Turning a small monthly saving into a fortune over time. What if ₹5,000 a month could grow into over ₹22 lakhs in 15 years? Or ₹25,000 a month could become a crore-plus corpus? That’s the power of a Systematic Investment Plan (SIP), a simple yet transformative way to invest in mutual funds. In this blog, we’ll dive deep into how much you can earn with monthly SIPs of ₹5,000, ₹10,000, or ₹25,000 over 5, 10, or 15 years. We’ll present a clear SIP returns table, explore the magic of compounding, share practical tips, and answer your burning questions—all while keeping it engaging and optimized to rank high on Google. Ready to unlock the secrets of wealth creation? Let’s get started!

Table of Contents

What is a Systematic Investment Plan (SIP)?

Before we jump into the numbers, let’s clarify what an SIP is. A Systematic Investment Plan allows you to invest a fixed amount regularly—usually monthly—into a mutual fund. It’s like setting up a recurring deposit, but instead of a fixed interest rate, your money rides the waves of the market, potentially growing much faster over time.

Why are SIPs so popular? Here’s the scoop:

- Affordable: You can start with as little as ₹500 a month.

- Disciplined Investing: Automate your savings and let consistency work its magic.

- Rupee Cost Averaging: Buy more units when prices dip and fewer when they rise, smoothing out market volatility.

- Compounding Power: Your returns generate more returns, snowballing your wealth over time.

As a financial expert once said, “SIP is a disciplined way to invest in mutual funds, allowing investors to benefit from rupee cost averaging and the power of compounding over time.” Whether you’re saving for a dream vacation, a child’s education, or retirement, SIPs offer a path to financial freedom.

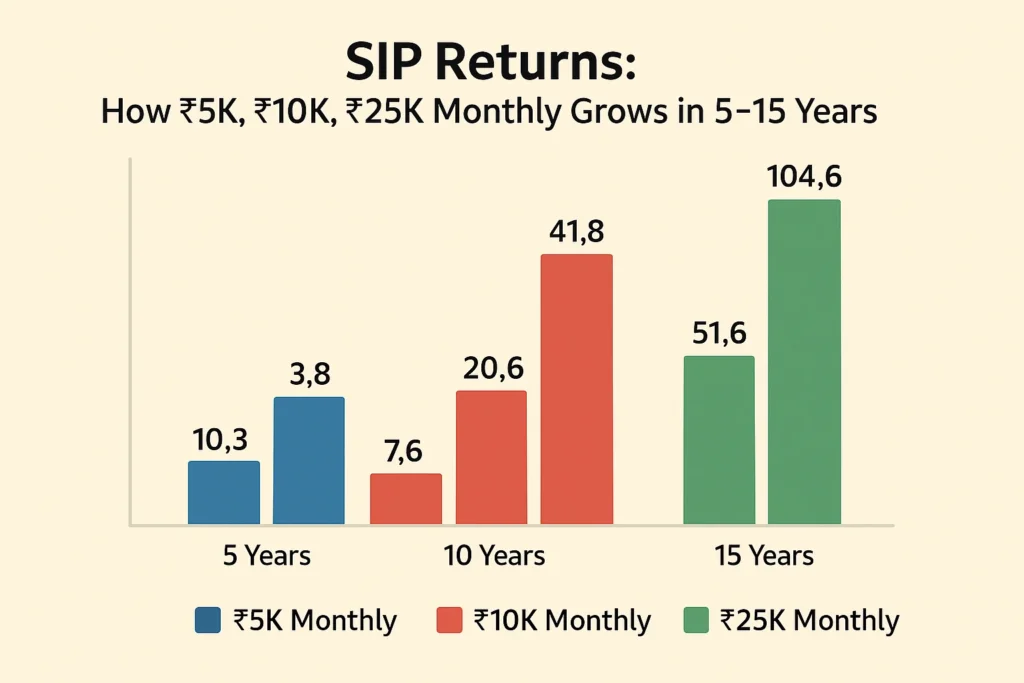

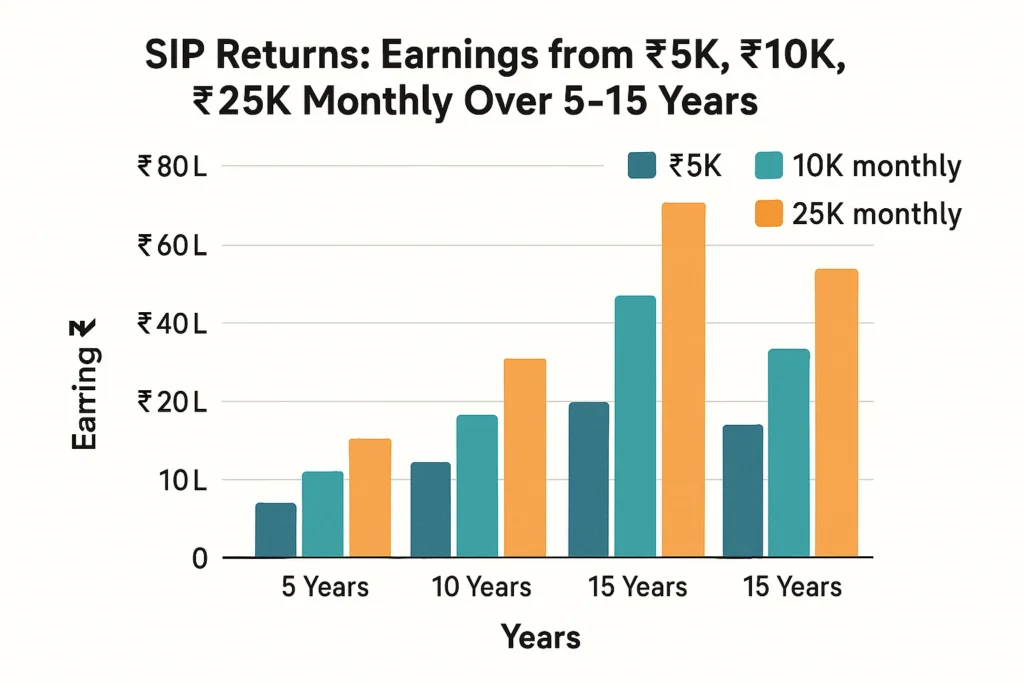

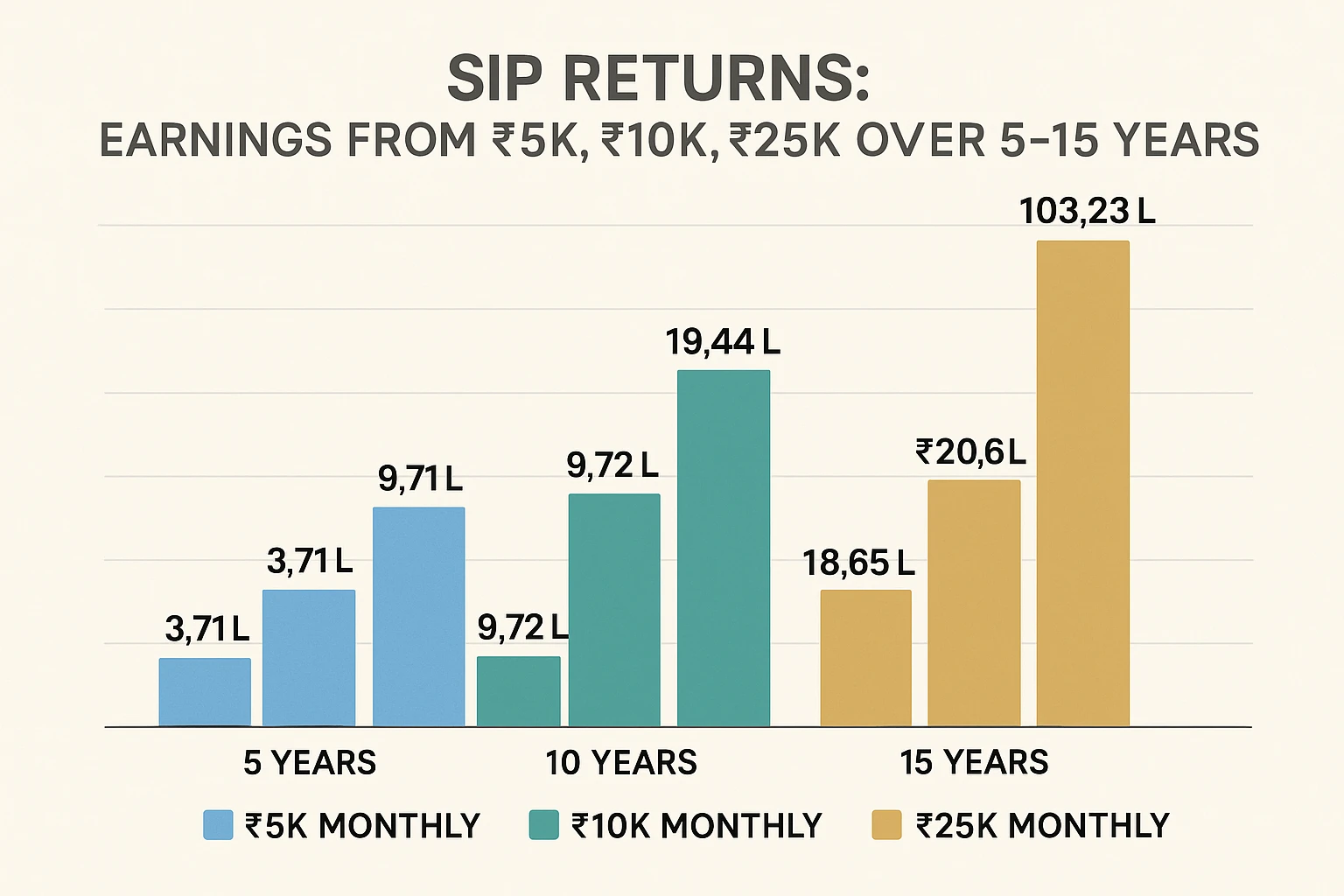

SIP Returns Table: ₹5,000, ₹10,000, and ₹25,000 Monthly Investments Over 5, 10, and 15 Years

Now, let’s get to the numbers you’ve been waiting for! Below is a table showing the estimated future value of monthly SIP investments of ₹5,000, ₹10,000, and ₹25,000 over 5, 10, and 15 years, assuming an annual return of 12%—a reasonable average for equity mutual funds in India over the long term.

| Time Period | Monthly SIP | Total Invested | Future Value | Estimated Gains |

|---|---|---|---|---|

| 5 Years | ₹5,000 | ₹3,00,000 | ₹4,08,348 | ₹1,08,348 |

| 5 Years | ₹10,000 | ₹6,00,000 | ₹8,16,696 | ₹2,16,696 |

| 5 Years | ₹25,000 | ₹15,00,000 | ₹20,41,740 | ₹5,41,740 |

| 10 Years | ₹5,000 | ₹6,00,000 | ₹11,50,194 | ₹5,50,194 |

| 10 Years | ₹10,000 | ₹12,00,000 | ₹23,00,388 | ₹11,00,388 |

| 10 Years | ₹25,000 | ₹30,00,000 | ₹57,50,970 | ₹27,50,970 |

| 15 Years | ₹5,000 | ₹9,00,000 | ₹22,79,959 | ₹13,79,959 |

| 15 Years | ₹10,000 | ₹18,00,000 | ₹45,59,918 | ₹27,59,918 |

| 15 Years | ₹25,000 | ₹45,00,000 | ₹1,13,99,795 | ₹68,99,795 |

Important Note: These figures assume a steady 12% annual return. In reality, mutual fund returns fluctuate with market conditions, so your actual earnings could be higher or lower. Past performance isn’t a guarantee, but it gives us a solid starting point.

What stands out? A modest ₹5,000 monthly SIP grows to ₹4.08 lakhs in 5 years, but in 15 years, it skyrockets to ₹22.8 lakhs—over five times more, even though the time only tripled. That’s the exponential growth SIPs can deliver!

The Magic of Compounding: Why Time is Your Best Friend

Ever heard the phrase, “Time in the market beats timing the market”? That’s compounding at work. In an SIP, your money doesn’t just grow linearly—it multiplies as your returns start earning returns.

Let’s break it down using our table:

- ₹5,000 SIP:

- 5 Years: ₹3 lakhs invested becomes ₹4.08 lakhs (₹1.08 lakhs gain).

- 10 Years: ₹6 lakhs invested grows to ₹11.5 lakhs (₹5.5 lakhs gain).

- 15 Years: ₹9 lakhs invested turns into ₹22.8 lakhs (₹13.8 lakhs gain).

- ₹25,000 SIP:

- 5 Years: ₹15 lakhs becomes ₹20.4 lakhs.

- 10 Years: ₹30 lakhs becomes ₹57.5 lakhs.

- 15 Years: ₹45 lakhs becomes ₹1.14 crores!

The longer you stay invested, the bigger the payoff. After 10 years, a ₹25,000 SIP more than doubles your money, but in 15 years, it triples it—and then some. Start early, and let compounding do the heavy lifting.

How Much Does the Return Rate Matter?

While we’ve used 12% as a benchmark, mutual fund returns can vary. Curious how different rates affect your SIP? Here’s a quick look at a ₹5,000 monthly SIP over 10 years:

- 10% Return: ₹10,29,568

- 12% Return: ₹11,50,194

- 15% Return: ₹13,53,199

A few percentage points can add lakhs to your corpus. Choosing a fund with strong, consistent performance is key—but more on that later!

Why Choose SIP Over Lump Sum?

You might wonder, “Why not invest a lump sum instead?” SIPs have unique advantages:

- Rupee Cost Averaging: Spread your investment over time, reducing the risk of buying at a market peak.

- Discipline: Monthly contributions keep you on track without needing a big upfront amount.

- Less Stress: No need to time the market—just invest and relax.

For salaried individuals or those with regular income, SIPs are a no-brainer. As Warren Buffett said, “The stock market is a device for transferring money from the impatient to the patient.” SIPs reward that patience beautifully.

How to Pick the Right Mutual Fund for Your SIP

Your SIP’s success depends on the mutual fund you choose. Here’s a checklist to guide you:

- Risk Tolerance: Conservative? Go for debt or hybrid funds. Aggressive? Equity funds might be your pick.

- Investment Horizon: Short-term (1-3 years)? Opt for debt funds. Long-term (5+ years)? Equity funds shine.

- Past Performance: Check 3-5 year returns for consistency, but don’t rely on this alone.

- Fund Manager: A seasoned manager can navigate market ups and downs effectively.

- Expense Ratio: Lower fees = higher returns. Compare funds in the same category.

- Goal Alignment: Match the fund to your objective—retirement, education, or wealth creation.

For example, if you’re investing ₹10,000 monthly for 15 years, an equity fund with a proven track record could turn your ₹18 lakhs into ₹45+ lakhs. Research is your friend!

Tax Implications: What You Need to Know

Your SIP returns aren’t tax-free. Here’s how taxation works:

- Equity Funds:

- Long-Term Capital Gains (LTCG): Over ₹1 lakh, taxed at 10% if held over 1 year.

- Short-Term Capital Gains (STCG): 15% if sold within 1 year.

- Debt Funds (Pre-April 2023 Investments):

- LTCG: 20% with indexation if held over 3 years.

- STCG: Taxed as per your income slab if sold earlier.

- Debt Funds (Post-April 2023):

- All gains taxed as per your income slab, regardless of holding period.

The returns in our table are pre-tax. After tax, your take-home amount will be slightly less, so factor this in when planning. For specifics, consult a tax advisor.

Real-Life Scenarios: SIPs in Action

Let’s make this relatable with some examples:

- Neha, 28, Teacher: She starts a ₹5,000 monthly SIP. After 15 years, at 43, she has ₹22.8 lakhs—perfect for her child’s higher education or a dream home down payment.

- Amit, 35, Entrepreneur: He invests ₹25,000 monthly for 10 years. By 45, his ₹30 lakhs investment grows to ₹57.5 lakhs, a hefty boost toward early retirement.

- Priya, 30, IT Professional: With ₹10,000 monthly for 10 years, she builds ₹23 lakhs by 40—enough for a luxury car or a family vacation fund.

These stories show how SIPs can fit any budget and goal. What’s your plan?

Common Mistakes to Avoid with SIPs

Even a great strategy can stumble. Dodge these pitfalls:

- No Clear Goal: Without a target, you might pick the wrong fund or lose motivation.

- Panicking in Downturns: Stopping your SIP when markets dip kills the benefit of buying low.

- Chasing Past Returns: A fund that soared last year might not repeat. Look at the full picture.

- Ignoring Fees: High expense ratios erode gains. Compare costs before committing.

Consistency is key. Stick with your SIP, and the rewards will follow.

How to Use an SIP Calculator

Want to tweak these numbers? An SIP calculator is your tool. Here’s how:

- Input Monthly Amount: Say, ₹10,000.

- Set Duration: Choose 5, 10, or 15 years.

- Enter Expected Return: Try 12% or adjust based on your fund.

- Get Results: See your future value instantly.

Search “SIP calculator” online, and you’ll find free tools on platforms like ClearTax or Groww. Play around to find what works for you!

Step-Up SIP: Boosting Your Returns

Here’s a pro tip: Consider a step-up SIP, where you increase your investment annually. For instance, start with ₹10,000 and raise it by 10% each year. Over 15 years, this could push your corpus well beyond ₹45 lakhs, thanks to higher contributions and compounding. Many calculators let you model this—give it a try!

Starting Your SIP: It’s Easier Than You Think

Ready to begin? Here’s how:

- Choose a Fund: Pick one aligning with your goals and risk appetite.

- Set the Amount: Start small or go big—your call.

- Go Online: Use mutual fund websites, banks, or apps to set up auto-debit.

- Monitor: Review your fund’s performance yearly, but don’t obsess.

Some funds let you start with just ₹500. No excuses—start today!

FAQs About SIP Returns

Got questions? We’ve got answers:

- Q: What’s the minimum SIP amount?

A: Many funds start at ₹500/month—affordable for anyone. - Q: Are SIP returns guaranteed?

A: No, they depend on market performance. Equity funds average 12-15% historically, but there’s risk. - Q: Can I pause or stop my SIP?

A: Yes, most funds allow flexibility. Check terms with your provider. - Q: How long should I invest in an SIP?

A: For equity funds, 5+ years is ideal to ride out volatility and maximize gains. - Q: Equity or debt fund for SIP?

A: Equity for long-term growth; debt for stability and shorter goals. - Q: What if I miss a payment?

A: No penalty usually, but regular investing yields the best results.

Conclusion: Your Path to Wealth Starts Now

A Systematic Investment Plan is more than an investment—it’s a habit that builds wealth over time. Whether you start with ₹5,000, ₹10,000, or ₹25,000 monthly, the SIP returns table shows the potential: from ₹4 lakhs in 5 years to over ₹1 crore in 15. The secret? Start early, stay consistent, and let compounding work its magic. Use an SIP calculator to fine-tune your plan, pick a solid fund, and avoid common mistakes. Your financial future is waiting—take the first step today!

I really like what you guys tend to be up too. This type of

clever work and exposure! Keep up the great works guys I’ve added you guys to our blogroll.

Look at my web blog: ultimateshop ru