If you’ve ever wondered whether a disciplined SIP (Systematic Investment Plan) can realistically turn a modest starting base into generational wealth, this deep-dive is for you. In the next few minutes, you’ll learn exactly how a well-structured SIP plan—anchored in equity, calibrated with risk, and upgraded annually—can aim for ₹5 crore by 2035. We’ll translate financial theory into an action plan, show you the numbers, and share expert-style insights you can use immediately.

Key promise: By the end of this guide, you’ll have a step-by-step SIP playbook (with data tables and projections) to navigate 2025–2035, complete with realistic return assumptions, risk controls, rebalancing rules, and a clear roadmap from ₹5 lakh to ₹5 crore.

Table of Contents

Why SIP Still Wins in 2025–2035

SIPs continue to dominate long-term retail investing because they compel consistency. Instead of timing the market, you buy through cycles—capturing the upside of long bull runs while averaging down during corrections. As market cycles compress and volatility spikes (a reality we’ve all seen in recent years), this rupee-cost averaging becomes your built-in shock absorber.

What’s changed since the last decade?

- Better fund categories & transparency: Passives (index funds) and smart-beta options have grown dramatically.

- Lower costs: Expense ratios have trended down, compounding your gains.

- Goal-based tools: Most platforms now show goal trackers, step-up modules, and probability bands.

- Investor behavior: SIP stoppage rates are lower; more investors hold through drawdowns.

The 5C Framework for a Bulletproof SIP

Think of your SIP as a business plan. The 5C framework keeps it watertight:

- Core: Low-cost index funds for Nifty 50, Nifty Next 50, or total-market exposure.

- Compliment: Flexi-cap or large-mid cap funds to capture manager alpha.

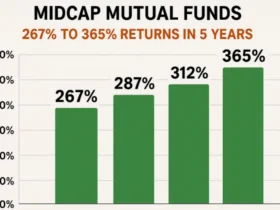

- Cyclical Tilt: A measured dose of mid/small-cap for growth spurts across cycles.

- Counterweight: A 10–25% allocation to balanced advantage or short-duration debt for sequence-of-returns protection.

- Calibration: Annual rebalancing and 10% step-up SIP to keep your plan aligned with inflation and income growth.

Top SIP Categories to Consider (Not Individual Fund Tips)

We’ll focus on categories rather than listing brand names. This keeps the guidance evergreen and lets you pick specific schemes that match your platform, KYC status, and cost preferences.

- Core Equity (40–50%)

- Index Funds: Nifty 50, Nifty Next 50, or a broad market index.

- Why: Low fees + market beta = dependable long-term compounding.

- Active Blends (20–30%)

- Flexi-Cap or Large & Mid Cap: Tactical allocation across caps.

- Why: Room for skilled managers to add alpha across cycles.

- Growth Tilt (15–25%)

- Mid-Cap/Small-Cap (keep combined ≤ 25%).

- Why: Higher upside over long horizons; limit to control volatility.

- Dynamic Cushion (10–20%)

- Balanced Advantage / Dynamic Asset Allocation.

- Why: Adjusts equity exposure based on valuations; reduces drawdown pain.

- Tax-Smart Satellite (Optional 0–10%)

- ELSS for tax efficiency (if eligible/needed under the prevailing tax regime).

A Simple Goal: ₹5 Lakh Today → ₹5 Crore by 2035

Let’s set a clear 11-year window (Jan 2025–Dec 2035). You start with ₹5 lakh as a lump sum buffer and commit to a monthly SIP, increasing it by 10% every year (the classic step-up SIP). We’ll show multiple paths so you can pick what fits your income and risk.

Reality check: ₹5 crore in ~11 years is ambitious, not guaranteed. You’ll likely need a high monthly SIP, a step-up, and equity exposure to growth engines. Think of this as a stretch but achievable with discipline.

Table 1: Suggested Asset Mix for a Growth-Focused SIP (Guideline)

| Bucket | Category | Allocation | Rationale |

|---|---|---|---|

| Core | Nifty 50 / Total Market Index | 35–40% | Low cost, stable beta |

| Blend | Flexi-Cap or Large & Mid | 20–25% | Active alpha potential |

| Growth Tilt | Mid-Cap | 10–12% | Cyclical growth kicker |

| Growth Tilt | Small-Cap | 5–8% | Satellite allocation only |

| Counterweight | Balanced Advantage | 10–15% | Valuation-aware de-risking |

| Optional | ELSS / Thematic (≤10%) | 0–10% | Tax planning or thematic spice |

Tip: Keep mid+small ≤25% combined. In euphoric years, rebalance.

What SIP Size Do You Need?

Below are illustrative projections (not predictions). They assume compounded monthly returns from annualized rates and a 10% yearly step-up in SIP. Your results will vary based on market behavior, sequence of returns, and fund selection. Use this to choose your SIP lane.

Also Read: Monthly SIP Chart to ₹1 Crore: All Horizons and Returns in One Table

Table 2: 10-Year Snapshot (2025–2034) — Step-Up SIP, 10% per year

| Monthly SIP (Year 1) | Expected CAGR (Equity-heavy mix) | Value at Year 10* |

|---|---|---|

| ₹25,000 | 12% | ~₹1.68 crore |

| ₹50,000 | 12% | ~₹3.37 crore |

| ₹1,00,000 | 12% | ~₹6.75 crore |

| ₹1,00,000 | 15% | ~₹7.91 crore |

*Includes only SIP leg, excludes any initial lump sum.

Insight: At ₹1 lakh/month with 10% annual step-up, even 12% CAGR over 10 years pushes north of ₹6.5 crore in the SIP leg alone. 15% boosts it further, but don’t bank on 15% as a sure thing; it’s an upper-range long-run equity assumption.

Where Does the Initial ₹5 Lakh Fit?

Use your ₹5 lakh as:

- A contingency buffer (ideally in liquid/short-term debt), or

- A staggered entry into equity over 6–12 months if your equity allocation is low, or

- A rebalance reserve to top up equity after corrections (pre-decide drawdown rules, e.g., deploy 20–30% of reserve if indices fall >15%).

Table 3: Lump Sum Companion — ₹5 Lakh Growth Scenarios (10 Years)

| Annualized Return | Value at Year 10 |

|---|---|

| 8% | ~₹10.79 lakh |

| 12% | ~₹15.53 lakh |

| 15% | ~₹20.23 lakh |

Takeaway: The SIP engine does the heavy lifting. The lump sum helps, but your monthly cashflow discipline is what moves the needle.

“Consistency beats intensity. A slightly smaller SIP you can sustain through bear markets is more powerful than a big SIP you quit in year two.”

“Rebalance annually. Trim excesses after frothy years; buy fear after drawdowns. It’s the only free lunch you truly control.”

“When in doubt, simplify. A two-fund core (broad index + balanced advantage) can outperform complex but poorly executed portfolios.”

(These are principle-based professional insights; always do your own due diligence or consult a SEBI-registered investment adviser.)

Building Your Plan (2025–2035)

Let’s translate everything into an actionable calendar:

- Start SIP (Jan 2025): Choose your base monthly amount (₹25k/₹50k/₹1L).

- Auto Step-Up (Every Jan): Increase SIP by 10%.

- Quarterly Check-In: Ensure SIP runs; no stops unless income disruption.

- Annual Rebalance (Dec): Realign to target allocations; harvest gains or add to underweights.

- Drawdown Playbook: If index corrects by >15%, consider a pre-decided top-up from your reserve (not from emergency funds).

- Tax & Cashflow: Optimize ELSS only if it fits your tax regime and goal; keep 6 months expenses separate.

Table 4: Suggested Rebalancing Rules of Thumb

| Scenario | Action | Why |

|---|---|---|

| Equity up >25% YoY | Trim growth tilt by 2–4% | Lock profits, control risk |

| Equity down >15% | Add 2–4% from counterweight | Average down systematically |

| Small-cap >10% of total | Cap at 8% | Prevent concentration risk |

| Debt <10% of total | Refill to 10–15% | Maintain ballast for shocks |

Three Realistic Tracks to ₹5 Crore

Not everyone can start at ₹1 lakh/month. Pick the track that aligns with your earnings and expected growth.

Track A: Accelerated Professional

- Starting SIP: ₹1,00,000/month

- Step-Up: 10%/year

- Mix: 45% index (core), 25% flexi, 15% mid, 5% small, 10% balanced advantage

- Target: ₹4.9–₹5.0+ crore by 2035 (assuming 11 years, 12–15% equity-heavy CAGR)

Why it works: High base + step-ups + growth tilt = compounding on steroids.

Track B: Steady Climber

- Starting SIP: ₹50,000/month

- Step-Up: 10%/year

- Mix: 45% index, 25% flexi, 10% mid, 5% small, 15% balanced advantage

- Target: ₹2.0–₹2.5 crore by 2035 (depending on 11-year outcomes)

Why it works: Balanced risk; suitable for dual-income households.

Track C: Starter With Upside

- Starting SIP: ₹25,000/month

- Step-Up: 15%/year (aggressive career growth)

- Mix: 50% index, 20% flexi, 10% mid, 5% small, 15% balanced advantage

- Target: ₹1.3–₹1.8 crore by 2035

Why it works: Lower base offset by higher step-ups; plan to upgrade categories over time.

Table 5: 11-Year Projection (2025–2035) — Step-Up SIP, 10%/yr

| Monthly SIP (Year 1) | Expected CAGR | Value at Year 11* |

|---|---|---|

| ₹50,000 | 12% | ~₹2.07 crore |

| ₹50,000 | 15% | ~₹2.47 crore |

| ₹1,00,000 | 12% | ~₹4.13 crore |

| ₹1,00,000 | 15% | ~₹4.93 crore |

*SIP leg only; adding disciplined top-ups during corrections and the initial ₹5 lakh can nudge the total closer to or beyond ₹5 crore under favorable market sequences.

Step-Up vs. Flat SIP: The Silent Superpower

A flat SIP may feel simpler, but a step-up compounds behaviorally and mathematically. When your SIP rises with your income, your savings rate stays constant, and the absolute rupees you invest go up—accelerating compounding in later years (when your portfolio base is largest).

Table 6: Flat vs Step-Up SIP (₹50k starting, 12% CAGR, 10 Years)

| Plan | Year-1 SIP | Year-10 SIP | Total Invested (10Y) | Value at 10Y |

|---|---|---|---|---|

| Flat SIP | ₹50,000 | ₹50,000 | ₹60,00,000 | ~₹1.40 crore |

| Step-Up 10% | ₹50,000 | ₹1,16,000 | ~₹93,00,000 | ~₹3.37 crore |

Moral: Step-up SIPs multiply outcomes despite committing to the same percentage of your income over time.

Risk Management You’ll Actually Follow

- Don’t over-allocate to small-cap mania during rallies. Keep it measured.

- Automate the step-up and SIP debit date. Friction kills compounding.

- One family, one plan: Consolidate scattered SIPs into a single goal tracker.

- Avoid timing: If you must, use a pre-decided top-up plan for drawdowns (e.g., deploy 20% of reserve at −15%, another 20% at −25%).

- Review once a year, not daily. Noise creates bad decisions.

Table 7: Drawdown Top-Up Playbook (Illustrative)

| Index Drawdown | Action | Source of Funds | Note |

|---|---|---|---|

| −10% | No action | — | Maintain discipline |

| −15% | Deploy 20% reserve | Contingency/Opportunity Fund | Pre-decide amount |

| −25% | Deploy additional 20% | Same | Maintain cash buffer |

| Recovery to ATH | Rebuild reserve | SIP + bonuses | Don’t stop SIPs |

Tax Planning: ELSS, New vs Old Regime

- ELSS (Equity-Linked Savings Scheme) can be a smart satellite if you benefit under the applicable tax rules.

- Don’t force ELSS if your chosen tax regime doesn’t reward it.

- Prioritize goal fidelity over tax gymnastics; tax tail shouldn’t wag the investment dog.

Common Pitfalls That Derail ₹5 Crore Plans

- SIP stoppage after a bad year (“I’ll resume later”). This is wealth suicide in slow motion.

- Style drift: Chasing last year’s hot theme.

- Over-diversification: 12+ funds = closet index + high friction.

- No rebalancing: You drift into a risk you never signed up for.

- Ignoring costs: Expense ratios and churn matter over a decade.

Table 8: Minimalist Portfolio Examples (By Experience)

| Investor Type | # of Funds | Mix |

|---|---|---|

| Beginner | 2 | 1× Broad Index + 1× Balanced Advantage |

| Intermediate | 3–4 | Index + Flexi-Cap + Mid-Cap + Balanced Advantage |

| Advanced | 4–5 | Add Smart-Beta / Factor or Next 50 thoughtfully |

Futuristic Projections (2025–2035): What Could Help or Hurt

Tailwinds

- India’s profit-to-GDP cycle maturing; manufacturing & capex upcycle.

- Digital rails deepening productivity; financialization of savings sustaining SIP flows.

- Lower costs via passives and direct plans.

Headwinds

- Global shocks (geopolitics, commodity spikes) disrupting earnings.

- Valuation air-pockets in mid/small caps—expect volatility clusters.

- Behavioral risks: The biggest risk is you (panic selling, stopping SIPs, chasing momentum).

Table 9: Scenario Bands for 2025–2035 (SIP ₹1L Step-Up 10%)

| Scenario | Equity CAGR | Value at 2035 (SIP only) |

|---|---|---|

| Bearish | 9% | ~₹3.5–₹3.7 crore |

| Base Case | 12% | ~₹4.1–₹4.3 crore |

| Optimistic | 15% | ~₹4.9–₹5.0 crore |

Add reserves deployed during corrections and your initial ₹5 lakh, and the upper band can cross ₹5 crore in favorable sequences. Not a guarantee—a possibility enabled by discipline.

Implementation Checklist (Save This)

- Decide your track (A/B/C).

- Set auto step-up = 10% (or 15% for Track C).

- Use 2–5 funds max spanning core, blend, growth tilt, and counterweight.

- Automate SIP dates and rebalancing reminders.

- Maintain a 6-month emergency fund outside your SIP plan.

- Pre-write your drawdown top-up rules. Tape it to your desk.

- Review once a year; ignore the noise the other 364 days.

Table 10: Putting It All Together — Sample 2035 Outcome Map

| Starting SIP | Step-Up | Equity CAGR | SIP Value (2035) | Add: Lump Sum & Top-Ups | Potential Total |

|---|---|---|---|---|---|

| ₹50,000 | 10% | 12% | ~₹2.07 cr | +₹0.2–₹0.4 cr | ~₹2.3–₹2.5 cr |

| ₹50,000 | 10% | 15% | ~₹2.47 cr | +₹0.3–₹0.5 cr | ~₹2.8–₹3.0 cr |

| ₹1,00,000 | 10% | 12% | ~₹4.13 cr | +₹0.3–₹0.6 cr | ~₹4.4–₹4.7 cr |

| ₹1,00,000 | 10% | 15% | ~₹4.93 cr | +₹0.3–₹0.7 cr | ~₹5.2–₹5.6 cr |

Illustrative; actual results depend on markets, costs, taxes, and behavior.

Sample One-Page IPS (Investment Policy Statement)

- Goal: ₹5 crore by Dec 2035

- SIP: ₹1,00,000/month (Step-Up 10%/yr; debit 5th of month)

- Allocation: 40% Index, 25% Flexi, 12% Mid, 8% Small, 15% Balanced Advantage

- Rebalance: Every Dec; small-cap capped at 8%

- Drawdown Top-Up: Deploy 20% reserve at −15%, +20% more at −25%

- Risk Controls: Stop loss = never stop SIP, only rebalance; emergency fund = 6 months

- Review: Annual (allocation drift, costs, taxes)

- Exit Strategy (2035): Move 12–18 months of need into liquid/short debt before goal date; stagger redemptions.

Frequently Asked Questions

Q1. What’s the single most important driver of reaching ₹5 crore?

A. Sustained step-up SIPs. Compounding multiplies late in the journey; your last 3–4 years can add more than the first 6–7 combined.

Q2. Should I choose active or passive?

A. Use both. Let passive be your low-cost core and active your flexible satellite. Keep total funds ≤5 to avoid closet indexing and complexity.

Q3. How much mid/small-cap is too much?

A. Cap combined at ≤25%. In late-cycle rallies, trim to your cap during rebalancing.

Q4. What if a bear market hits in 2026–2027?

A. You’ll keep SIPs running and execute the drawdown playbook (pre-decided top-ups). Market stress is when wealth compounds—if you stay systematic.

Q5. Do I need ELSS?

A. Only if it improves your net-of-tax outcome under your chosen tax regime. Don’t distort your core allocation for tax alone.

Q6. How do I lower the risk of a bad sequence of returns?

A. Maintain a counterweight (balanced advantage/short-duration debt), rebalance annually, and avoid concentration in small caps.

Q7. Can I start with ₹25k and still get big outcomes?

A. Yes—provided you step up (10–15%/yr) and stay disciplined. Consider Track C, then graduate to Track B as income grows.

Q8. Should I diversify across fund houses?

A. Reasonable to split across 2–3 AMCs for operational comfort, but don’t over-split. Costs and clutter reduce performance.

Q9. Is 15% CAGR realistic for a decade?

A. It’s an upper-band scenario for a growth-tilted equity plan. Base plans on 10–12%, treat 15% as a best-case. Plan for range, not a point.

Q10. When do I start de-risking?

A. In the final 12–18 months before the goal, stagger into liquid/short-duration debt to protect the finish line.

Final Words: Your 10-Year Edge

You don’t need perfect timing, exotic strategies, or a bull market on demand. You need a clean plan you can stick to:

- Start a track you can sustain.

- Automate your step-up and SIP dates.

- Rebalance without drama.

- Top-up during pain.

- Review once a year and keep living your life.

Your Motivational CTA

Start today. Open your app, set the first SIP, lock in a 10% annual step-up, and write down your drawdown playbook. Ten years from now, you’ll thank your past self for choosing consistency over excuses—and for turning ₹5 lakh and a disciplined SIP into a genuine shot at ₹5 crore.

Leave a Reply