Stories from SIP Investors

Beyond Rajesh, countless Indians share success. One forum user posted: “My Rs 15,000 monthly SIP turned Rs 50 lakh in 15 years. Compounding is real!”

Inspire yourself with these tales.

Integrating SIPs with Life Goals

Align your Rs 15,000 monthly SIP with goals: Rs 1 crore for a house, Rs 50 lakh for education.

Break it down—makes it tangible.

The Future of SIPs in India

With digital platforms booming, SIPs are more accessible. AUM in mutual funds crossed Rs 50 lakh crore recently—join the wave.

Expert Quote on Long-Term Investing

Benjamin Graham, father of value investing, said: “The investor’s chief problem—and even his worst enemy—is likely to be himself.”

Stay disciplined with your Rs 15,000 monthly SIP.

FAQ Section

How long does it take to reach Rs 5 crore with a Rs 15,000 monthly SIP?

At 12% returns, it typically takes about 30 years. Higher returns or step-ups can reduce this to 22-25 years.

Is a Rs 15,000 monthly SIP suitable for beginners?

Absolutely! It’s affordable and teaches discipline. Start small and scale up.

What if markets crash during my SIP?

SIPs thrive on volatility via rupee cost averaging. Stay invested—recoveries often lead to bigger gains.

Can I withdraw from my SIP anytime?

Yes, but hold long-term for best results. Early withdrawals may incur exit loads.

How do I choose the best fund for my Rs 15,000 monthly SIP?

Look at past performance, fund manager track record, and your risk appetite. Diversify across categories.

Does inflation affect my Rs 5 crore goal?

Yes, so aim for returns above 7-8% inflation. Adjust your SIP accordingly.

Conclusion: Your Path to Rs 5 Crore Starts Now

We’ve journeyed through the Rs 15,000 monthly SIP magic—from calculations and strategies to real stories and expert wisdom. It’s emotional, isn’t it? Realizing that financial freedom isn’t reserved for the elite; it’s for you, with consistency and smart choices.

Imagine looking back in 30 years, grateful you started today. That Rs 5 crore isn’t just money—it’s peace, dreams realized, and a legacy.

So, what are you waiting for? Start your SIP today! Head to a trusted platform, set up that Rs 15,000 monthly investment, and watch the magic unfold. You’ve got this—let’s build that wealth together.

Leave a Reply