Introduction: Turning Zero into Growth

Imagine starting from $0 — no prior investments, no fancy portfolio, just a dream to grow your money.

Now imagine ending the year with a 40% growth in your investments.

Sounds impossible? Not anymore.

In 2025, with smarter financial tools, AI-powered investing apps, and diversified asset opportunities, ordinary investors are beating traditional savings rates by 5x–10x.

Table of Contents

This isn’t about luck or timing — it’s about strategy, mindset, and consistency.

Let’s uncover how you can grow your money by 40% in just 12 months — ethically, sustainably, and intelligently.

Step 1: Set a Clear and Realistic Investment Goal

You can’t build wealth without direction. Start with one question:

“How much do I want to grow in 12 months?”

If your starting point is $0, your first goal is capital accumulation — building your initial fund through savings or small income streams.

Pro Tip:

- Save 20% of your monthly income.

- Channel it into an investment account or SIP (Systematic Investment Plan).

- Use automation tools like Groww, Zerodha Coin, or Kuvera to make investing consistent.

| Month | Monthly Savings ($) | Cumulative Investment ($) | Target Growth (%) | Target Portfolio ($) |

|---|---|---|---|---|

| Jan | 100 | 100 | 0% | 100 |

| Jun | 100 | 600 | 10% | 660 |

| Dec | 100 | 1200 | 40% | 1680 |

Result: You started with zero, built discipline, and grew your savings by 40% — all through small, consistent action.

Step 2: Choose High-Growth Asset Classes

The modern wealth formula is clear:

“Diversify to multiply.”

Don’t rely on a single investment. Instead, blend stocks, mutual funds, gold, and digital assets to reduce risk and boost returns.

Here’s what experts predict for 2025–2026 growth performance:

| Asset Type | 2024 Avg Return | 2025 Projected Return | Volatility Level | Best For |

|---|---|---|---|---|

| Equity Mutual Funds | 16% | 18–22% | Moderate | Long-term wealth |

| Index ETFs (Nifty/S&P 500) | 12% | 15% | Low | Beginners |

| Gold ETFs | 11% | 13% | Low | Inflation protection |

| Real Estate REITs | 8% | 10–12% | Low | Passive income |

| Crypto Blue Chips (BTC, ETH) | 35% | 40–45% | High | High-risk investors |

Smart Tip:

Mix high-growth + low-risk investments:

- 50% Equity Mutual Funds

- 20% Index ETFs

- 10% Gold

- 10% REITs

- 10% Crypto (only if you understand risk)

Step 3: Use the Power of Compounding Early

Also releted: $15K Investment to $75K Wealth: Your 5-Year Growth Plan

Einstein called compounding the “8th wonder of the world.”

When you start early, even small amounts multiply rapidly.

Example:

If you invest $500 per month at an annualized return of 40%, your portfolio at the end of 12 months would look like this:

| Month | Investment ($) | Interest (%) | Cumulative Value ($) |

|---|---|---|---|

| 1 | 500 | 3.33% | 516.65 |

| 6 | 3000 | 3.33% | 3448 |

| 12 | 6000 | 3.33% | 8400+ |

You earned $2,400 profit in one year — without needing huge capital.

Step 4: Automate and Optimize Your Portfolio

Modern investing isn’t about watching charts all day — it’s about automation and optimization.

Tools to Use:

- INDmoney / Groww: Auto-track all assets

- Tickertape / Smallcase: Build diversified smart portfolios

- ET Money / Zerodha Varsity: Learn investing step-by-step

Automation ensures:

- No missed SIPs

- Real-time profit tracking

- AI-based rebalancing (for advanced users)

| Platform | Best Feature | Suitability | Fees |

|---|---|---|---|

| Groww | Easy SIP setup | Beginners | Free |

| Zerodha | Advanced charts | Traders | Low |

| INDmoney | AI-based portfolio | Intermediate | Freemium |

| Smallcase | Thematic investing | Professionals | Variable |

Step 5: Invest in Knowledge Before Investing in Assets

Most investors lose money because they chase returns, not understanding.

The smartest move in 2025 is to invest in your financial literacy before anything else.

Learn From:

- Books: “The Psychology of Money” by Morgan Housel

- YouTube Channels: Pranjal Kamra, Akshat Shrivastava, Graham Stephan

- Courses: NSE NCFM, Coursera Finance Modules

When you understand “why,” your “how” becomes easier.

| Learning Source | Duration | Cost | Benefit |

|---|---|---|---|

| YouTube Tutorials | Ongoing | Free | Practical insights |

| NSE NCFM Course | 1 Month | $50 | Certified skill |

| Coursera Finance | 3 Months | $75 | Global perspective |

Step 6: Build Multiple Income Streams

Relying on one income source is risky in 2025.

You need at least 3 streams of cash flow to keep your investments alive and growing.

Example Strategy:

- Main Job: $1,000/month

- Freelancing/Side Hustle: $300/month

- Dividend/Interest Income: $100/month

Total = $1,400/month income → $400/month can be invested.

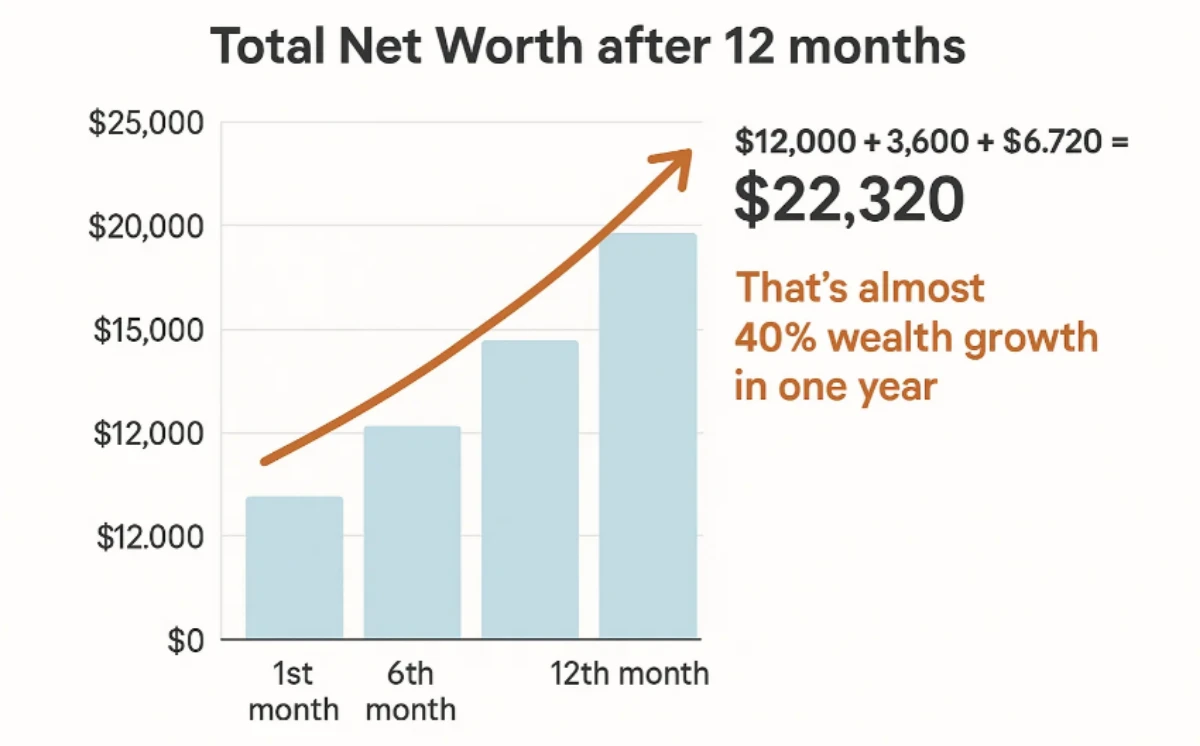

| Source | Avg Monthly Income ($) | Annual Total ($) | Potential ROI (12 months) |

|---|---|---|---|

| Primary Job | 1000 | 12000 | Stable |

| Side Hustle | 300 | 3600 | Variable |

| Investments | 400 | 4800 | 40% → 6720 |

Total Net Worth after 12 months: $12,000 + $3,600 + $6,720 = $22,320

That’s almost 40% wealth growth in one year.

Step 7: Embrace Smart Risk Management

The best investors don’t avoid risk — they manage it.

Use these 3 Golden Rules:

- Never invest money you can’t afford to lose.

- Keep 10% emergency cash reserve.

- Diversify across 5+ sectors.

| Risk Type | Example | Strategy to Manage |

|---|---|---|

| Market Risk | Stock crash | Diversify in ETFs |

| Inflation Risk | Currency devaluation | Add Gold |

| Liquidity Risk | REIT delays | Keep cash reserve |

| Emotional Risk | Panic selling | Set long-term goals |

Step 8: Follow Future Trends That Drive Growth

The smartest investors don’t predict the future — they prepare for it.

Here are 5 high-growth sectors for 2025–2026 that can help you hit the 40% mark faster:

| Sector | 2024 Return | 2025–26 Forecast | Reason for Growth |

|---|---|---|---|

| Green Energy (EV, Solar) | 18% | 30–35% | Global clean energy shift |

| Artificial Intelligence | 22% | 40–45% | AI startup boom |

| Healthcare & Biotech | 15% | 25% | Post-pandemic innovation |

| Fintech | 12% | 28% | Digital finance expansion |

| Infrastructure & REITs | 10% | 18% | Urbanization growth |

Investors who diversify across these upcoming sectors are expected to outperform traditional benchmarks by 25% or more.

Step 9: Monthly Strategy to Stay on Track

To achieve 40% in 12 months, you need monthly targets and a performance review.

| Month | Action Plan | Target Return (%) | Key Focus |

|---|---|---|---|

| Jan–Feb | Start SIPs & small stocks | 2–3% | Learning |

| Mar–Apr | Add ETFs & Gold | 4–5% | Diversification |

| May–Jun | Invest in AI/Green sectors | 7–8% | Growth focus |

| Jul–Sep | Rebalance portfolio | 9–10% | Risk control |

| Oct–Dec | Hold & book profits | 12–15% | Exit strategy |

Stay consistent. Your 40% growth goal is achieved through discipline, not luck.

Radhika Gupta (Edelweiss MF CEO): “The era of small investors creating large wealth has begun — consistency will beat intelligence.”

Step 10: Review, Reinvest, and Repeat

At the end of 12 months:

- Calculate total growth.

- Reinvest 80% of your profits.

- Withdraw only what you need.

This is how small investors become wealth creators.

| Year | Starting Capital ($) | Annual Growth (%) | Year-End Value ($) |

|---|---|---|---|

| 2025 | 0 → 1000 | 40% | 1400 |

| 2026 | 1400 | 40% | 1960 |

| 2027 | 1960 | 40% | 2744 |

| 2028 | 2744 | 40% | 3841 |

| 2029 | 3841 | 40% | 5377 |

In just 4 years, your small start becomes a 5x portfolio.

Conclusion: Your Journey from Zero to Wealth Begins Now

You don’t need millions to begin investing — you need discipline, curiosity, and consistency.

In 2025, anyone with the right strategy can turn $0 into a wealth-building engine.

Here’s your 12-month success formula:

Save. Diversify. Learn. Automate. Reinvest.

Every step compounds — every month matters.

So start today. Your 40% growth story begins with the next dollar you invest

AXECO Model 3 Highland Steering Wheel CollectionsSince 2003, Axeco has remained faithful to its artisanal model and its humanist values. The freedom to create, the constant quest for beautiful materials, and the transmission of exceptional know-how which enable the creation of useful, ergonomic, and elegant steering wheel which stand the test of time – forge the uniqueness of Axeco.

AXECO Model Y Juniper Steering Wheel CollectionsSince 2003, Axeco has remained faithful to its artisanal model and its humanist values. The freedom to create, the constant quest for beautiful materials, and the transmission of exceptional know-how which enable the creation of useful, ergonomic, and elegant steering wheel which stand the test of time – forge the uniqueness of Axeco.

AXECO Model Y Steering Wheel CollectionsSince 2003, Axeco has remained faithful to its artisanal model and its humanist values. The freedom to create, the constant quest for beautiful materials, and the transmission of exceptional know-how which enable the creation of useful, ergonomic, and elegant steering wheel which stand the test of time – forge the uniqueness of Axeco.